Financial Statement Analysis

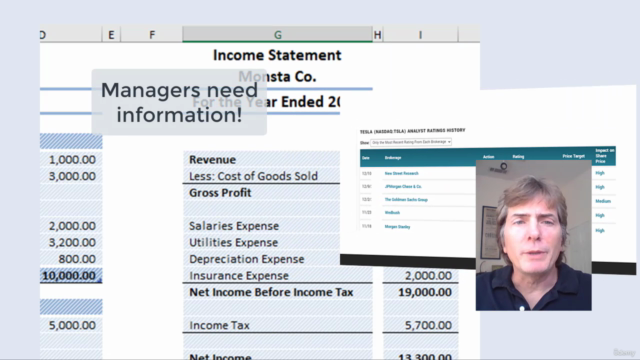

Why take this course?

-

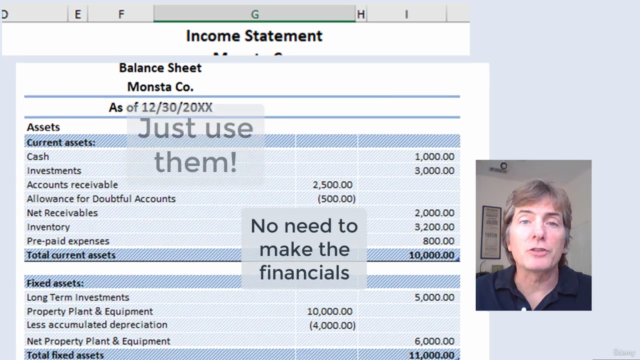

Book Value: This refers to the value of a company's assets minus its liabilities, which gives us the net worth or owner's equity as per the balance sheet. Book value is an accounting measure that reflects the amount at which assets appear on the company's balance sheet. It represents the residual interest in the assets of the company after deducting liabilities from the total asset value. For example, if a company has total assets of $1 million and liabilities of $600,000, the book value of the company is $400,000 ($1 million - $600,000). This value can be broken down into stockholders' equity or shareholders' equity, which is the amount of money that would remain if the company was sold off and all liabilities were paid off.

-

Balance Sheet: The balance sheet is one of the three core financial statements (alongside the income statement and the statement of cash flows) and provides a snapshot of a company's finances at a specific point in time. It categorizes the company's assets, liabilities, and shareholders' equity. The formula for the balance sheet is Assets = Liabilities + Shareholders' Equity. This ensures that assets are financed either through borrowing (liabilities) or from ownership investments (shareholders' equity).

-

Intangibles: These are non-physical assets such as patents, trademarks, brand recognition, and copyrights, which have value to the business but do not physically occupy space. They appear on the balance sheet under assets. Intangible assets can be an important part of a company's competitive advantage.

-

Liabilities: These are the financial debts or obligations that the company owes to other parties. Liabilities are categorized as current (short-term) and non-current (long-term), depending on whether they are expected to be settled within one year or beyond one year, respectively.

-

Statement of Cash Flows: This statement breaks down the sources and uses of cash for a company over a period of time. It is divided into three sections: operating activities, investing activities, and financing activities. The operating activities section shows how cash was affected by core business operations, which is crucial for understanding the liquidity of the business.

-

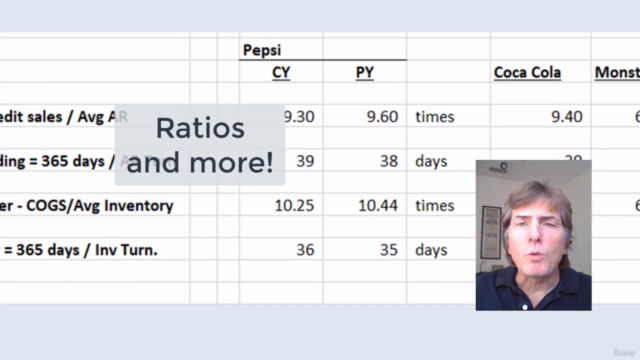

Cash Ratios: These ratios measure a company's ability to generate positive cash flow from its operations and are important indicators of short-term financial stability and health. Examples include the current ratio and quick ratio.

-

Valuation Techniques: Valuing a business or its assets involves various methodologies such as discounted cash flow (DCF), comparable company analysis, and precedent transactions. Each method has its strengths and weaknesses and is suitable for different types of businesses and circumstances.

-

Credit Analysis: When assessing the creditworthiness of a business, analysts look at various financial metrics and statements to gauge the risk of lending money or extending credit. This includes evaluating profitability, cash flow, debt levels, and management's ability to operate effectively.

-

Contracts and Financial Statements: Financial statements provide critical data that can influence contract terms and conditions, particularly in areas such as supply chain management, where the financial stability of suppliers is a key concern.

-

Executive Compensation: This involves setting up compensation structures for top executives that align their interests with those of the shareholders. It often includes a mix of salary, bonuses, stock options, and long-term incentives.

-

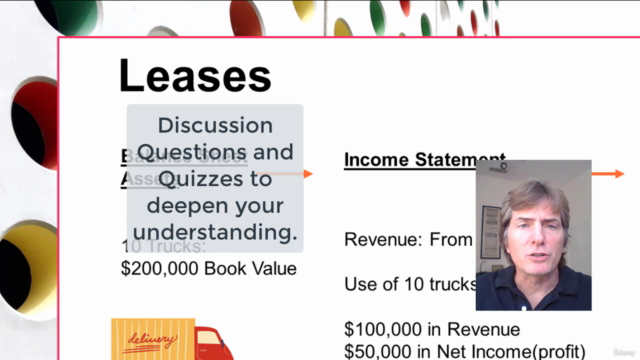

Leases: Lease obligations are important to consider in financial analysis because they represent a significant portion of a company's operating expenses and commitments. Off-balance sheet financing through leasing can affect the apparent financial health of a company.

-

Owners' Equity: This represents the residual interest in the assets of the company after all debts have been paid. It is often divided into different classes of stock, each with its own rights and claims on the company's profits and assets.

-

Earnings Per Share (EPS): EPS measures a company's profitability on a per-share basis and is a key metric used by investors to assess the financial health of a company. It is calculated by dividing the net income by the total number of outstanding shares. Adjusted for dilutive securities, it is known as "diluted EPS."

Understanding these concepts is crucial for anyone involved in financial analysis, investment decisions, or corporate finance, as they provide a comprehensive view of a company's financial position and performance.

Course Gallery

Loading charts...