Principles of Insurance: The Backbone of Coverage

Why take this course?

🎓 Principles of Insurance: The Backbone of Coverage

🎉 Course Description:

Dive into the world of insurance with our comprehensive course, Principles of Insurance: The Backbone of Coverage, designed to give you a solid understanding of the fundamental principles that underpin all types of insurance. Led by the knowledgeable and experienced Prabh Kirpa, this course is your gateway to mastering the intricacies of insurance contracts, risk management, and financial protection.

🧐 What You Will Learn:

-

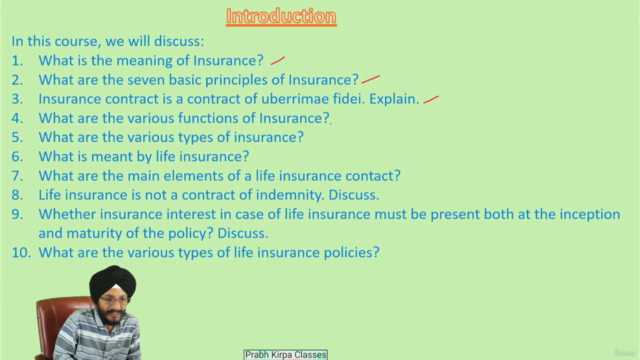

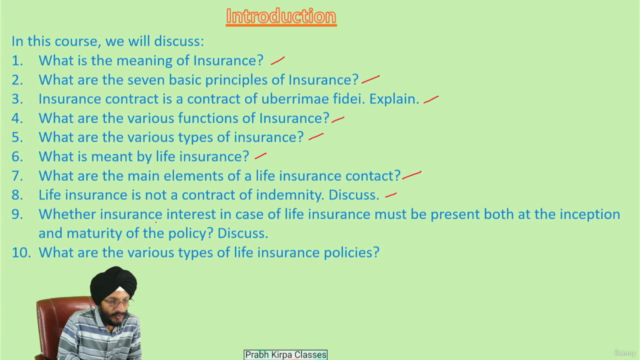

The Essence of Insurance: We'll start by exploring what insurance truly means and why it's an indispensable tool in our lives.

-

The Necessity of Insurance: Understand the critical need for insurance in both personal and professional contexts, and how it serves as a safety net against unforeseen events.

-

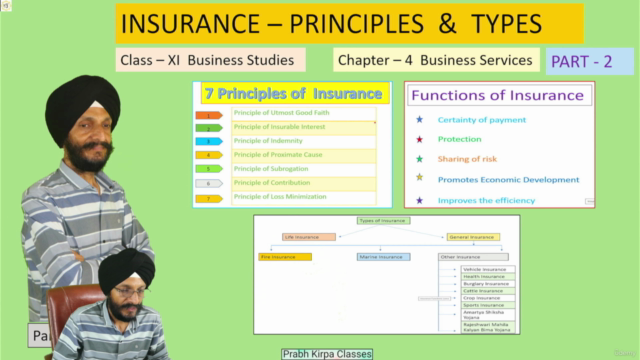

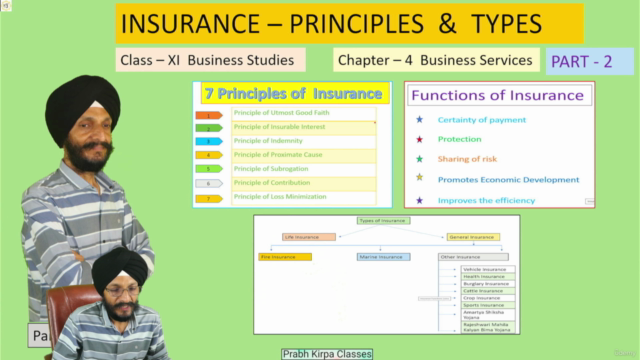

The 7 Principles of Insurance: Delve into the core principles that guide the insurance industry, from uberrimae fidei to indemnity, ensuring you grasp each concept thoroughly.

-

Key Concepts Explained:

- Insurance Contract of Uberrimae Fidei: Learn about this doctrine of utmost good faith and why honesty is paramount in insurance agreements.

- Material Fact: Discover what constitutes a material fact and why its disclosure is crucial.

- Insurable Interest: Establish how an insurable interest is established, protecting the interests of all parties involved.

- Principle of Indemnity: Understand the principle that aims to return the insured to their financial position pre-loss.

- Proximate Cause: Learn about this legal concept in insurance and its role in determining liability.

- Act of God (AOG) Perils: Explore what AOG perils are and how they differ from human negligence.

- Subrogation: Uncover the process by which an insurer steps into the shoes of the insured to recover losses from a third party.

- Contribution Principle: Understand when and how the principle of contribution is applied in insurance claims.

- Loss Minimization Principle: Learn about this principle that encourages policyholders to minimize losses.

-

Functions of Insurance: Discover the various roles insurance plays in society, from protection to economic development.

-

Promoting Economic Growth: Analyze how insurance contributes to the country's economic development and stability.

-

Types of Insurance: From life to general, explore the different types of insurance and their unique functions.

-

Life Insurance Insights: Examine the two main types of insurance and the three broad categories of general insurance.

-

Understanding Life Insurance: Grasp the meaning of life insurance, how it functions, and why it's so important.

-

Policy and Premium Clarified: Learn about the meaning of a policy and how premiums are determined and paid.

-

Specialized Policies: Examine the benefits of whole life policies, annuity policies, and what makes a child endowment plan unique.

Why Take This Course?

This course is perfect for anyone looking to gain a foundational understanding of insurance principles, whether you're a student, a professional in the field, or simply someone who wants to make informed decisions about your insurance coverage. By the end of this course, you'll have a clear grasp of the legal and practical aspects of insurance, enabling you to navigate the world of insurance with confidence.

Enroll today and join us on this journey to unravel the complexities of insurance, ensuring you're well-equipped with the knowledge needed to protect your assets and plan for your future! 🌟

Course Gallery

Loading charts...