Investment analysis & Portfolio Management course

Why take this course?

🌟 Investment Analysis & Portfolio Management Course 🌟

Course Overview:

Embark on a comprehensive journey through the complex world of financial markets, fixed income securities, and investment analysis with our Investment Analysis & Portfolio Management course. Taught by the seasoned expert Satyendra Singh, who brings to the table NCFM and NSIM certifications, as well as extensive experience in technical analysis, portfolio management, and machine learning.

This course is designed to equip you with a solid foundation in investment decision-making, financial market dynamics, and modern portfolio theory. With a blend of theoretical knowledge and practical insights, you'll gain the skills necessary to navigate the investment landscape confidently.

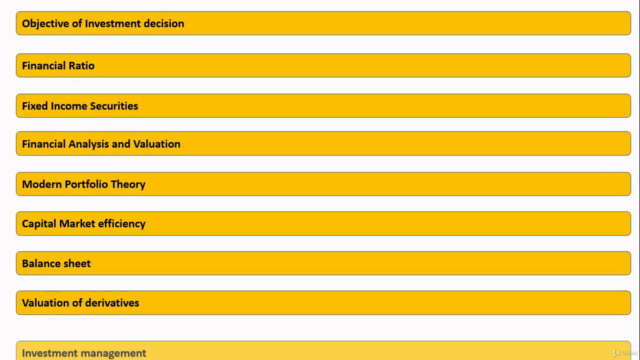

What You Will Learn:

🎯 Objectives of Investment Decisions:

- Introduction to investment decisions and their objectives.

- Understand the different types of investors - individuals vs. institutions.

- Analyze constraints, liquidity, investment horizons, and taxation that influence investment decisions.

Financial Markets:

- Delve into primary and secondary markets, with a focus on trading in secondary markets.

- Explore the money market, including T-Bills, commercial paper, and certificates of deposit (CDs).

- Dive into the bond market, covering Treasury Notes (T-Notes), T-Bonds, state and municipal government bonds, corporate bonds, and international bonds.

Fixed Income Securities:

- Grasp the concept of the time value of money.

- Learn about simple and compound interest rates.

- Master bond pricing fundamentals, including yields and interest rates.

Capital Market Efficiency:

- Understand market efficiency in its three forms: weak, semi-strong, and strong.

Financial Analysis and Valuation:

- Analyze financial statements to understand the profit & loss (Income Statement), balance sheet, and cash flow statement.

- Calculate and interpret key financial ratios for return, operation, and profitability.

- Learn valuation techniques for common stocks.

Modern Portfolio Theory:

- Explore the principles of diversification and understand portfolio risks.

- Delve into the Capital Asset Pricing Model (CAPM) to understand investment equilibrium.

- Examine forward, future contracts, call and put options, and option pricing.

Investment Management:

- Investigate various types of investment companies and their roles in your portfolio.

- Compare active vs. passive portfolio management strategies.

- Learn how to classify funds and understand the performance assessment metrics such as Sharpe Ratio, Traynor Ratio, and Jensen's Alpha (Portfolio Alpha).

Assessment & Real-World Application:

- Reinforce your knowledge with more than 200 objective multiple-choice questions.

- Apply what you learn to become a proficient investor and enhance your portfolio management skills.

This course is designed to challenge and inspire you, ensuring that you come out on the other side not just informed but confident in your investment analysis and portfolio management capabilities. 🚀

Enroll now to transform your understanding of investments and take the first step towards mastering the art of managing a diverse portfolio in today's financial markets! 📈✨

Course Gallery

Loading charts...