Fraud: Focus on Financial Statement Fraud – Part Two

Why take this course?

🎓 Course Title: Fraud: Focus on Financial Statement Fraud – Part Two

🧐 Course Headline: Dive Deeper into the World of Financial Statement Fraud with ACFE Expertise!

Course Description:

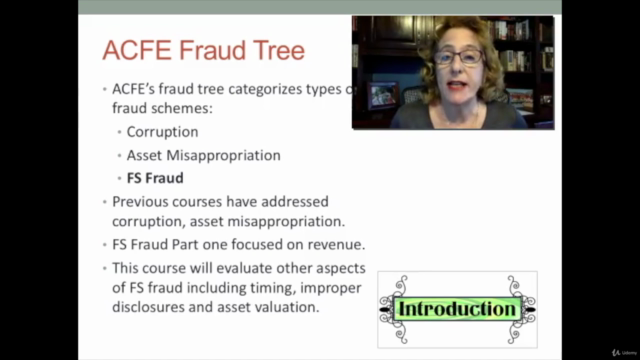

This course is a compelling follow-up to our previous exploration of financial statement fraud. It delves deeper into the intricate world of financial manipulation as defined by the Association of Certified Fraud Examiners (ACFE). The ACFE's comprehensive fraud tree categorizes financial crimes into three main types: Corruption, Asset Misappropriation, and Financial Statement (FS) Fraud. Let's unravel the complexities of FS Fraud.

Understanding Financial Statement Fraud:

Financial statement fraud involves the deliberate misrepresentation of an enterprise's financial condition through intentional misstatement or omission in the financial statements, with the objective to deceive stakeholders. According to the ACFE’s 2016 Report to the Nation, FS fraud accounted for 9.6% of occupational fraud cases and resulted in a median dollar loss of $975,000. The average duration before detection? A staggering 24 months.

Key Areas of Financial Statement Fraud:

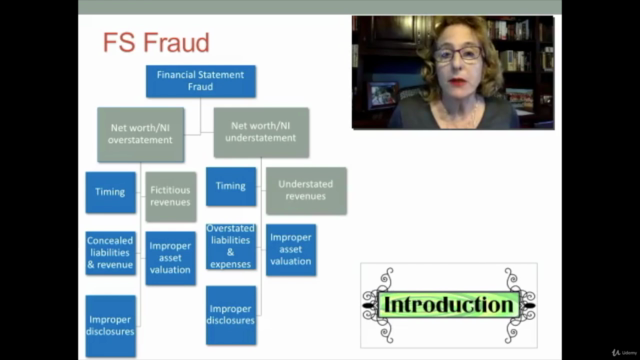

- Revenue Recognition: There are several methods for recognizing revenue, and perpetrators often exploit these to their advantage by finding loopholes.

- Timing Issues: Perpetrators may delay recording revenue or advance the recognition of expenses to manipulate financial results.

- Concealed Liabilities and Revenue: Hiding liabilities or revenues that should have been recorded can artificially improve a company's financial standing.

- Overstated Liabilities and Expenses: Inflating liabilities or expenses can reduce net income and, consequently, the apparent amount of income available for reinvestment or distribution.

- Improper Asset Valuation: Overvaluing assets on the balance sheet can lead to overstatement of equity and net worth.

- Improper Disclosures: Failing to disclose critical information or misstating disclosures can distort the true financial position of a company.

In our previous course, we delved into the nuances of revenue recognition within financial statement fraud. In this continuation, we'll explore the other facets of FS fraud as outlined in the ACFE's fraud tree. These areas are not only critical to understanding financial statement manipulation but are also essential for any professional looking to safeguard their organization against such risks.

About Illumeo:

Illumeo, founded in 2009 and based in the heart of Silicon Valley, CA, is at the forefront of revolutionizing corporate learning. We empower corporate professionals and organizations of all sizes to enhance their skills and capabilities. With a focus on Finance, Accounting, HR, Sales, and Marketing, Illumeo offers a robust platform that includes assessments, competency analyses, a vast library of expert-developed courses, collaborative tools, and the ability for companies to self-publish their internal content to preserve and disseminate institutional knowledge.

At Illumeo, we're passionate about the belief that everyone can be an expert at their job. Our platform is designed to help you achieve just that, with tailored learning experiences that align with your career goals and organizational objectives.

Join us on this enlightening journey into the intricate world of financial statement fraud detection and prevention. With Illumeo's expertise, you'll gain the knowledge necessary to protect your company's integrity and maintain transparency in its financial reporting. Let's embark on this course together and ensure we all become experts in our respective fields! 🎓✨

Course Gallery

Loading charts...