Multi-State Employee Tax Withholding

Why take this course?

Course Title: Mastering Multi-State Employee Tax Withholding

Course Headline: Navigate the Complexities of State Taxes for Remote Workforces 🌐💼

Course Description:

Are you ready to tackle the tax tribulations that come with managing a workforce spread across different states? This comprehensive course, designed for HR professionals, payroll specialists, and business owners, delves into the nuanced world of state taxes for employees who live in one state but work in another (or even multiple states).

What You'll Learn:

-

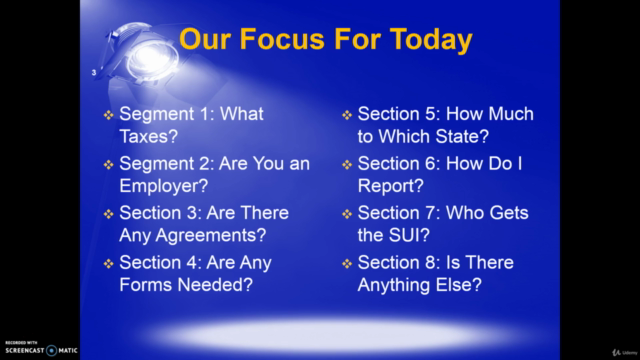

Understanding State Taxes: Learn about the various state taxes you need to be aware of, including state income tax, disability insurance, unemployment insurance, and local taxes.

-

IRC Conformity and Supplemental Taxation: Gain insights into how states conform with the Internal Revenue Code and how to manage supplemental taxation requirements.

-

Employer Responsibilities: Determine if your company is an employer in a given state and what that means for your tax withholding obligations.

-

Residency Definitions: Understand the difference between resident and nonresident employees and how it impacts state tax withholding.

-

Reciprocal Agreements: Explore the impact of reciprocal agreements between states on state income tax withholding.

-

State Withholding Certificates: Discover the various state withholding certificates, including those for nonresidents and military spouse exemptions.

-

Allocating Taxable Wages: Learn how to properly allocate taxable wages among multiple states when an employee works in two or more locations.

-

Reporting Methods: Familiarize yourself with the three methods available for allocating wages across state lines.

-

Correct Form W-2 Reporting: Get practical examples and guidance on how to report income accurately on Form W-2 for employees working in multiple states.

-

State Unemployment Insurance (SUI): Understand how to determine which state to pay SUI to when an employee's work spans multiple jurisdictions.

Why Take This Course?

-

Expert Instruction: Learn from industry experts who specialize in multi-state employment tax issues.

-

Practical Examples: Real-world scenarios and examples bring complex concepts to life, helping you apply what you learn.

-

Compliance Confidence: Gain the knowledge and tools needed to ensure your company remains compliant with state tax laws.

-

Interactive Learning: Engage with interactive content that allows you to test your understanding and reinforce learning.

Don't let the complexity of multi-state employee tax withholding leave you second-guessing. Enroll in this course today and become the go-to expert for handling these critical tax matters with confidence! 🚀📚💰

Key Takeaways:

-

State Tax Overview: Understand the various state taxes and their implications.

-

Employer Tax Obligations: Determine your company's responsibilities as an employer in multiple states.

-

Residency Impacts: Know how employee residency affects tax withholding.

-

Reciprocal Agreements: Navigate the complexities of state reciprocal agreements.

-

Withholding Certificates: Learn about the different types of certificates needed for state tax withholding.

-

Taxable Wage Allocation: Master the allocation of taxable wages among multiple states.

-

Reporting Accuracies: Ensure correct reporting on Form W-2 and for state unemployment insurance.

-

Compliance and Best Practices: Stay up-to-date with the latest tax laws and reporting requirements.

Ready to Become a Multi-State Tax Pro? Sign Up Now! 🎓🔍

Course Gallery

Loading charts...