Hax to Save Tax for Professionals, Freelancers & Consultants

Why take this course?

🧾 Master Tax Planning with Confidence! 🚀

About the Course: Welcome to our meticulously crafted course titled "Tax Planning for Professionals"! As a professional, freelancer, or consultant, you understand the importance of efficient tax management. This course is your gateway to mastering the art of tax planning and ensuring that you save as much as you can on taxes legitimately.

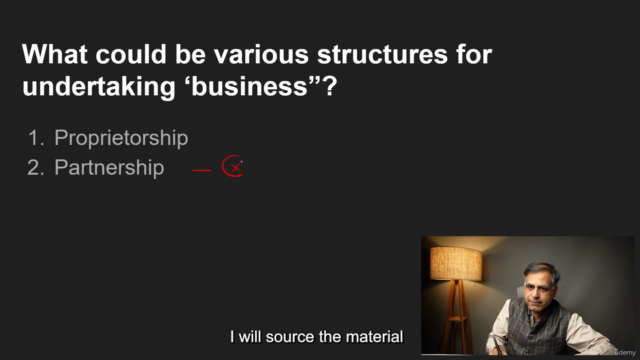

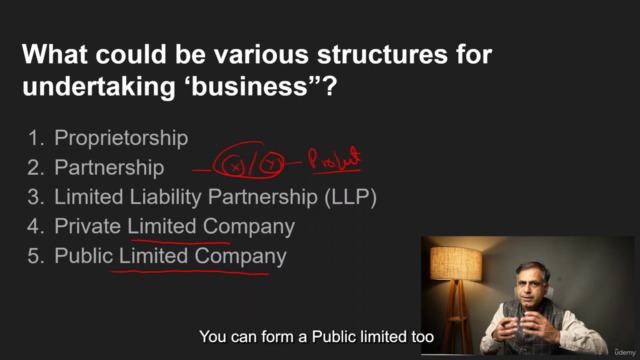

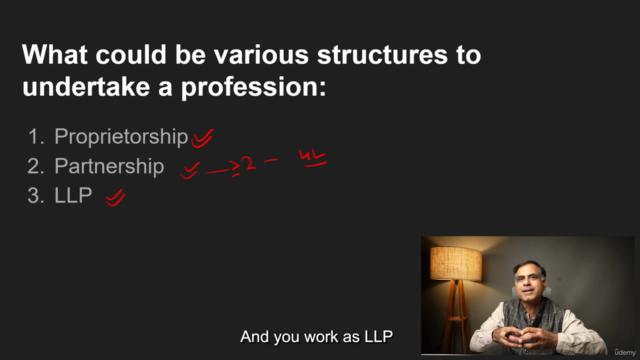

In this comprehensive course, you'll delve into the nuances of tax planning and explore the various heads of income such as salary, business, profession, and capital gains. You'll gain insights on how to accurately compute your income tax and strategically utilize deductions and exemptions to optimize your financial standing.

💡 Key Learning Points:

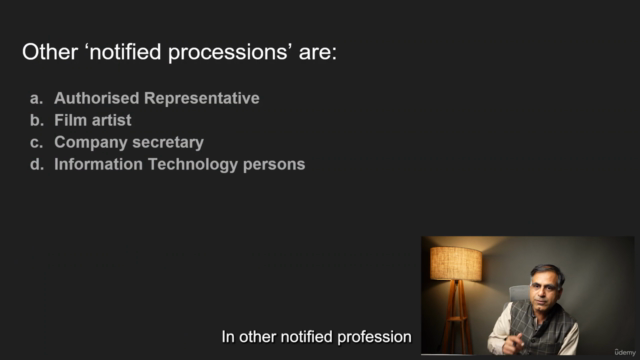

- Understand the different heads of income under which professionals fall

- Learn how to calculate and manage your income tax liabilities effectively

- Get to grips with setting off losses and navigating the complex clubbing provisions

- Discover advanced tax planning strategies to enhance your tax savings

Why this course? Tax planning isn't just about numbers; it's a critical financial strategy that can make or break your financial health. This course is designed to empower you with the latest tax regulations and enable you to plan ahead, saving more and worrying less about taxes. With our expert instructors who boast years of experience in the field, you're assured of gaining comprehensive knowledge that adheres to current tax laws.

Our course materials are tailored to be accessible and engaging, combining video lectures, interactive quizzes, and practical assignments. You can learn at your convenience and pace, making this an unparalleled learning experience.

🎓 Who should take this course?

- Professionals: Doctors, Engineers, Lawyers, Chartered Accountants, and other career professionals who want to streamline their tax liabilities.

- Freelancers: Independent contractors, consultants, writers, designers, and artists looking for smart ways to save on taxes.

- Consultants: Business advisors, management experts, HR consultants, and IT consultants aiming to manage their finances better.

Enrollment Benefits:

- Learn at your own pace, with 24/7 access to course materials.

- Interactive quizzes and assignments to reinforce your learning.

- Access to a community of like-minded professionals for networking and knowledge sharing.

- Expert guidance and support throughout your learning journey.

📅 Ready to transform your tax planning game? 🌟 Enroll in "Tax Planning for Professionals" today and embark on a journey towards a more financially savvy future! With LLA Professional Training Institute, you're not just learning—you're preparing for a lifetime of financial success. 💼💰

Sign up now and take the first step towards smart tax planning! 🚀💪

Course Gallery

Loading charts...