Forex Trading

Why take this course?

🚀 Forex Trading Mastery: A Comprehensive Guide with Sydney Tinki 🌟

Outcome of Learning This Course

By the end of this course, you'll be armed with a robust understanding of forex trading, encompassing both the fundamental and technical aspects, various trading strategies, effective risk management, and a deep dive into trading psychology. You'll also get to grips with advanced topics like options trading, futures, and derivatives. 📊✅

What This Course Offers

Section 1: Introduction to Forex Trading

- What is Forex Trading?: Discover the basics of forex trading and how it differs from other markets.

- Why Trade Forex?: Learn about the advantages and benefits of trading currencies.

- When can you trade Forex?: Understand the global markets and when they're open for business.

- How to trade Forex?: Get step-by-step guidance on starting your forex trading journey.

- Demo account: Practice your skills without risking real money.

- Payment methods: Explore the various ways to fund your trading accounts.

- Copy trading: Find out how you can follow successful traders.

- Algorithmic trading: Dive into automated trading strategies.

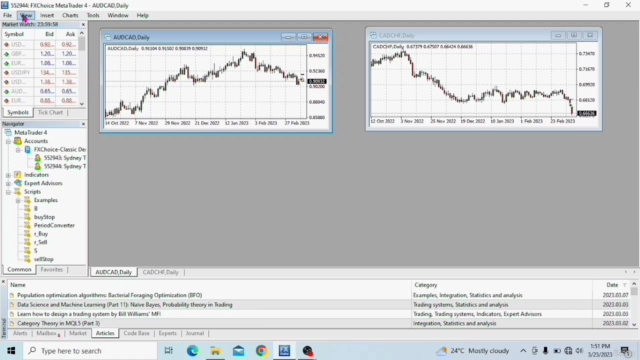

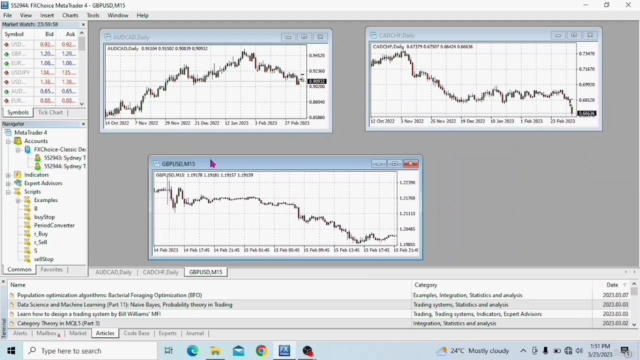

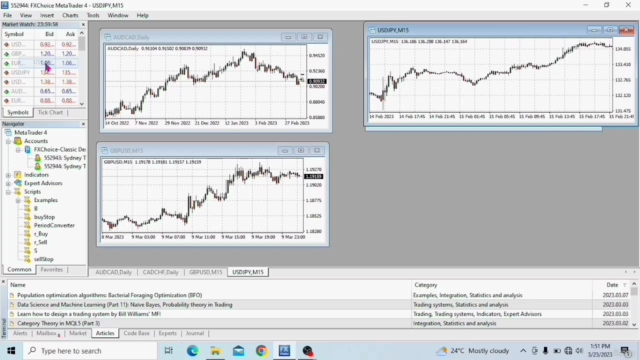

Section 2: Trading platforms

- Metatrader 4 and 5: Discover the most popular platforms for forex trading and their features.

Section 3: Forex Knowledge

- Currency pairs: Learn about the different currency pairs and how they move in relation to each other.

- Bid and ask prices: Understand the dynamics between bid and ask prices.

- Balance and Equity: Get to grips with your trading account's financial terms.

- Order types: Master the various types of orders you can place.

- Lot: Know how much currency you are trading.

- Volume: Understand the volume of trades being executed.

- Leverage: Learn how to use leverage to amplify your profits (and losses!).

- Margin: Grasp the concept of margin and margin calls.

Section 4: Fundamental Analysis

- Economic Indicators and News Events: Stay ahead with insights on how economic data can impact currency prices.

- Central Banks and Monetary Policy: Learn how central bank decisions influence the forex market.

- Understanding Interest Rates: Get to know how interest rates affect currency valuations.

Section 5: Technical Analysis

- Introduction to technical analysis: Lay the foundation for analyzing charts and market trends.

- Price action analysis: Learn to interpret price movements without relying on indicators.

- Technical indicators: Understand various indicators like RSI, MACD, and Fibonacci retracements.

- Moving averages: Discover how to smooth out price data and identify trends.

- Key Support and Resistance Levels: Identify the levels at which a market may reverse.

Section 6: Trading Strategies

- Trend trading: Master the art of trading with the trend for consistent gains.

- Swing trading: Capitalize on short-to-medium term price movements.

- Breakout trading: Learn to exploit the breakouts from support and resistance levels.

Section 5: Trading Psychology

- Emotions and Trading: Fear and Greed: Understand how emotions can impact your decision-making and how to manage them.

More

- Market report: Stay updated with daily market analysis and insights.

Why Should You Enroll in This Course?

This course is tailored for both beginners who are stepping into the world of forex trading and experienced traders looking to refine their skills. Whether you're passionate about the markets or aiming to diversify your investment portfolio, this course will equip you with the necessary tools and knowledge to navigate the forex market successfully. 📈💡

Course by: Sydney Tinki 🎓

With years of experience in web development and a keen interest in forex trading, Sydney Tinki brings a unique perspective to this course. Her expertise will guide you through the complexities of forex trading, ensuring you have a solid foundation to trade with confidence. Enroll now and start your journey to becoming a successful forex trader!

Course Gallery

Loading charts...