Increase Income Lower Taxes Using Rent-a-Room Income

Why take this course?

🚀 Unlock the Potential of Your Space with "Hospitality Marketing for Schedule E"! 🚀

Are you ready to transform your extra space into a lucrative income stream and maximize your tax savings? Welcome to "Increase Income Lower Taxes Using Rent-a-Room Income" – the ultimate online course crafted by the expert herself, Sandy Ingram. This course is your golden ticket to the world of hospitality marketing and Schedule E rental income!

🏡 Why This Course?

- Tailored Strategies: Whether you're offering a cozy room, an entire vacation home, or unique accommodations like tree houses or RVs, this course is designed to help you maximize your earnings.

- Tax Mastery: Gain a comprehensive understanding of tax deductions specifically for Schedule E rental income and learn the ins and outs of depreciation to minimize your tax liabilities.

- Legal Perks: Discover how non-property owners can legally tap into rental income tax deductions and tax write-offs, ensuring you stay within the legal framework while boosting your profits.

- Marketing Magic: Master the art of marketing your rental property effectively to achieve a low to zero-vacancy factor, maximizing your occupancy rates and revenue.

📚 Course Curriculum Breakdown:

Module 1: Introduction to Schedule E Rental Income

- Understanding Schedule E

- The basics of rental income and expenses

- Setting up your rental property for success

Module 2: Tax Deductions & Depreciation

- Identifying deductible expenses

- Maximizing depreciation to your advantage

- Keeping accurate records for tax time

Module 3: Marketing Your Rental

- Crafting a compelling rental listing

- Photography and virtual tours that sell

- Pricing strategies to optimize occupancy and income

Module 4: Operating a Hassle-Free Rental Business

- The essentials of guest communication and hospitality

- Managing listings across various platforms

- Streamlining operations for efficiency and profitability

Module 5: Navigating the Legalities & Staying Compliant

- Understanding the legal aspects of rental hosting

- Ensuring compliance with local, state, and federal regulations

- Protecting your income with the right insurance

🛠️ Practical Tools & Resources:

- Real-life case studies to inspire your success

- Downloadable checklists and resources

- Exclusive access to a community of like-minded hosts

🎓 Who Should Take This Course?

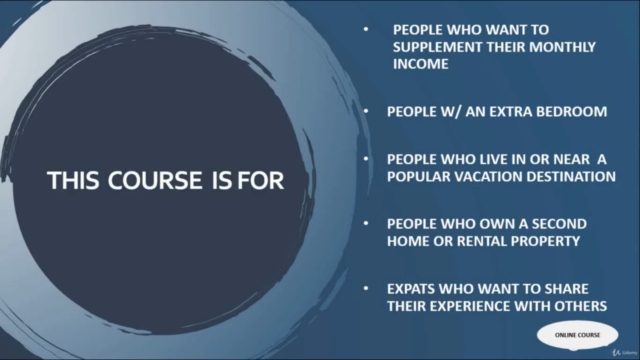

- Aspiring or current rental property owners looking to boost their income

- Individuals interested in leveraging their space for additional earnings

- Real estate investors seeking to diversify their investment portfolio

- Anyone looking to understand the tax implications of rental income

🚀 Take the First Step Today! 🚀 Don't miss out on the opportunity to turn your extra space into a profitable venture and optimize your tax situation. Enroll in "Hospitality Marketing for Schedule E" now and join the ranks of successful rental hosts with Sandy Ingram as your guide. Your journey to financial freedom begins here!

Course Gallery

Loading charts...