INCOME TAX

Why take this course?

🎓 Course Title: Basic to Advance in Income Tax

Headline: Master Income Tax Laws with Dr. Mohd Saifi Anwar's Expert Guidance!

What will you learn in this course?

In this comprehensive course, you will gain a deep understanding of income tax laws and regulations, from the basics to advanced concepts. You'll learn about the various types of taxes, the intricacies of the Income Tax Act 1961, and the different categories of assessees, including individuals, Hindu undivided families (HUFs), companies, firms, and other entities.

Understanding the residential status, agricultural income, house property income, and capital gains is crucial for effective tax planning and compliance. Dr. Mohd Saifi Anwar will guide you through practical problems and real-world solutions in each of these domains.

You'll also explore the specific deductions under sections 80C to 80U, which can significantly reduce your tax liability. Finally, the course concludes with the calculation of total income and the determination of tax liability, ensuring you're well-prepared for filing taxes under both old and new tax regimes.

Course Modules:

-

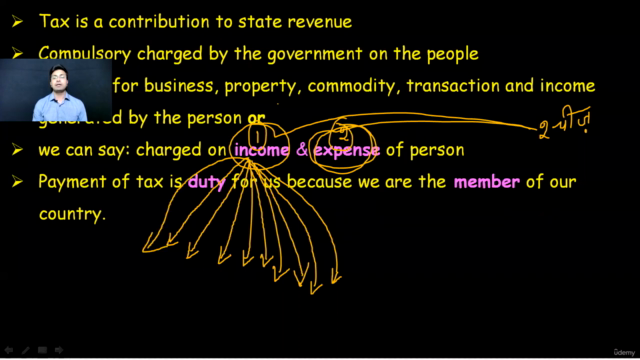

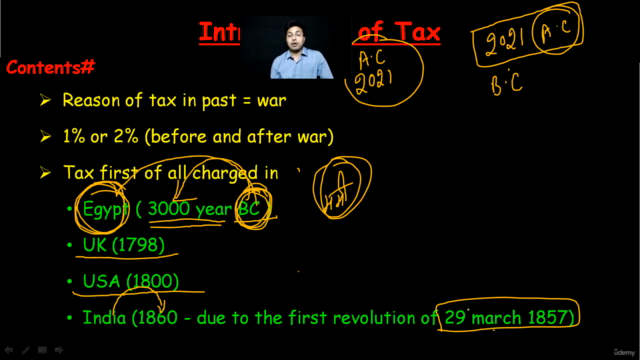

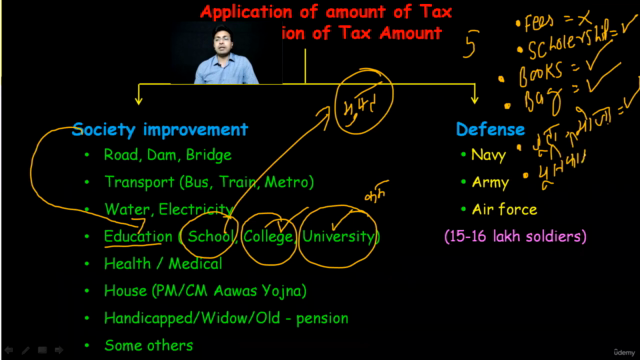

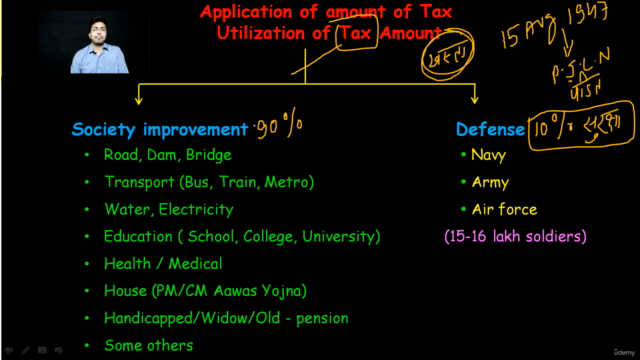

Introduction to Income Tax:

- Types of Taxes in India

- Overview of the Income Tax Act 1961

-

Understanding Taxable Entities:

- Difference between Resident and Non-Resident

- Taxation of Individuals, HUFs, Companies, etc.

-

Income from Different Sources:

- Income from Salary & Business/Profession

- Agricultural Income

- Other Sources of Income

-

Property and Investment Taxation:

- Tax on House Property

- Capital Gains and their implications

-

Deductions for Enhanced Tax Benefits:

- An in-depth study of Section 80C to 80U deductions

- Deduction eligibility, qualifications, and limits

-

Clubbing of Income:

- Understanding transfer of income without transfer of assets

- Clubbing provisions for minor’s income and other scenarios

-

Setting Off and Carrying Forward Losses:

- Practical application of loss carry-forward rules

- Set-off provisions between different heads

-

Computation of Total Income:

- Step-by-step guide to calculating total income

- Understanding rounding off and tax liability calculation

-

Practical Problem Solving:

- Case studies with real-world examples

- Common pitfalls and how to avoid them

-

Course Summarization:

- Key takeaways and final assessment

- Preparing for the practical application of income tax laws

Why Take This Course?

This course is designed for anyone looking to understand income tax laws thoroughly, including:

- Tax Professionals and Consultants: Stay ahead in advising clients with the latest updates and strategies.

- Business Owners and Entrepreneurs: Make informed decisions regarding your company's financial planning.

- Freshers in Finance and Taxation: Build a strong foundation in tax laws as you enter the professional world.

- Students of Commerce and Economics: Gain practical knowledge that complements your academic studies with real-world applications.

- Individuals Filing Their Own Tax Returns: Navigate the complexities of tax filings confidently and accurately.

Join Now to Embark on Your Journey to Income Tax Mastery with Dr. Mohd Saifi Anwar! 🌟

Course Gallery

Loading charts...