Financial Modeling & DCF Valuation Model: Investment Banking

Why take this course?

🌟 Equity Valuation & Corporate Finance Mastery: Financial Modeling & DCF Valuation Model 🌟

Overview

In the world of finance, understanding how to properly value a company and build robust valuation models is not just an advantage—it's imperative. Whether you're an entrepreneur seeking to understand your company's worth or an investment banker evaluating potential investments, the stakes are high. My comprehensive course on Financial Modeling & Company Valuation will equip you with the essential techniques and strategies needed to excel in this domain.

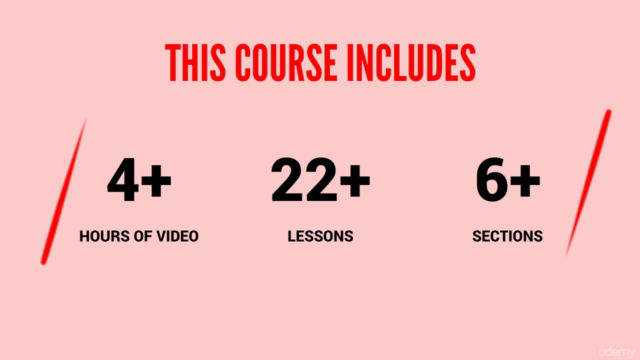

What's Included in This Course?

Your Company And Equity Valuations Will Never Be The Same. With the knowledge gained from this course, you'll avoid common pitfalls that can lead to missed investment opportunities or misguided business decisions. As Warren Buffett famously said, "Accounting numbers are the beginning, not the end, of business valuation."

This course comes with a 30-day money-back guarantee, allowing you to explore its contents with zero financial risk.

Core Topics Covered:

In this course, you'll dive deep into the following areas:

- Financial Modeling & Financial Reporting

- Build A Discounted Cash Flow (DCF) from scratch

- Calculate Free Cash Flows, Net Cash Flows, and the Present Value of Cash Flows

- Dividend Discount Models

- Business Valuation & Tools

- Investment Banking and Analysis Techniques

- Modeling Growth, Revenue, Costs, and Expenses

- The 3 Company Valuation Methods

- Private Equity and Venture Capital Calculating

- Continuing Value & Equity Value

Who Is This Course For?

This course is a game-changer for:

- Entrepreneurs who wish to understand their company's true value.

- Individuals who have experienced investment failures and want to know why.

- Aspiring investment bankers or analysts looking to refine their valuation skills.

- Anyone intrigued by the art of company valuation and eager to master it.

Why Master Financial Modeling?

Understanding financial modeling and valuation is crucial because:

- Master Company Valuation: Know what drives a company's value.

- Know Which Data Matters: Learn to focus on the right metrics.

- Build Value in Your Company: Understand how to make your business more valuable.

- Perfect Financial Modeling: Create accurate and insightful models that can influence decision-making and attract investments.

The Importance of Strong Interview Skills:

Having strong interview skills, especially in the context of finance, can be a significant advantage. Here's why:

- Master Financial Concepts: Impress interviewers with your understanding of financial principles.

- Showcase Your Ability to Analyze Data: Demonstrate your analytical prowess.

- Demonstrate Valuable Skills: Exhibit skills that are highly sought after in the finance industry.

- Get More Interviews: Stand out from the crowd and increase your chances of landing that dream job.

Conclusion

I'm thrilled to offer you this course, which is packed with knowledge and experience. You'll absolutely love it, and I can't wait to share with you the insights and strategies that have made a difference in my career.

Don't wait any longer. Click the green "Buy Now" button today to embark on this transformative financial journey, secure in the knowledge that your purchase is risk-free for 30 days. Let's unlock the full potential of your financial expertise together!

Course Gallery

Loading charts...