Futures & Options Masterclass for Indian Stock Market

Why take this course?

🚀 Futures & Options Masterclass for Indian Stock Market 🎓

Are you ready to unlock the full potential of your trading portfolio with the power of Futures & Options? Dive into the "Futures & Options Masterclass" by Koustav Chowdhury, a NISM & NCFM Certified expert, and learn how to trade effectively in the Indian stock market.

Why You Should Take This Course:

- 🛠️ Easy Learning Path: This course simplifies the complex concepts of Futures & Options trading, making it accessible for all levels of investors.

- ✨ Comprehensive Coverage: From basics to advanced topics, this course equips you with a complete understanding of Options strategies, Greeks, and market conditions.

- 🌟 Real-Life Examples: Learn with practical examples that will help you apply your knowledge directly in the markets.

- 📊 Demo Trading: Gain hands-on experience with a demo that allows you to practice trading without risking real money.

Course Highlights:

- Certified Expert Guidance: Learn from a NISM & NCFM Certified Technical Analyst who has mastered the art of Options trading.

- Tailored for All Levels: Whether you're a beginner or an experienced trader, this course is designed to meet your unique needs.

- Absolutely Complete: After completing this course, you won't need to look for any other Futures & Options trading courses.

What You Will Learn:

- 📈 Futures Basics: Get familiar with the terminology and concepts of Futures trading.

- ⚙️ Futures Order Management: Understand how to place, close, and manage orders, including margin requirements and risk management.

- 🎯 Index vs Stock Futures: Learn the differences between Index and Stock Futures and their hedging strategies.

- 📉 Stocks vs Futures: Compare and contrast the two to make informed decisions.

- 🤫 (Options) Terminology Mastery: Grasp the essential terms used in Options trading.

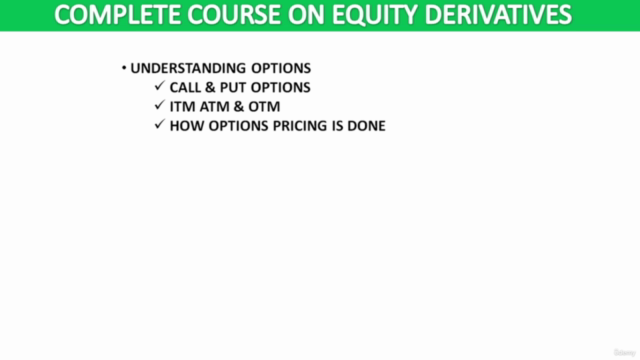

- 💰 Call & Put Options: Explore the intricacies of Call and Put options.

- 📊 Option Chain & Open Interest: Analyze and interpret the Option chain and understand the concept of Open Interest.

- 🏦 Option Buying vs Selling: Decide which strategy suits your trading style better.

- 🧮 Option Greeks: Dive deep into the math behind options strategies, including the Block Scholes model for option pricing.

- 🎨 Strategies for Every Market: Learn bullish, bearish, and neutral market strategies like Straddle, Strangle, Bull Call Spread, Bull Put Spread, Bear Call Spread, and Bear Put Spread.

- ⏰ Time & Volatility Impact: Understand how time decay and volatility affect option pricing.

Course Topics at a Glance:

- What are Futures - Basic terminology of Futures

- Placing order of Futures, closing of Futures, Margin requirements of Futures, and risk management of Futures

- Comparison of Index Futures vs Stock Futures

- Futures hedging strategies

- Stocks vs Futures

- Options terminology

- Call & Put option

- Option Chain & Open Interest

- Option buying vs Option selling

- Option Greeks and Block Scholes model for Option pricing

- Basics of Options strategies for bullish, bearish, and neutral markets

- Impact of time and volatility on Options pricing

- Straddle

- Strangle

- Bull Call Spread

- Bull Put Spread

- Bear Call Spread

- Bear Put Spread ...and much more!

🚀 Ready to embark on your Futures & Options journey? 📈

Click the "Take This Course" or "Start Free Preview" button up on the page to begin your mastery of trading with Futures & Options today! Don't miss out on this opportunity to elevate your investment strategy. Enroll now and transform your approach to trading in the Indian stock market.

Course Gallery

Loading charts...