Financial analysis using ratios

Why take this course?

🌟 Financial Analysis using Ratios - Online Course by Omkareshwar 🌟

Course Headline: 🚀 Master Financial Analysis with Real-Life Examples Using 34 Key Ratios! 🚀

Description: This comprehensive course will equip you with the essential skills to perform in-depth financial analysis using ratios. By studying real companies like Amazon, Facebook, Walmart, and Apple, you'll gain practical insights into how these metrics work in the real world.

🎓 Why Should You Enroll? ✅ Enhance Job Skills: If you're aspiring for roles in Finance such as Financial Analyst, Accountant, Auditor, Business Analyst, Financial Controller, Financial Manager, CFO, CEO, Investment Banker, Equity Research Analyst, Investor, or Entrepreneur, mastering financial ratios is a non-negotiable skill. ✅ Detailed Interpretation of Ratios: This course goes beyond mere formulas; it provides in-depth analysis and interpretation of financial ratios using actual financial statements. ✅ Time-Saving Resources: With our ready-to-use Formulas Sheet, Calculation templates, and Peer Comparison sheet, you'll save time and focus on understanding the core concepts. ✅ Expert Guidance: Learn from an expert who will guide you through each ratio, ensuring clarity and comprehension.

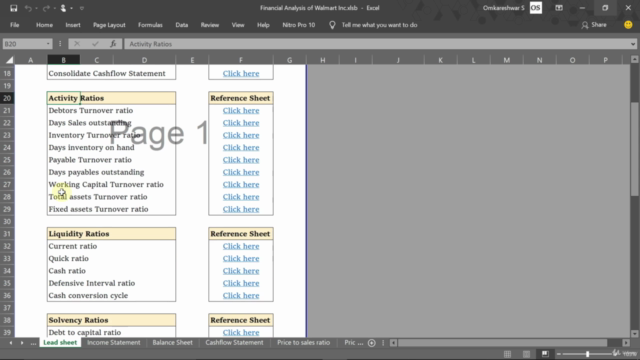

Course Outline: 📊 Activity Ratios:

- Debtors Turnover Ratio

- Days Sales Outstanding (DSO)

- Inventory Turnover Ratio

- Days Inventory on Hand

- Payable Turnover Ratio

- Days Payable Outstanding (DPO)

- Working Capital Turnover Ratio

- Total Assets Turnover Ratio

- Fixed Assets Turnover Ratio

💧 Liquidity Ratios:

- Current Ratio

- Quick Ratio

- Cash Ratio

- Defensive Interval

- Cash Conversion Cycle (CCC)

💰 Solvency Ratios:

- Debt to Capital Ratio

- Debt to Asset Ratio

- Debt to Equity Ratio (D/E)

- Capital Gearing Ratio

- Financial Leverage Ratio

- Interest Coverage Ratio

🚀 Profitability Ratios:

- Gross Profit Margin

- Operating Profit Margin

- Pretax Profit Margin

- Net Profit Margin

- Return on Assets (ROA)

- Return on Capital (ROC)

- Return on Equity (ROE)

📈 Valuation or Market Price Ratios:

- Earnings per Share (EPS)

- Price to Earnings Ratio (P/E)

- Price to Earnings Growth Ratio (PEG)

- Payout Ratio

- Dividend Yield

- Price to Cash Flow Ratio (P/FCF)

- Price to Sales Ratio

What You'll Get: ✅ Lifetime Course Access: No expiration date on your learning! ✅ Full-Money Back Guarantee: 30 days, risk-free. If you're not satisfied, we'll refund your money, no questions asked. ✅ Course Updates: Stay up-to-date with the latest course content and downloadable resources. ✅ Exclusive Resources: Access our Formulas Sheet, Calculation templates, and Peer Comparison sheet to support your learning journey.

Disclaimer Note: This course is for educational and informational purposes only. The discussion of Amazon, Facebook, Walmart, Apple, or any other company as part of this course is not intended as investment advice. Always do your own research before making investment decisions. 📘

📅 Enroll Now and Elevate Your Financial Analysis Skills to New Heights! 🚀

Course Gallery

Loading charts...