LBO Valuation: Fundamentals and Excel Modeling

Why take this course?

🌟 Master LBO Modeling: LBO Valuation Course for Aspiring Finance Professionals 🌟 GroupLayout: Intermediate Duration: 8 Weeks (4-6 hours/week) Language: English Enrollment Period: [Insert Start and End Date] Instructor Expertise: Industry-Leading Investment Bankers and Financial Models Experts

🎓 Course Headline: Elevate your financial modeling skills and gain a deep understanding of leveraged buyout strategies in this comprehensive LBO Valuation course.

Course Description:

Are you ready to delve into the world of finance with a focus on Leveraged Buyout (LBO) valuations? Our LBO Valuation: Fundamentals and Excel Modeling course is meticulously designed for finance enthusiasts, investment banking aspirants, and financial analysts looking to solidify their expertise in LBO modeling.

📚 What You Will Learn:

- Foundational Theory: Dive into the intricate world of LBO transactions and understand the various financial instruments, covenants, and structures involved.

- Real-World Application: Engage with practical scenarios to determine maximum debt capacity, identify potential lenders, and explore different types of value creation strategies in an LBO.

- Historical Case Study Analysis:</) Examine the legendary Dell LBO deal, a landmark transaction known as the "deal of the century."

- Hands-On Experience: Tackle two comprehensive case studies that bridge the gap between theoretical knowledge and real-world application.

- Excel Modeling Mastery: From creating a simplified 'paper LBO' for interview preparation to constructing a detailed financial model, you'll master the art of financial modeling within Excel.

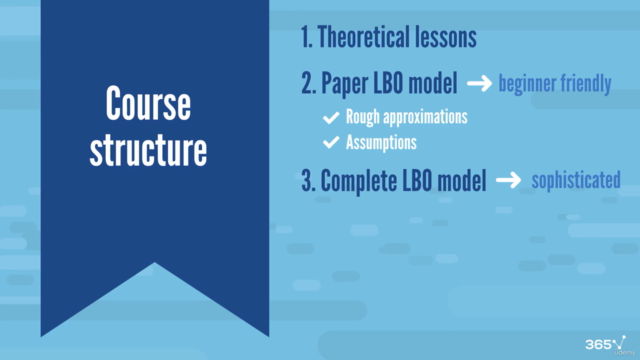

Course Outline:

- LBO Theory and Concepts: Learn the basics of LBO transactions and the role they play in corporate finance.

- Financial Modeling Fundamentals: Understand how to build a basic financial model using Excel, essential for any investment banking role.

- Dell's Legendary LBO Case Study: Analyze this iconic deal to understand the strategic and financial considerations involved in an LBO.

- Real-World LBO Modeling: Work on two detailed case studies that will challenge you to apply your theoretical knowledge to solve real problems.

- Advanced Excel Modeling Techniques: Develop your skills by creating a comprehensive LBO valuation model with transaction fees, goodwill, and more.

- Interview Preparation: Craft a 'paper LBO' to demonstrate your financial modeling capabilities in an interview setting.

- Sophisticated Financial Modeling: Engage in a multi-layered LBO valuation, enhancing your ability to perform complex financial analyses.

Why Take This Course?

- Industry-Relevant Skills: Gain the skills that are highly sought after by top investment banks and finance firms.

- Career Advancement: Equip yourself with knowledge that will set you apart in the competitive finance industry.

- Recruitment Readiness: Prepare for investment banking interviews and demonstrate your financial modeling expertise to potential employers.

Join Us Today! Embark on your journey to master LBO modeling and valuation with our expert instructors guiding you every step of the way. Whether you're looking to launch a career in finance or enhance your existing skills, this course will provide the comprehensive understanding and hands-on experience necessary for success. 🚀

Enroll now and transform your financial acumen with our LBO Valuation: Fundamentals and Excel Modeling course. Secure your place among the finest minds in finance and elevate your career to new heights! 💼✨

Course Gallery

Loading charts...