Master These 4 Essential Harmonic Patterns in Forex Trading

Why take this course?

🌟 Master These 4 Essential Harmonic Patterns in Forex Trading 🌟

What are Harmonic Patterns in Forex?

Harmonic patterns are not just random shapes that appear on your price charts. They are distinct formations with a significant story behind them – a story that you can only begin to read by mastering my 3 simple techniques for identification, and then further deciphered by applying specific Fibonacci ratios unique to each pattern type.

📌 Why Use Fibonacci Ratios in Harmonic Trading?

Harmonic trading isn't just about recognizing patterns; it's about understanding the underlying mathematics that drives these formations. The answer lies within the Fibonacci sequence – a series of numbers where the next number is the sum of the two preceding ones: 0, 1, 1, 2, 3, 5, 8, 13, 21, and so on (note how I've highlighted the most significant Fibonacci numbers in bold).

This sequence is not just a playground for mathematicians; it's a tool that traders use to predict price movements with precision. Harmonic patterns repeat themselves due to human behavior and market psychology, which are influenced by these universal ratios found throughout nature and society.

Key Fibonacci Ratios in Forex Trading:

-

Fibonacci Retracement: 0.382, 0.50, 0.618 (often considered the golden ratio), 0.886, and 0.786. These ratios help traders understand potential reversal or continuation points after a price has retraced from its prior move.

-

Fibonacci Expansion: 1.41, 2.0, 2.24, 1.618, 2.618, 3.14, and 3.618. These ratios are used to project potential breakout levels and can be instrumental in identifying expansion phases of a market movement.

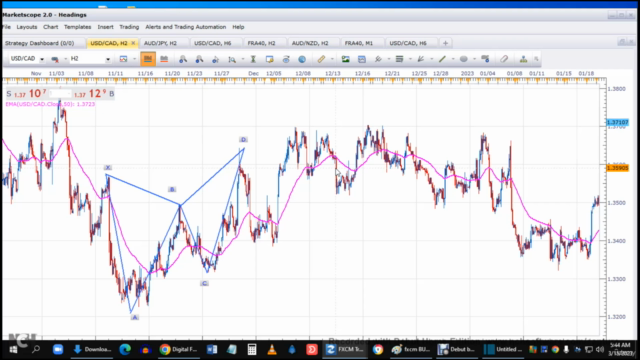

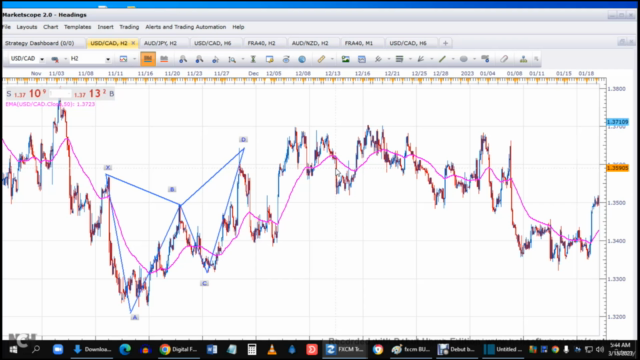

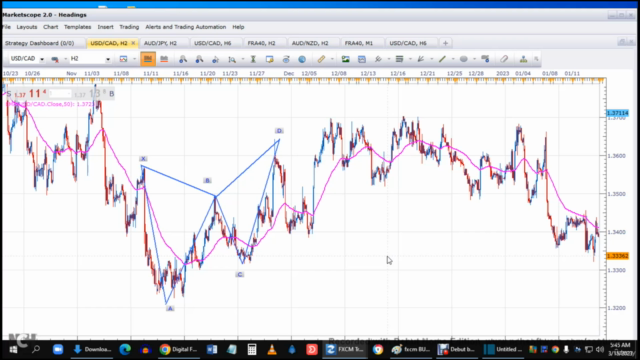

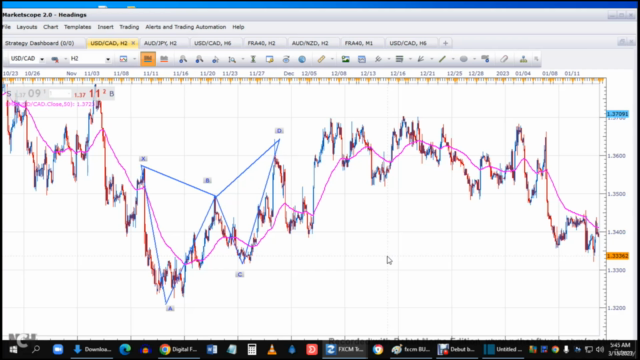

The Harmonic Patterns Labeling System:

Most Harmonic patterns are identified through a 5-point labeling system starting from X, A, B, C, D. The price typically moves into the opposition direction at the D leg, which is where you should pay close attention. This labeling system is crucial for traders looking to align Fibonacci ratios with their trading strategies.

The Power of Fibonacci Ratios in Harmonic Patterns:

In this course, "Master These 4 Essential Harmonic Patterns in Forex Trading," you will learn:

-

The Gartley Pattern: A four-phase pattern that is extremely popular due to its clarity and simplicity.

-

The Bat Pattern: This pattern tends to occur as a correction within the trend and is known for its short, sharp movements.

-

The Crab Pattern: Identified by its three swings, this pattern can be seen at the end of trends or as consolidation patterns.

-

The Butterfly Pattern: This pattern is one of the most powerful and reliable harmonic patterns due to its high probability of success in trading.

By the end of this course, you'll have a solid understanding of how to identify these patterns and apply Fibonacci ratios to enhance your Forex trading strategy. With this knowledge, you'll be able to spot high-probability trades and make informed decisions based on the natural harmonies found within market dynamics.

Ready to unlock the power of Fibonacci ratios in Harmonic patterns? Enroll now and start your journey towards becoming a master Forex trader! 🚀💸

Course Gallery

Loading charts...