FBR: Income tax return, PSID, Online salary slip, ATL, NTN

Why take this course?

🎉 Master the Art of Tax Compliance with FBR's Income Tax System! 🧾

Course Title: 📚 FBR: Understanding Income Tax Return Submission, PSID Creation & Payment, Online Salary Slip, ATL Status, NTN, Tax Slabs

Are you ready to demystify the world of income tax? Whether you're a salaried individual or a business owner, understanding and navigating the FBR system can seem daunting. That's where our comprehensive course comes in! 🕸️

Course Instructor: 👩🏫 Nazir Ahmad, an expert with years of experience in guiding individuals through the complexities of Pakistan's tax system.

Why Take This Course?

- Comprehensive Coverage: From registering on IRIS to understanding your NTN and tax slabs, this course leaves no stone unturned.

- Step-by-Step Guidance: Each lesson is meticulously crafted for clarity and practical application, ensuring you can follow along with ease.

- Essential Skills: Learn how to prepare, save, verify, and submit your income tax return without relying on external help.

Course Highlights:

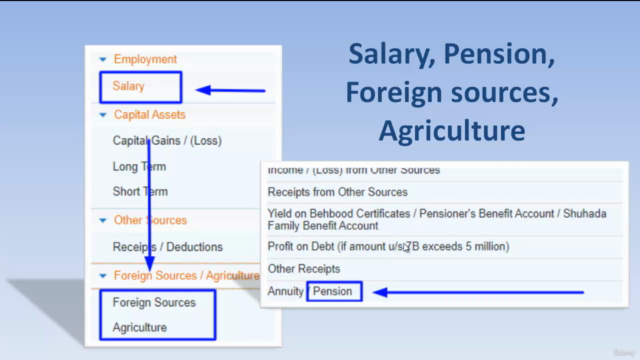

🎯 Understanding the Basics:

- Learn how to register and use IRIS for tax payment and submitting returns.

- Discover the difference between a normal tax return and a salary tax return.

- Explore various types of income (pension, foreign sources, agricultural) and their implications.

💼 Deducting Personal Expenses:

- Understand what personal expenses are and how to accurately include them in your tax return.

- Learn about assets and liabilities and their role in your tax filing.

💰 Dealing with Unreconciled Amounts:

- Find out what to do if you encounter an unreconciled amount during your tax process.

📑 Submission Savvy:

- Get guided through saving, verifying, and submitting your income tax return.

- Check your status on the Active Taxpayer List (ATL).

- Learn how to create a PSID (Personal Securities Investment Account Detail) and understand its importance.

🔍 Payment Simplified:

- Explore various methods to pay through your PSID.

- Verify your NTN/Reference No. for secure transactions.

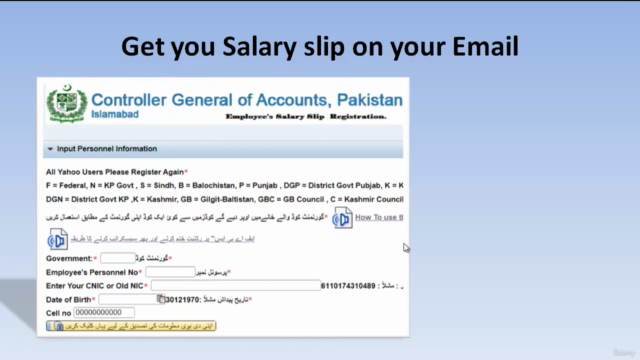

📬 Online Salary Slip:

- Discover how to get your monthly salary slip emailed to you effortlessly.

🔒 Security and Privacy:

- Learn how to change your password and PIN code to enhance the security of your tax return submission.

📊 Past Returns & Tax Slabs:

- View your past history of tax returns for reference.

- Understand the income tax slabs in 2023 and how they apply to you.

⚙️ Income Tax Calculators:

- Utilize the latest income tax calculator as per the Finance Act 2023 for salaried individuals, businesses (Individuals/AOP/COY).

By the end of this course, you'll have the confidence to manage your income tax return with ease. Whether you're a new entrant or looking to sharpen your tax knowledge, this course is tailored to ensure you stay compliant and informed. 🚀

Enroll Today and Transform Your Tax Experience! 📈

Course Gallery

Loading charts...