Financial Modeling and its Business Applications

Why take this course?

🎉 Course Title: Financial Modeling and its Business Applications

🌍 Headline: Master the Fundamentals and Concepts of Building a Financial Model from Scratch with Real-World Business Applications! 🚀

📘 Course Description: Embark on a journey to master financial modeling, the indispensable tool for strategic decision-making in business. This course is meticulously crafted to offer you a comprehensive understanding of financial modeling concepts, with a practical, hands-on approach that will empower you to apply these skills directly to real-world business scenarios.

With a focus on a client's work-brief, you'll learn the ins and outs of financial modeling from its inception to its application. Whether you're working with a company that has no historical data or financial statements, this course will guide you through every step, ensuring you have the knowledge and tools needed to build a robust financial model from the ground up.

🔍 What You Will Learn:

- Understanding Business Operations: Learn how a business's operations feed into the framework of financial modeling.

- Business & Accounting Cycle: Dive deep into the accounting cycle and its significance in financial modeling.

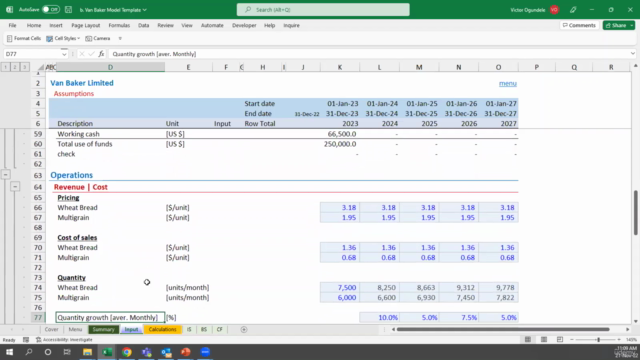

- Data Collection Techniques: Utilize an Information Request List to gather the necessary data for your model, as demonstrated through a practical client case study.

- Professional Model Template Construction: Create a professional template that serves as the foundation of any financial model.

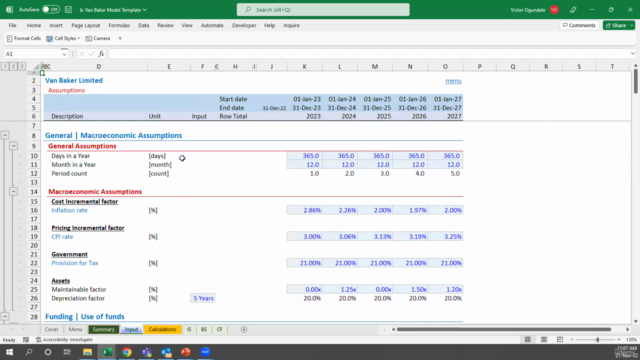

- Inputs Structuring with FAST Standard: Learn how to extract and structure inputs effectively using the Financial Analysis Software Standard (FAST).

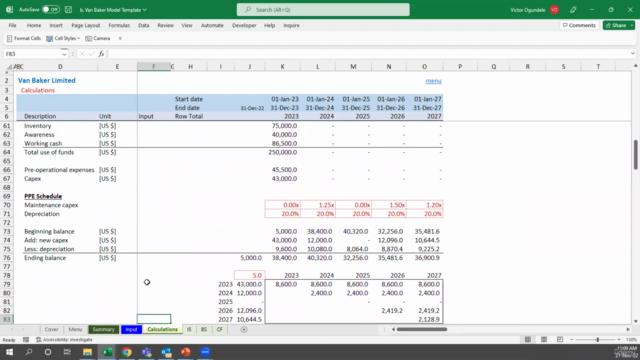

- Calculations & Schedules Building: Develop the calculations, schedules, and logic necessary within your financial model.

- Projected Financial Statements Creation: Construct projected financial statements including Profit and Loss, Balance Sheet, and Cash Flow Statement.

🧠 Prerequisite Skills: To maximize the benefits of this course, you should have:

- Accounting Knowledge: Familiarity with building and interpreting 3-financial statements and understanding their interconnectivity.

- Finance Fundamentals: A grasp on investment evaluation and incorporating macroeconomic factors into forecasting.

- Microsoft Excel Proficiency: Competence in applying formulas, functions, and advanced features within Microsoft Excel.

- Analytical Skills: The ability to analyze and interpret data effectively.

Join Victor Ogundele, a seasoned professional with extensive experience in financial modeling, as he leads you through this transformative learning experience. With practical techniques and real-world applications, you'll be equipped to build financial models that drive business success and provide valuable insights for strategic decision-making.

👩🎓 Enroll Now and unlock the door to mastering financial modeling for your career! 🌟

Course Gallery

Loading charts...