Financial Audit Procedures - Non Current Assets

Why take this course?

🎓 Financial Audit Procedures - Non Current Assets 🚀

Course Overview:

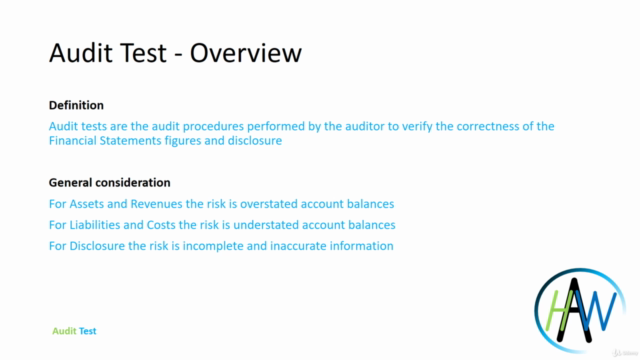

Master the intricacies of auditing non-current assets with our comprehensive online course, designed to elevate your audit expertise. Dive into the detailed procedures for testing Tangible and Intangible Fixed Assets, Investment valuation, Financial Assets, Deferred Tax, and more. Learn from the founder of HAW - How Audit Work, Mk, who brings over 9 years of international audit experience from Big4 firms across the US, UK, Netherlands, and Italy.

Key Learning Points:

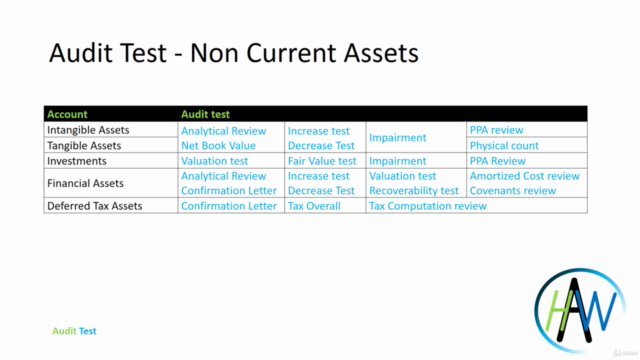

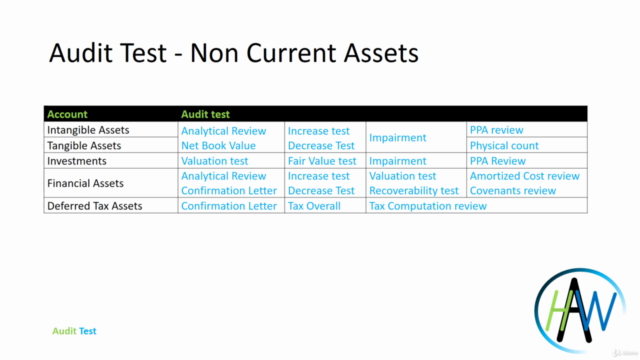

- Tangible and Intangible Fixed Assets: Understand valuation, count, depreciation, and amortization to ensure accurate asset records.

- Investment Valuation and Impairment: Learn how to assess investment values and identify impairments.

- Financial Assets: Get a grip on the complexities of loans, interests, recoverability, covenants, discounted present value, and amortized cost.

- Deferred Tax: Gain insights into deferred tax asset measurement, recognition, and disclosure.

Instructor Profile:

Mk, the founder of HAW - How Audit Work, is not just a seasoned auditor but also an exceptional educator. With nearly a decade of experience in some of the world's most prestigious audit firms, Mk combines practical knowledge with engaging teaching methods to make learning effective and enjoyable.

Course Benefits:

- Real-World Experience: Learn from an auditor who has walked the walk in various international markets.

- Multi-Course Promotions: Contact us via email, Facebook, LinkedIn, or Youtube to discover exclusive promotions for our suite of audit courses.

Available HAW Courses:

- Audit Planning

- Accounting Procedures & Internal Controls

- Confirmation Letter

- Audit test - Non-Current Assets 🏗️💰

- Audit Test - Current Assets

- Audit Test - Equity & Liabilities

- Audit Test - Income Statement

- Audit Test - All Others

- Audit Operative Overview

- Audit High Level Overview

- Audit Summary

- Audit Insight - Become & Evolve to be a Top Auditor 🌟 (Free)

- Audit Insight - Career & Lifestyle of Auditors (Free)

- Audit Insight - Audit Perception & Career After Audit (Free)

Enhance Your Career:

Don't let your audit skills lag behind. With HAW's online courses, you can advance your career and become a top-notch auditor. Whether you're just starting or looking to refine your expertise, our courses provide the knowledge you need.

"Just focus, learn & do it! Remember, continuous learning is key to professional growth." - Mk

Course Details:

- Duration: Flexible learning pace with lifetime access to course materials.

- Format: Interactive video lectures, real-world case studies, quizzes, and expert Q&A sessions.

- Certification: Upon successful completion, receive a certificate that demonstrates your commitment to excellence in financial auditing.

Ready to take the next step in your audit career? 🎓✨

Enroll now and unlock the full potential of your auditing skills with HAW - How Audit Work! Let's embark on this learning journey together! 🚀💼

Course Gallery

Loading charts...