FRM Part 1 - Book 1 - Foundations of Risk Management

Why take this course?

🚀 FRM Course by Prof. James Forjan 🎓

Course Overview:

In this comprehensive FRM Part 1 - Book 1 course, Prof. James Forjan, a seasoned professional with over 25 years of experience in teaching college-level business classes, guides you through the foundational elements of risk management. This course is meticulously structured to align with the first part of the "Foundations of Risk Management" book and is tailored to equip you with a deep understanding necessary for excelling in the FRM Part 1 exam.

Course Highlights:

- Expert Instruction: Learn from Prof. Forjan, a renowned instructor known for his clarity and depth of knowledge in risk management.

- Full Coverage: Each chapter is carefully crafted to cover all critical aspects of risk management, ensuring you're well-prepared for the exam.

- Real-World Application: Gain insights into how firms manage financial risks and understand the governance structures that regulate these processes.

- Advanced Risk Concepts: Master the Modern Portfolio Theory (MPT), Capital Asset Pricing Model (CAPM), Arbitrage Pricing Theory, and Multifactor Models to understand risk and return dynamics.

- Data Analysis Skills: Learn the principles of risk data aggregation and reporting to enhance your ability to manage risks effectively within an organization.

- Ethical Framework: The course integrates the GARP Code of Conduct, emphasizing the importance of ethical considerations and professional standards in risk management.

📚 Course Structure:

This course is structured into 11 comprehensive modules:

-

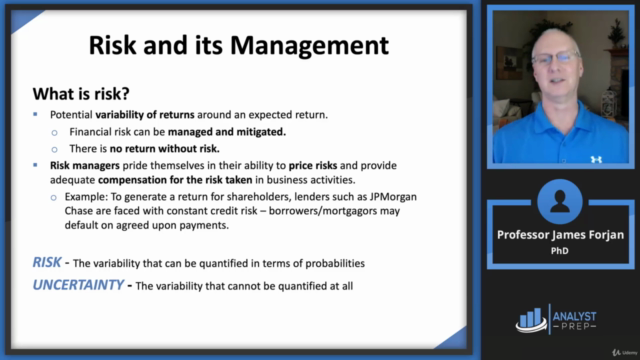

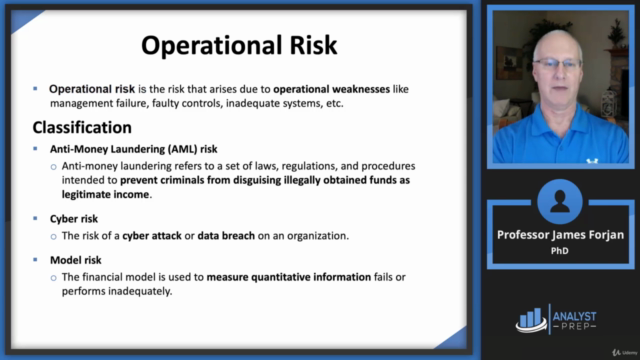

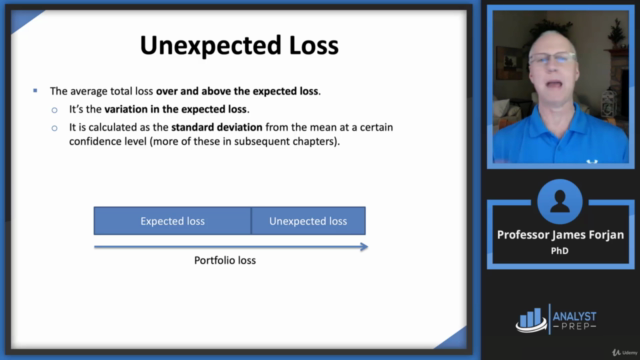

The Building Blocks of Risk Management

- Laying a solid foundation for understanding complex risk concepts.

-

How Do Firms Manage Financial Risk?

- Exploring the strategies and techniques firms use to manage financial risks.

-

The Governance of Risk Management

- Understanding the governance structures and frameworks in place for effective risk management.

-

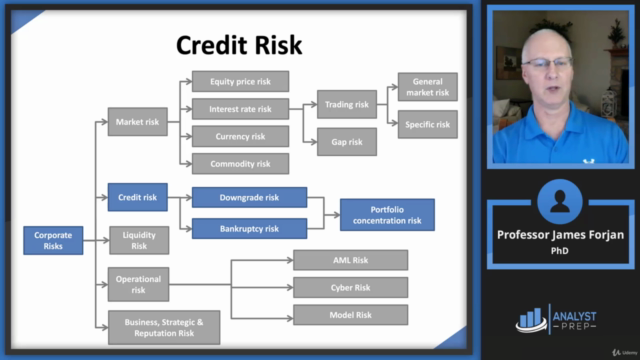

Credit Risk Transfer Mechanisms

- Dissecting the mechanisms that facilitate the transfer of credit risks, enhancing your grasp of risk mitigation strategies.

-

Modern Portfolio Theory (MPT) and Capital Asset Pricing Model (CAPM)

- Gaining a deep understanding of MPT and CAPM for effective market and investment strategy analysis.

-

The Arbitrage Pricing Theory and Multifactor Models

- Exploring the theories behind risk-return relationships and their practical implications.

-

Risk Data Aggregation and Reporting Principles

- Mastering the critical skills of aggregating and reporting risk data to improve decision-making processes.

-

Enterprise Risk Management and Future Trends

- Staying ahead by understanding current trends and the future direction of risk management practices.

-

Learning From Financial Disasters

- Analyzing financial disasters to learn valuable lessons that can prevent similar events in the future.

-

Anatomy of the Great Financial Crisis of 2007-2009

- A detailed examination of one of the most significant financial crises, its causes, and its effects on the global economy.

-

GARP Code of Conduct

- Emphasizing the importance of adhering to ethical standards and professional best practices in risk management.

Embark on your journey to becoming a risk management expert with this FRM Part 1 course. Dive into each chapter with confidence, knowing that you are being guided by one of the most respected voices in the field. This course is not just about passing an exam; it's about understanding the core principles of risk management that will serve you throughout your career. Enroll today and unlock your potential in the world of financial risk management! 💼✨

Course Gallery

Loading charts...