FRM Part 1 - Book 2 - Quantitative Analysis

Why take this course?

🎓 FRM Course by Prof. James Forjan - Master Quantitative Analysis for FRM Part 1 Exam Success!

Course Overview: Prof. James Forjan, a seasoned expert with over 25 years of college-level business teaching experience, presents an essential summary of Book 2: Quantitative Analysis from the FRM course materials. This comprehensive course is meticulously designed to empower candidates preparing for the FRM Part 1 exam, ensuring they command the quantitative concepts pivotal for success in financial risk management.

What You'll Learn:

Foundations of Probability 🔹

- Gain a solid understanding of the basics that form the bedrock for more complex statistical analysis.

Random Variables 🔹

- Explore the nature and importance of random variables in quantitative analysis, especially within the context of financial risk assessment.

Univariate & Multivariate Random Variables 🔹

- Delve into the dynamics of single and multiple variable interactions which are crucial for understanding risk factors.

Sample Moments 🔹

- Learn how sample data can be utilized to make inferences about a larger population, laying the groundwork for hypothesis testing.

Hypothesis Testing 🔹

- Master the rigorous process of testing assumptions and theories statistically, providing a critical skill in risk management decision-making.

Linear Regression 🔹

- Understand the application of linear regression as a fundamental tool in financial modeling.

Regression with Multiple Explanatory Variables 🔹

- Discover how to interpret and manage relationships between various financial variables, enhancing your modeling accuracy.

Regression Diagnostics 🔹

- Assess the validity and reliability of regression models, ensuring robust and trustworthy analysis.

Time Series Analysis 🔹

- Cover essential topics in time series analysis, including stationary and nonstationary time series data modeling and forecasting techniques.

Measuring Return, Volatility, and Correlation 🔹

- Equip yourself with the quantitative skills necessary for risk and portfolio management.

Advanced Techniques: Simulation & Bootstrapping 🔹

- Explore modern risk modeling techniques that are crucial for decision-making under uncertainty.

Course Structure: This course is structured to facilitate a step-by-step learning process, making complex quantitative concepts accessible to all, regardless of their prior expertise in the subject. The chapters included are:

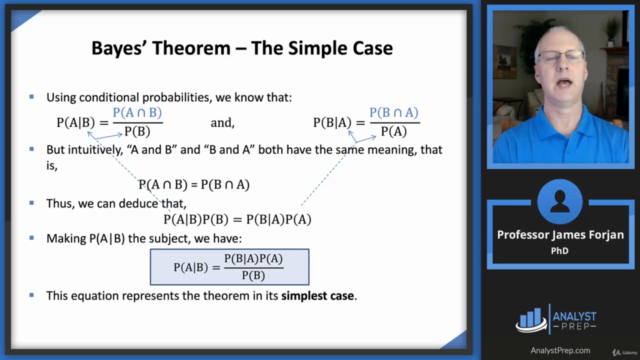

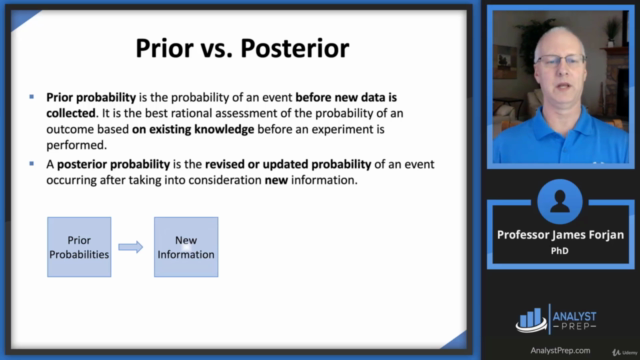

- Fundamentals of Probability - The starting point for understanding probability and its role in financial risk assessment.

- Random Variables - Explore random variables and their significance in quantitative analysis.

- Common Univariate Random Variables - Understand the characteristics and applications of common univariate random variables.

- Multivariate Random Variables - Learn how to analyze multiple variables simultaneously, a key aspect in assessing risk factors.

- Sample Moments - Discover how sample data can inform us about population characteristics.

- Hypothesis Testing - Learn the process of testing financial hypotheses with statistical rigor.

- Linear Regression - Master the tool of linear regression for financial modeling and forecasting.

- Regression with Multiple Explanatory Variables - Understand complex relationships between various financial variables.

- Regression Diagnostics - Ensure that your regression models are robust and reliable by learning how to conduct proper diagnostics.

- Stationary Time Series - Delve into the principles of stationary time series analysis, crucial for financial data interpretation.

- Nonstationary Time Series - Learn techniques for dealing with nonstationary time series data in financial modeling.

- Measuring Return, Volatility, and Correlation - Master the quantitative tools used to measure these key elements in finance and risk management.

- Simulation & Bootstrapping - Discover modern techniques used in simulation and bootstrapping for risk modeling and decision-making under uncertainty.

By completing this course, you will not only be prepared for the FRM Part 1 exam but also be equipped with a robust set of quantitative skills that are essential for a successful career in finance and risk management. Join us on this journey to master quantitative analysis! 🚀📚✨

Course Gallery

Loading charts...