FRM Part 1 - Book 4 - Valuation and Risk Models (Part 2/2)

Why take this course?

🏆 FRM Course by Prof. James Forgan, PhD 🎓 Förgan's FRM Journey Continues! 🚀

Course Overview:

Welcome to the FRM Part 1 - Book 4 - Valuation and Risk Models (Part 2/2), where Prof. James Forgan, PhD, distills the essence of the last 9 chapters from the Valuation and Risk Models book into an engaging and comprehensive course tailored for your FRM Part 1 exam preparation.

With over 25 years of experience teaching college-level business classes, Prof. Forgan brings a wealth of knowledge and expertise to this course. He will guide you through complex concepts with clarity and ease, ensuring that you are well-prepared to tackle one of the most challenging exams in the field of financial risk management.

What You Will Learn:

This course covers the essential chapters every FRM candidate needs to master:

-

Chapter 9: Pricing Conventions, Discounting, and Arbitrage

- Understand the core principles of bond pricing and the importance of arbitrage.

-

Chapter 10: Interest Rates

- Learn how interest rates affect bond prices and your investment decisions.

-

Chapter 11: Bond Yields and Return Calculations

- Master the various measures of returns for bonds to make informed investment choices.

-

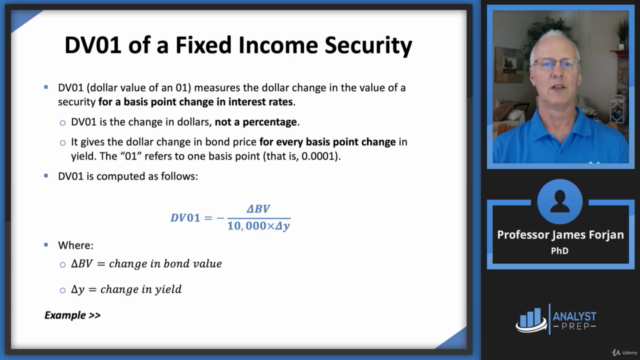

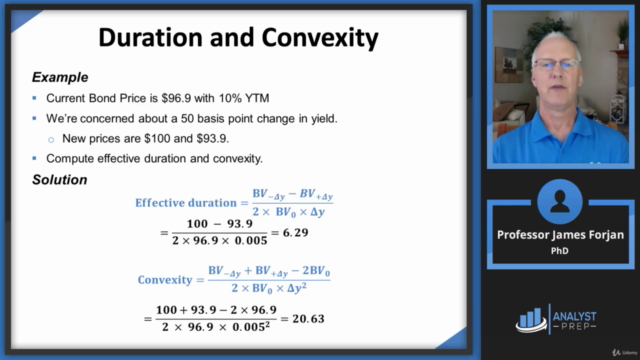

Chapter 12: Applying Duration, Convexity, and DV01

- Discover the tools used to manage interest rate risk effectively.

-

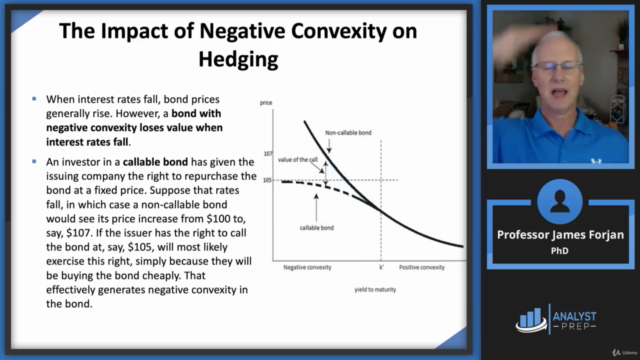

Chapter 13: Modeling and Hedging Non-Parallel Term Structure Shifts

- Gain insights into modeling yield curves and hedging strategies for complex financial instruments.

-

Chapter 14: Binomial Trees

- Explore the use of binomial trees in option pricing and risk management.

-

Chapter 15: The Black-Scholes-Merton Model

- Dive deep into the famous Black-Scholes model, learning its applications and limitations.

-

Chapter 16: Option Sensitivity Measures: The “Greeks”

- Understand the critical "Greeks" that risk managers use to measure an option's sensitivity to various factors.

Why Enroll?

- Expert-Led Learning: Learn from a seasoned professional with extensive experience in the field.

- Comprehensive Content: Cover all the essential topics required for the FRM Part 1 exam.

- Interactive Course Material: Engage with content that makes learning effective and enjoyable.

- Practical Applications: Real-world examples to help you apply what you learn in practice.

- Exam Readiness: Prepare yourself thoroughly for the rigorous FRM Part 1 exam.

How It Will Benefit You:

By enrolling in this course, you will not only gain a solid understanding of the valuation and risk models but also develop the skills necessary to apply these concepts in real-world scenarios. Whether you're a finance professional aiming to become FRM certified or a student looking to deepen your knowledge, this course will equip you with the tools and insights you need to succeed.

Join Prof. Forgan on This Journey:

Are you ready to master the intricacies of financial risk management? Click enroll now to begin your journey towards becoming an FRM certified professional with Prof. James Forgan, PhD. 🎓✨

Course Gallery

Loading charts...