IFRS 16 Leases - Beginner to Advance

Why take this course?

Course Instructor: Abhishek Agrawal

**Course Title:** IFRS 16 Leases - Beginner to Advanced

**Course Headline:** 🎓 Master Lease Accounting under IFRS 16 with Ease! 🚀

Introduction:

Hello and welcome to IFRS 16 Leases - Beginner to Advanced! This comprehensive course is your gateway to understanding everything there is to know about lease accounting as per International Financial Reporting Standards (IFRS). Whether you're a finance beginner or an experienced professional looking to bridge the gap in your knowledge, this course will guide you through the intricacies of IFRS 16 in clear, understandable terms.

Course Overview:

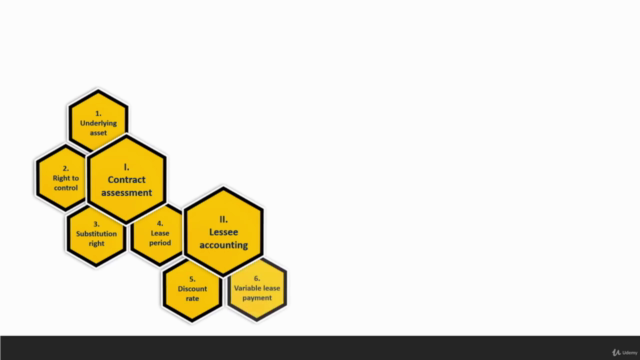

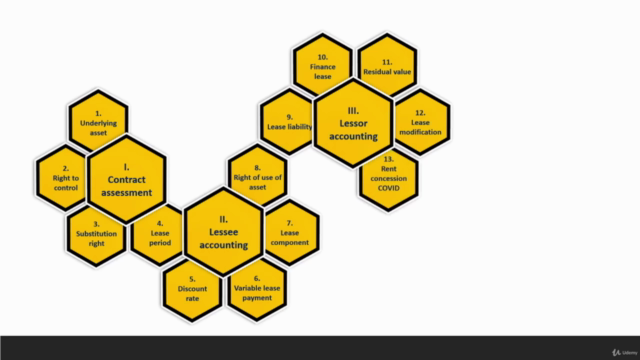

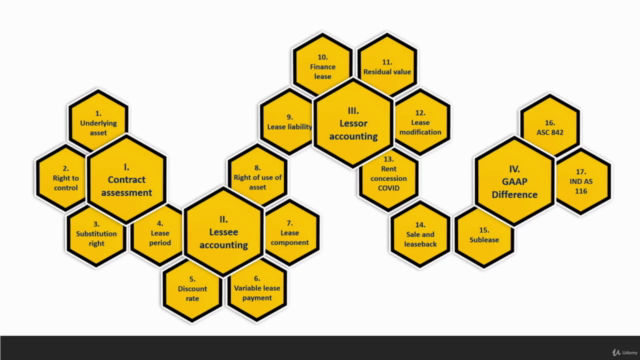

This course is meticulously structured to take you from the foundational concepts all the way to advanced topics in lease accounting. Here's what you can expect to learn:

-

Basic Concepts: We start by defining key terms and explaining fundamental principles, such as what constitutes a lease under IFRS 16 and how to recognize lease arrangements.

-

Core Principles: We'll dive into the core elements of lease accounting, including understanding the present value of lease payments and the implicit rate of interest in leases.

-

Advanced Topics: As we progress, we'll tackle more complex issues like multiple lease components, lease modifications, sublease, sale and leaseback arrangements, and rent concessions – especially those relevant to the COVID-19 pandemic.

Course Highlights:

-

Detailed Explanations: Every concept is broken down into easy-to-understand segments, ensuring even those new to lease accounting can follow along.

-

Real-World Application: We'll show you how to apply these concepts through practical accounting entries for both lessors and lessees.

-

Comprehensive Coverage: This course covers the disclosure requirements in the Statement of Financial Position, Statement of Profit and Loss, and Statement of Cash Flows, providing a complete view of lease accounting under IFRS 16.

GAAP Differences:

- A special focus on the differences between IFRS 16, ASC 842 (US GAAP), and IND AS 116 (Indian Accounting Standards). You'll understand the nuances that distinguish these three key global accounting standards.

Learning Objectives:

By the end of this course, you will:

-

Have a full grasp of the IFRS 16 leasing standard – from basic to advanced concepts.

-

Be able to apply the standard in real-world scenarios, ensuring you can confidently handle lease accounting situations.

-

Understand the GAAP differences, allowing you to navigate between different sets of accounting standards with ease.

Why Take This Course?

🚀 Whether you're an accountant, auditor, finance manager, or a student, mastering IFRS 16 is crucial for accurate financial reporting and decision-making. This course offers the perfect blend of foundational knowledge and advanced insights to help you excel in lease accounting.

Enroll Now and Secure Your Spot!

Dive into the world of international finance and elevate your accounting career with IFRS 16 Leases - Beginner to Advanced. Let's embark on this learning journey together, and I assure you that by the end, you'll have a clear understanding of lease accounting under IFRS 16 and its differences from GAAP standards like ASC 842 and IND AS 116. 🏗️📊🌟

Course Gallery

Loading charts...