Investing Mastery: Stocks, ETFs, Crypto, BTC, REITs & Gold

Why take this course?

🚀 Welcome to the Comprehensive Guide to Mastering Investing! 🚀

This guide is designed to take you on a deep dive into the world of investing across various asset classes, including stocks, ETFs, cryptocurrencies, real estate investment trusts (REITs), and more. Whether you're a beginner or an experienced investor looking to expand your knowledge, this resource will provide you with valuable insights and practical tools to enhance your investment strategy.

🎓 What You'll Learn:

-

Understanding Growth Stocks with PEG Ratio: Learn how to evaluate companies that are expected to grow at an above-average rate.

-

EBITDA and EV/EBITDA Multiples: Explore the use of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and its enterprise value counterpart in assessing a company's financial health.

-

Challenges of EBITDA and EV/EBITDA: Understand the limitations and potential pitfalls when using these multiples for stock valuation.

-

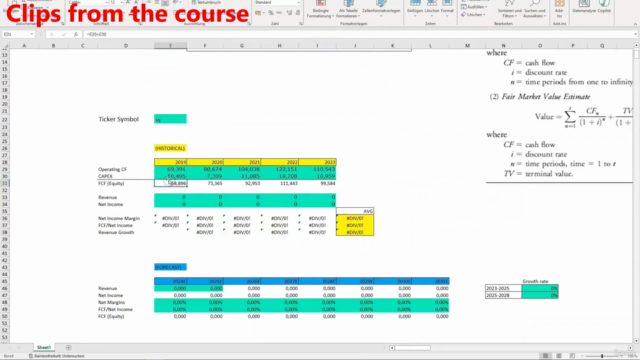

Discounted Cash Flow (DCF) Model: Dive into the fundamental analysis technique used to estimate the value of an investment based on its expected cash flows.

-

PE and Free Cash Flow Ratios: Apply profitability ratios and free cash flow analysis to make informed investment decisions.

-

Return on Invested Capital (ROIC) Analysis: Analyze how effectively a company is using its investments to generate profits.

-

Efficient Market Theory (EMT) Examination: Debate the efficiency of markets and what it means for your investment approach.

-

Stock Compensation and Share Buybacks: Understand the impact of these corporate actions on stock valuations.

-

Valuing Bitcoin Using Mathematical Models: Analyze the unique challenges of valuing cryptocurrencies like Bitcoin.

-

Growth Investing Strategies and Market Identification: Learn how to identify and capitalize on growth opportunities in different markets.

-

Finding Growth Stocks and ETFs: Discover various methods for uncovering promising investment opportunities.

-

Value Investing Techniques: Screening for value stocks and replicating successful investment portfolios.

-

Finding Value Stocks and ETFs: Learn how to identify undervalued stocks and ETFs.

-

Determining Fair Value of Stocks and ETFs: Understand what fair value means for different types of investments.

-

Income Investing: Generating Cash Flow from Dividends: Explore the world of dividend-paying stocks and ETFs.

-

Evaluating Dividend Stocks and ETFs: Assess the sustainability and attractiveness of dividend payments.

-

Understanding Bonds and Their Functioning: Learn the basics of bond investing, from coupons to maturity dates.

-

Investing in Bonds: Find out how to invest in bonds and what to look for in a bond investment.

-

Peer-to-Peer (P2P) Loans Investing: Consider the risks and rewards of P2P lending.

-

Real Estate Investment and Leverage: Understand the fundamentals of real estate investing, including the use of leverage to amplify returns.

-

Alternative Investments: Explore the world of alternative investments like art, coins, metals, watches, and cars.

-

Creating a Sample Portfolio: Combine stocks, ETFs, and cryptocurrencies into a diversified investment portfolio.

-

Practical Guide to Paper Trading and Real Trading on Kraken: Learn the ropes of trading with paper trading before committing real capital.

-

Setting Up and Using Hardware Wallets for Cryptocurrencies: Ensure the security of your crypto investments with hardware wallets.

-

Time in Market and Dollar Cost Averaging Strategies: Understand the benefits of long-term investing and dollar-cost averaging.

-

Tracking Portfolio Performance and Financial Management: Learn how to monitor and manage your investment portfolio effectively.

-

Portfolio Rebalancing Considerations: Know when and how to rebalance your portfolio to maintain your desired risk profile.

-

Hedging Strategies: Explore various hedging strategies to protect your investments against market downturns or currency fluctuations.

-

Tax Efficiency in Investing: Optimize your investment strategy for tax efficiency.

-

Behavioral Finance and the Psychology of Investing: Understand how behavioral finance affects investment decisions and learn strategies to overcome biases.

📚 Resources and Tools:

- Financial Calculators: Use tools like IRR, NPV, and ROI calculators to assess investment projects.

- Investment Platforms: Utilize robust platforms for trading stocks, options, and crypto.

- Portfolio Tracking Software: Keep an eye on your investments with real-time tracking and analytics.

- Financial News and Analysis: Stay informed with the latest financial news, market analysis, and investment research.

📈 Interactive Learning:

- Simulations and Games: Engage in interactive stock market simulations to practice your trading skills without financial risk.

- Webinars and Workshops: Attend live sessions with industry experts to gain deeper insights into the world of investing.

- Community Forums: Join a community of investors to exchange ideas, discuss strategies, and share experiences.

🔑 Key Takeaways:

- Diversification: Spread your investments across various asset classes to mitigate risk.

- Continuous Learning: Stay updated with market trends and investment techniques.

- Risk Management: Understand the risk-return spectrum and how it applies to your portfolio.

- Patience and Discipline: Investing is a long-term endeavor that requires patience and discipline.

🚀 Embark on Your Investing Journey! 🚀

Remember, investing involves risks, including the potential loss of principal. The information provided here is for educational purposes and should not be considered investment advice. Always do your own research or consult with a financial advisor before making investment decisions.

Happy investing!

Course Gallery

Loading charts...