Financial Modelling, Financial Planning and DCF Valuation

Why take this course?

🌟 Master Financial Modelling & Valuation with Confidence! 🌟

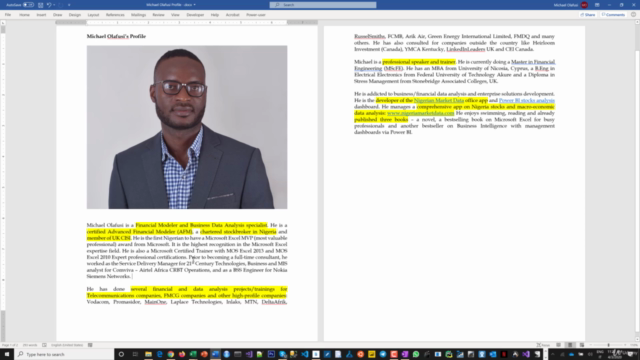

Enroll Today and Gain Lifetime Access to Regular Live Support Sessions! Get ready to transform your financial analysis skills with our comprehensive online course, "Financial Modelling, Financial Planning, and DCF Valuation" led by the esteemed Michael Olafusi. This isn't just a course—it's a journey from zero to hero in creating a startup or existing company financial model from scratch. And it doesn't stop there! This course sets you on a path towards achieving the coveted Advanced Financial Modeler (AFM) certification.

🎓 Why You Should Enroll:

- Hands-On Approach: Dive into a real-world project as you build a robust, dynamic, and fully automated financial model using Excel.

- Practical Application: Learn how to use the model input sheet effectively to aggregate all your client's plans for a comprehensive forecasting approach.

- Scenario Planning: Master creating optimistic, conservative, and pessimistic scenarios that will dynamically adjust your entire financial statement forecast.

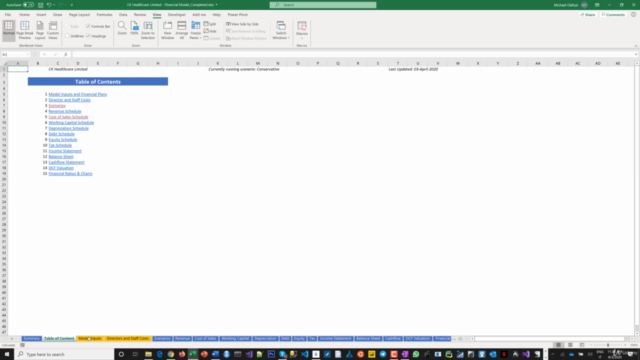

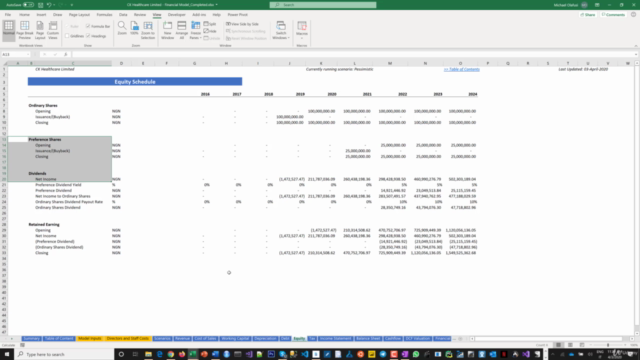

- Comprehensive Coverage: From creating individual schedules such as Revenue, Cost of Sales, Working Capital, Depreciation, Debt, Equity, Tax, Income Statement, Balance Sheet, and Cash Flow Statements to understanding the nuances of DCF Valuation and Financial Ratios.

- Expert Guidance: Benefit from live support sessions that will help you align what you are learning with your career growth objectives.

🔥 What You Will Learn:

-

Template Creation & Excel Tips: Start by building a financial model template from scratch, leveraging Excel functions and best practices for efficiency and reliability.

-

Input Aggregation: Easily manage and aggregate all your client's plans into a single input sheet, ensuring a clear and maintainable financial model.

-

Dynamic Scenario Analysis: Learn to set up optimistic, conservative, and pessimistic scenarios that will automatically adjust your entire forecast without manual intervention.

-

Schedule Creation: Gain proficiency in creating all the necessary schedules, including Revenue, Cost of Sales, Working Capital, Depreciation, Debt, Equity, Tax, Income Statement, Balance Sheet, and Cash Flow.

-

DCF Valuation: Understand the principles of Discounted Cash Flow (DCF) valuation and how to apply them in real-world situations.

-

Financial Ratios Computation: Learn to compute essential financial ratios that will provide insights into the health of a business.

📅 Course Curriculum Breakdown:

- Financial Model Template Creation and Excel Tips

- Dedicated Model Input Sheet

- Scenario Planning (Optimistic, Conservative, Pessimistic)

- Revenue Schedule Creation

- Cost of Sales Schedule Creation

- Working Capital Schedule Creation

- Depreciation Schedule Creation

- Debt Schedule Creation

- Equity Schedule Creation

- Tax Schedule Creation

- Income Statement Creation (Dynamically)

- Balance Sheet Creation (Dynamically)

- Cash Flow Statement Creation (Dynamically)

- DCF Valuation

- Computing Financial Ratios

🚀 Take the Next Step in Your Career:

Don't let another day pass where you're not leveraging your potential in financial modelling and valuation analysis. With Michael Olafusi's guidance, you'll not only understand the mechanics of financial modelling but also how to apply them effectively for startups or existing companies.

Enroll now and join a community of professionals who are propelling their careers forward with the power of financial expertise. 🚀

**🔥 Limited Time Offer: ** Secure your spot with an exclusive early bird discount! But hurry, this offer won't last forever.

Take charge of your financial future today by clicking 'Enroll Now' and embark on a transformative learning journey with "Financial Modelling, Financial Planning, and DCF Valuation" course! 🎓💼

Course Gallery

Loading charts...