Valuation using DCF and Relative Valuation Techniques

Why take this course?

Course Title: Valuation using DCF and Relative Valuation Techniques

Unlock the Secrets of Financial Modeling with FinXcel Academy

🚀 Course Description:

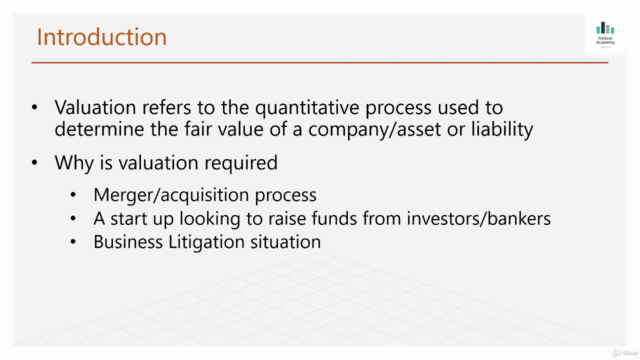

Embark on a comprehensive journey into the world of financial valuations with our "Valuation using DCF and Relative Valuation Techniques" course at FinXcel Academy. This course is meticulously designed for novices and experienced professionals alike who aim to master the art of business appraisal through robust discounted cash flow (DCF) and relative valuation methods.

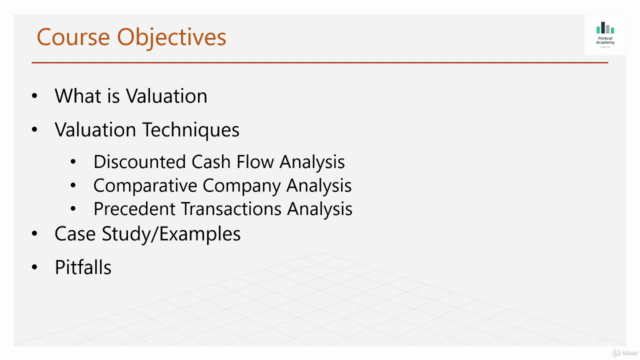

🔍 What You'll Learn:

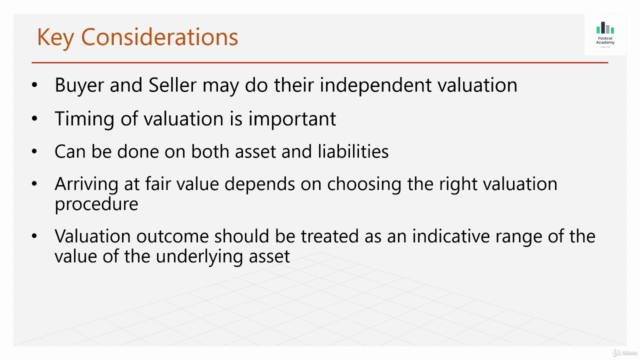

- Foundations of Valuation: Understand the core principles, importance, and applications of valuation in various financial scenarios.

- Absolute vs Relative Valuation: Explore the nuances between absolute (DCF) and relative valuation techniques and learn when to apply each.

- Hands-On Approach: Engage with real-world case studies and apply the concepts through downloadable, practical financial models.

🔥 Course Highlights:

-

Discounted Cash Flow (DCF) Method:

- Learn the fundamentals of the DCF method.

- Analyze a case study of an e-commerce company with a step-by-step model to understand the mechanics and common pitfalls.

-

Comparable Company Analysis (CCA) Method:

- Dive into the CCA approach, selecting appropriate peer companies.

- Study a tech company's valuation using comparable transactions data.

-

Precedent Transactions Method:

- Gain insights into valuing companies based on historical transaction data.

- Examine a case study of a tech company, identifying comparable transactions and addressing potential pitfalls.

📊 Course Structure:

-

Discounted Cash Flow (DCF) Method:

- Introduction to the DCF method.

- Case Study with a working model and common pitfalls analysis.

-

Comparable Company Analysis (CCA) Method:

- Introduction to the CCA method.

- Case Study including peer selection and working model application, with a focus on common pitfalls.

-

Precedent Transactions Method:

- Introduction to the precedent transactions approach.

- Case Study with model application, highlighting potential pitfalls.

✅ Who Should Take This Course?

This course is ideal for:

- Beginners: Those who are new to valuation concepts and wish to build a solid foundation.

- Financial Modelers: Professionals looking to refine their skills or expand their knowledge base in financial valuations.

By the end of this course, you'll not only understand the intricacies of valuation but also be equipped with the practical tools and knowledge to apply these techniques confidently in real-world scenarios.

📅 Enroll Now & Transform Your Financial Analysis Skills!

Join us at FinXcel Academy and take your first step towards mastering financial valuations. With our expert-led course, you'll gain the knowledge and skills to make informed decisions and stand out in your professional journey.

Enroll Today & Unlock the Power of Financial Valuation! 💰📈

Course Gallery

Loading charts...