Financial Modeling for Mining

Why take this course?

🌟 Financial Modeling for Mining: Master Project Finance for Natural Resources 🚀

Course Objective

🚀 Transform Your Skills: Dive into the world of financial modeling with our comprehensive course designed exclusively for mining projects. Gain the expertise to construct and analyze sophisticated financial models that are indispensable for investment analysis, debt structuring, and operational scenario evaluations in the most complex environments. 🏗️💡

By the end of this course, you will be empowered to create intricate project finance models tailored for the mining sector, enabling you to make informed decisions about investment and financing.

What This Course is About?

🔍 Essential Finance Modeling: Learn how to model complex financial transactions for mining projects from scratch in Excel, assessing the risk-reward profiles associated with lending to and investing in these ventures.

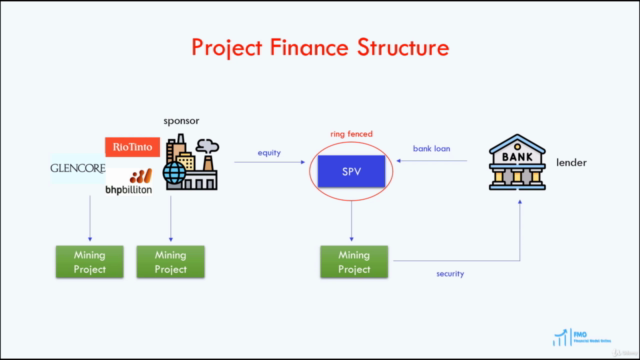

You will understand the dynamics of developing and financing mining projects, which are critical for creating accurate and reliable financial models.

Key Learning Areas:

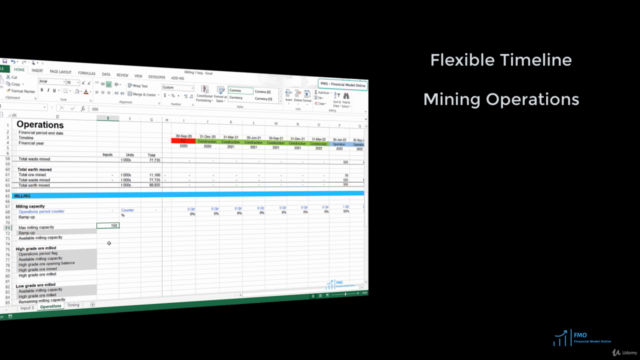

✅ Building a Financial Model: Master the art of constructing a project finance model for a mining operation using Excel from the ground up.

✅ Development & Finance: Understand the lifecycle of a mining project and the financial mechanisms that underpin its development and financing.

✅ Advanced Macros & VBA: Learn how to use macros and Excel VBA codes to resolve circularities in your models, ensuring accuracy and efficiency.

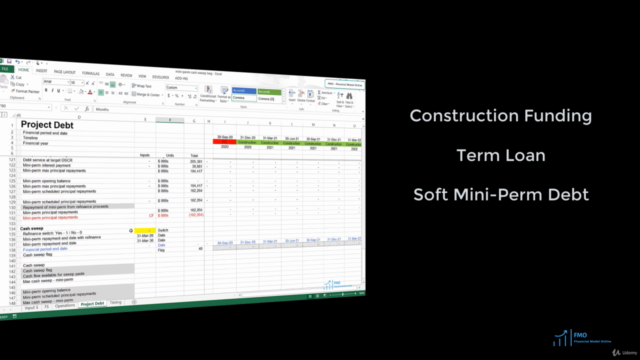

✅ Debt Sizing & Covenants: Gain skills in sizing debt according to various covenants specific to mining projects.

✅ Complex Accounting Considerations: Model financial aspects such as Debt Service Reserve, Maintenance Reserve, Working Capital, Asset Retirement Obligation Reserve Accounts, and more.

✅ Debt Structure & Refinancing: Explore mini-perm debt structures with refinancing facilities, financing fees during construction and operation.

✅ Tax & Accounting Complexities: Incorporate advanced project finance modeling concepts and accounting practices like flexible timing, mini-perm debt, refinancing, cash sweep, equity bridge loan, asset retirement obligation, the unit of production depreciation method, NOL carry forward expiration, etc.

Course Workflow:

📈 Step-by-Step Learning: Engage with over 14 hours of course content, meticulously structured to guide you from the basics to advanced modeling techniques.

-

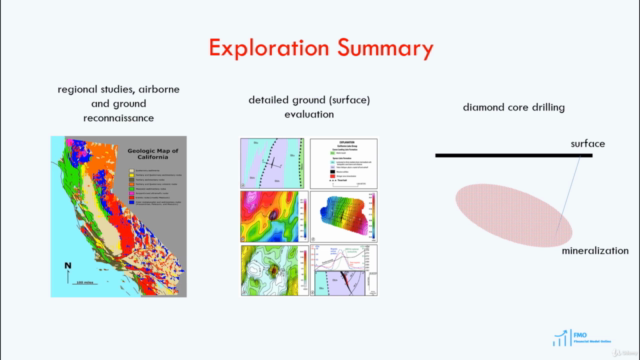

Review of Mining Project Development: Understand the components and dynamics of mining operations and project finance transactions within the industry.

-

Financial Modeling Tools & Methods: Get up to speed with essential Excel functions and financial modeling methods that will enhance your productivity and accuracy in building financial models.

-

Real-World Financial Modeling: Apply your knowledge by constructing a comprehensive financial model for an open-pit gold project.

Is This Course For You?

This course is ideal for:

- Analysts, Managers, Senior Managers, and Associate Directors seeking to deepen their financial modeling expertise.

- Financial Advisors and Investment Bankers who want to refine their skills in project finance.

- Professionals from Private Equity and Infrastructure Funds looking to assess and structure investments in the mining sector.

- CFOs at project companies, investment banks, or other financial institutions involved with natural resources projects.

🎓 Who Should Enroll?

Anyone involved in building, reviewing, or analyzing financial models for mining projects will benefit from this course. This includes finance professionals across various sectors who aim to enhance their project finance modeling skills.

Course Prerequisites:

- Familiarity with Excel, particularly within the context of financial modeling.

- Basic knowledge of investment concepts such as Net Present Value (NPV) and Internal Rate of Return (IRR).

Join us in this transformative learning journey and unlock the full potential of your financial modeling expertise! 🌟

Course Gallery

Loading charts...