FRM Part 2 - Book 1 - Market Risk (Part 2/2)

Why take this course?

🎓 FRM Course by Prof. James Forgan, PhD 🚀

Unlock the Secrets of Market Risk with a Master in Finance!

Course Instructor: 🧑🏫 Prof. James Forgan, PhD

With over a quarter-century of teaching experience at the graduate and post-graduate levels, Prof. James Forgan is not just an educator but a seasoned finance expert. His academic prowess is evident in his educational background—a Bachelor of Science in Accounting, a Master of Science in Finance, and a PhD in Finance (with a minor in Economics and completion of two PhD-level courses in Econometrics). Adding to his credentials, he successfully completed the CFA Program in 2004 and earned the CFA charter later that year. Prof. Forgan has graced the halls of six prestigious institutions as a college professor, imparting knowledge in subjects such as Corporate Finance, Investments, Derivatives Securities, and International Finance.

Course Overview:

Dive into the world of Market Risk with this comprehensive FRM Part 2 course, focusing on Book 1—Market Risk. This course meticulously summarizes the critical concepts from the last 7 chapters of the "Market Risk Measurement and Management" book, tailored to prepare you for the FRM part 2 exam with clarity and confidence.

What You Will Learn:

✅ Chapter 10: Empirical Approaches to Risk Metrics and Hedging - Understand the practical applications of risk metrics and learn how to effectively hedge against market risks.

✅ Chapter 11: The Science of Term Structure Models - Gain insights into the complex models that govern interest rates and their implications for market risk.

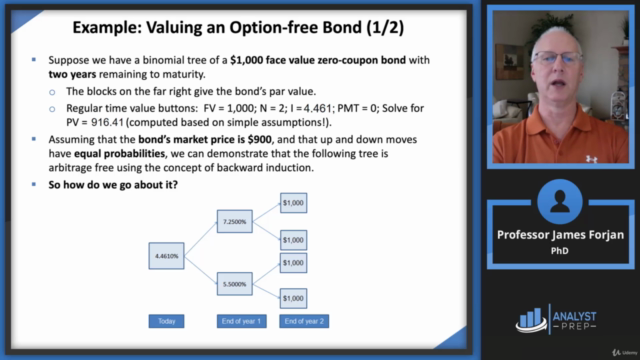

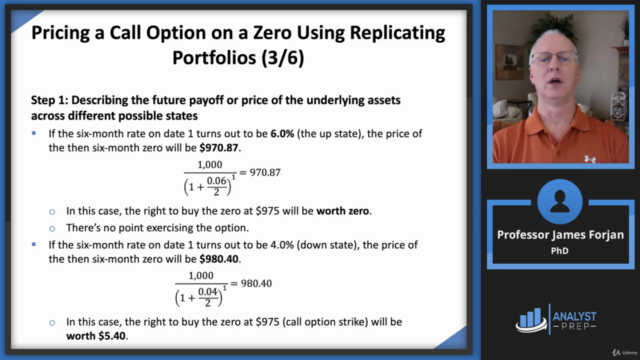

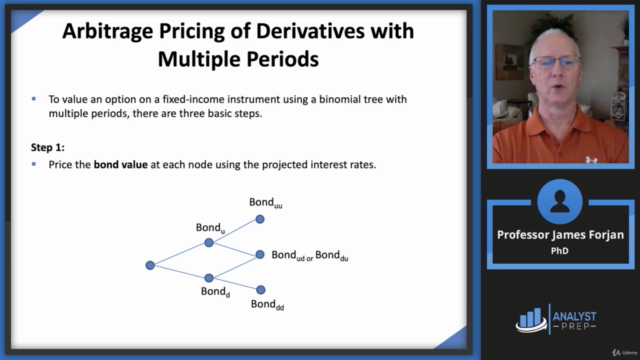

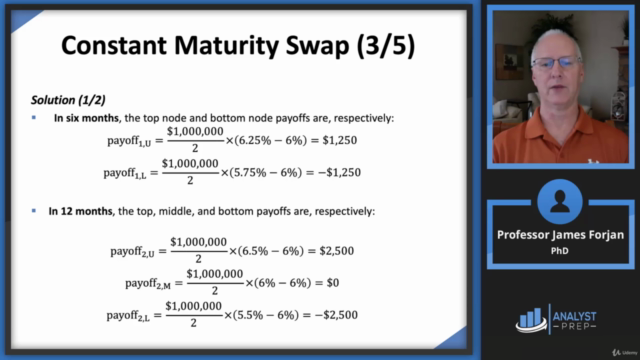

✅ Chapter 12: The Evolution of Short Rates and the Shape of the Term Structure - Explore how short-term interest rates evolve and the factors influencing the term structure.

✅ Chapter 13: The Art of Term Structure Models: Drift - Delve into the concept of drift in term structure models and its significance in financial decision-making.

✅ Chapter 14: The Art of Term Structure Models: Volatility and Distribution - Discover the nuances of volatility and distribution in modeling interest rates and market risk.

✅ Chapter 15: Volatility Smiles - Analyze the Volatility Smile phenomena and its implications for option pricing and portfolio management.

✅ Chapter 16: Fundamental Review of the Trading Book (FRTB) - Understand the latest regulatory framework for trading book risk management.

Why Choose This Course?

- Expert Led: Learn from an industry veteran with a diverse background in finance and economics.

- Comprehensive Content: Cover all essential topics for the FRM part 2 exam in one place.

- Real-World Applications: Apply theoretical concepts to real-world scenarios, enhancing your practical understanding of market risk.

- Exam Preparation: Use this course as a study guide to reinforce your knowledge and prepare for success in the FRM exams.

Embark on Your Journey to Mastering Market Risk Today! 🌟

Enroll now and transform your understanding of market risk with Prof. James Forgan's expertise. Whether you're a seasoned financial analyst or aspiring to become one, this course will equip you with the knowledge and skills needed to navigate the complexities of financial markets. 📚✨

Course Gallery

Loading charts...