Options Trading Foundational Building Blocks

Why take this course?

🌟 Options Trading Foundational Building Blocks: Introduction to Maximizing Profits with Financial Derivatives

Course Overview: This isn't your run-of-the-mill "get rich quick" options trading course. It's crafted from the ground up by a conservative investor who once shunned options for being too risky, yet discovered their potential to enhance investment strategies without additional tax burdens. 📈

What You'll Learn:

- Foundational Concepts: Dive deep into the essence of call and put options, understanding long and short positions.

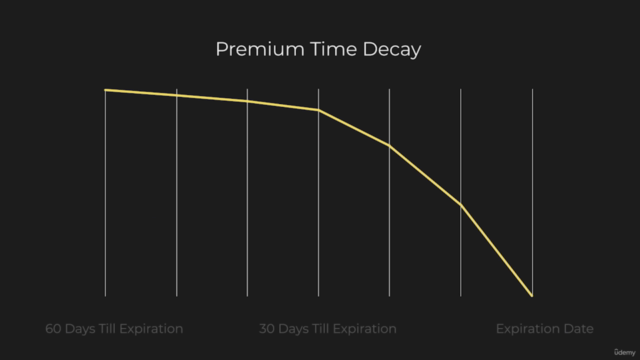

- Option Valuation: Explore how different option properties influence their premiums and breakeven points, and get familiar with the Greek factor, Theta, and its impact on your trades.

- Market Dynamics: Learn about liquidity, volume, open interest, and the bid-ask spread to make informed trading decisions.

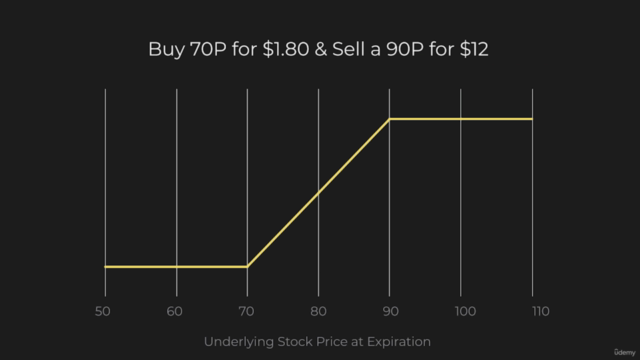

- Financial Strategies: Understand the difference between initial credit and debit positions and their unique characteristics.

- Tax Considerations: Gain insight into tax implications associated with selling stocks and the differences between short-term and long-term capital gains.

- LEAPS & Short Selling: Explore the world of Long-Term Equity Anticipation Securities (LEAPS) and delve into the concept of short selling and inverse ETFs.

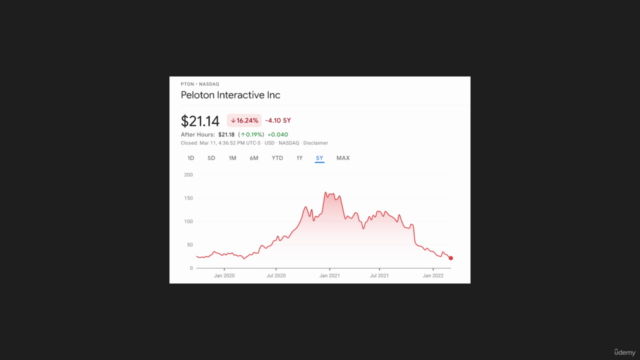

- Timing Your Trades: Consider the impact of quarterly earnings reports and fundamental research on your trading strategy.

- Safety First: Start your options trading journey with a solid foundation to build upon, reducing the risk associated with more complex strategies.

Course Structure:

-

Introduction to Stock Options 🎫

- Types of options: Calls and Puts

- Long vs. Short positions

-

Options Valuation Basics 💸

- Factors affecting option premiums

- Breakeven prices

- Introduction to Theta and time decay

-

Market Dynamics 📊

- Liquidity, volume, and open interest

- Bid-ask spread

- Market impact and order types

-

Financial Strategies 🚀

- Initial credit vs. debit positions

- LEAPS explained

- Short selling and inverse ETFs

-

Tax Implications 🧾

- Capital gains: short-term vs. long-term

- Understanding tax effects on options strategies

-

Earnings Considerations 📈

- Timing your trades around earnings reports

- Impact of fundamental analysis

-

Risk Management & Advanced Strategies 🛡️

- Building upon your foundation with multi-leg trades

- Risk assessment and management strategies

Legal Disclaimer: The information presented in this course is for educational purposes only and should not be considered as a recommendation or solicitation to buy or sell any securities. Always consult with a licensed financial or tax advisor before applying any investment strategy you learn here. We cannot be held responsible for any losses incurred by using the information from this course. The views expressed are subject to change and should not be relied upon as a reflection of future market conditions. Please remember that investing in financial markets involves risk, and it is possible to lose money. Your use of this course constitutes an acceptance of these terms.

Join us on this journey into the world of options trading, where knowledge equals power and profitability! 💫

Course Gallery

Loading charts...