FRM Part 2 - Book 1 - Market Risk (Part 1/2)

Why take this course?

🎓 FRM Course by Prof. James Forgan, PhD Unlock the Secrets of Market Risk with an Expert Guide!

🚀 About Your Instructor: With over a quarter-century of teaching experience under his belt, Prof. James Forgan has mastered the art of finance education. His academic credentials are nothing short of impressive: a Bachelor of Science in Accounting, a Master of Science in Finance, and a Doctorate in Finance (with a minor in Economics and two courses in Econometrics). To cap it all off, he's a CFA charterholder since 2004. As a seasoned college professor, Prof. Forgan has graced the halls of six prestigious institutions, imparting his knowledge on subjects ranging from Corporate Finance to International Finance and beyond.

🌍 Course Overview: Dive into the intricacies of Market Risk with our comprehensive FRM Part 2 - Book 1 course. This is the perfect opportunity to enhance your understanding or prepare for your upcoming FRM part 2 exam. Prof. Forgan distills the essential concepts from the first nine chapters of the "Market Risk Measurement and Management" book, ensuring you're well-versed in the key topics.

🔥 Key Course Chapters:

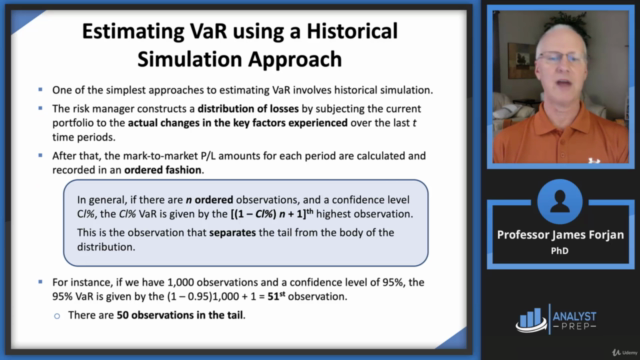

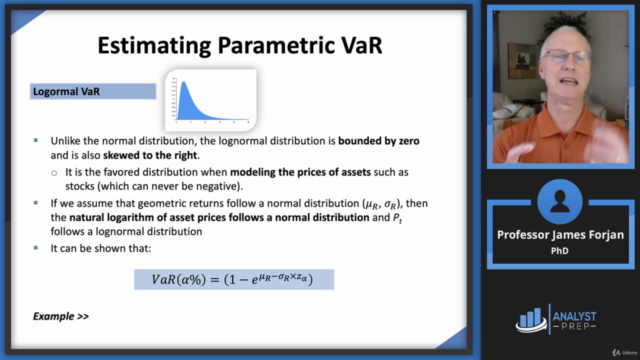

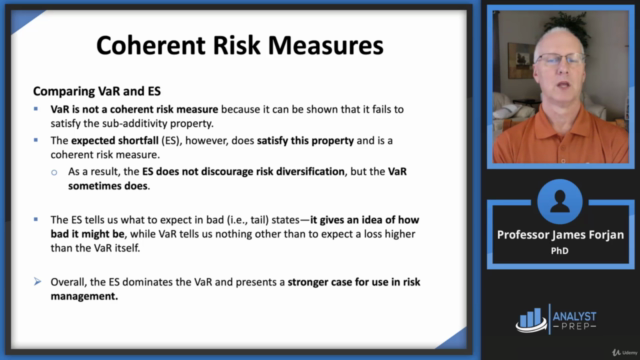

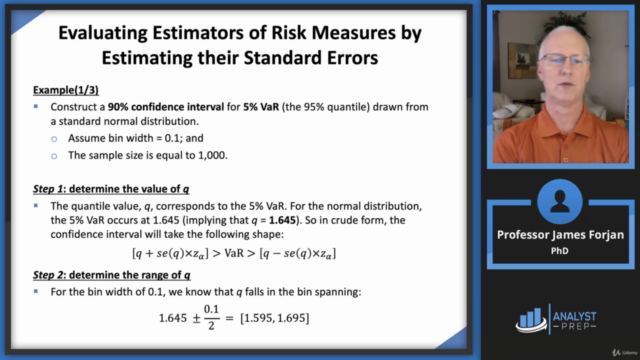

- Estimating Market Risk Measures 📈: Gain insights into the foundational aspects of market risk measures.

- Non-Parametric Approaches 🔍: Explore the methodologies that don't rely on specific distributions.

- Parametric Approaches (II): Extreme Value 🌪️: Delve into the parametric approaches focusing on modeling extreme market events.

- Backtesting VaR 🕰️: Learn how to validate the Value at Risk (VaR) through historical data analysis.

- VaR Mapping 📋: Understand the process of mapping VaR for different portfolios and market conditions.

- Messages from the Academic Literature on Risk Management for the Trading Book 📚: Get a grasp of the academic insights that drive risk management strategies in trading books.

- Some Correlation Basics: Properties, Motivation, Terminology 🔗: Discover the fundamental properties and applications of correlation in financial markets.

- Empirical Properties of Correlation: How Do Correlations Behave in the Real World? 🌍: Analyze real-world data to understand how correlation manifests across different market conditions.

- Financial Correlation Modeling – Bottom-Up Approaches 🛠️: Learn about the practical methods of modeling financial correlations from the ground up.

🎟 Why Choose This Course?

- Expert Knowledge: Learn from a seasoned finance educator with a diverse background and extensive experience.

- Comprehensive Content: Cover the essential chapters that are critical for the FRM Part 2 exam.

- Interactive Learning: Engage with the material through a structured curriculum designed for optimal understanding.

- Real-World Application: Apply theoretical concepts to practical scenarios, preparing you to manage market risk effectively.

🚀 Embark on Your Risk Management Journey Today! Whether you're looking to solidify your knowledge or prepare for the FRM exam, this course offers a deep dive into market risk measurement and management. With Prof. James Forgan as your guide, you'll navigate through the complexities of financial risk with confidence. 🌟

Sign up now to secure your spot in this transformative learning experience and take a significant step towards mastering market risk!

Course Gallery

Loading charts...