Excel Financial Modeling and Business Analysis Masterclass

Why take this course?

🌟 Excel Financial Modeling and Business Analysis Masterclass 🌟

Welcome to Your Journey in Financial Mastery!

Embark on an exciting learning adventure with our Excel Financial Modeling and Business Analysis Masterclass. This comprehensive course, led by the expert tutelage of Andreas Exadaktylos, is meticulously designed to empower you with the skills to craft scalable, flexible, and reusable financial models using Excel. 🚀

Course Overview:

-

Understanding Financial Modeling: We kick off by defining what financial modeling is, who uses it, and why it's crucial in decision-making processes across various industries. 📈

-

Planning & Designing Your Financial Model: Learn the art of sourcing data, structuring models, and integrating documentation to ensure clarity and adaptability. 🔍

-

Excel Tools & Techniques: Master Excel's functionalities such as cell referencing, dynamic ranges, profit and loss calculations, and data validation to enhance your modeling capabilities. 🛠️

-

Excel Shortcuts: Discover time-saving keystrokes and navigation tips that will revolutionize the way you interact with Excel spreadsheets. ⏫

Dive into Essential & Advanced Functions:

-

Essential Functions: Get to grips with fundamental Excel functions necessary for setting up practical calculations within your models. 🧮

-

Advanced Functions: Explore sophisticated functions tailored for robust financial analysis and modeling. 🔬

-

Financial Functions: Learn the specific Excel functions that are indispensable for accurate financial modeling. 💰

Practical Application & Real-World Scenarios:

-

Scenarios in Financial Models: Understand and apply drop-down scenarios, sensitivity analysis with data tables, and the Scenario Manager to evaluate various business situations. 🌟

-

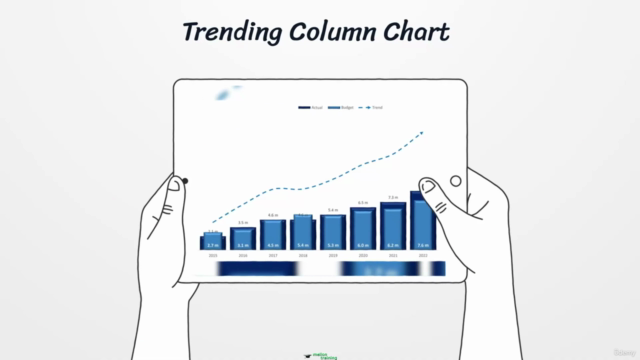

Charting Techniques: Learn how to create compelling charts that visually communicate your findings effectively. 📊

Master Accounting Fundamentals:

- Everyday Accounting Tasks: Gain insights into the daily accounting tasks and approaches accountants utilize in their work. 📌

Hands-On Financial Model Building:

-

Financial Statements (3-statement) Model: Learn to construct a comprehensive model that reflects the financial health of any business. 🧿

-

Project Costing Model: Understand how to evaluate projects by accounting for all related costs accurately. 🏗️

-

Discounted Cash Flow (DCF) Modelling: Dive into the complexities of forecasting cash flows and valuing investments using the DCF method. ✈️

-

Activity-Based Costing: Discover how to allocate costs by activity to identify cost-saving opportunities within an organization. 📋

-

Budgeting: Learn the process of creating a budget, which serves as a roadmap for financial planning and performance tracking. 🗺️

Engage in Interactive Learning:

-

Quizzes & Exercises: Test your knowledge with quizzes and hands-on exercises designed to reinforce your understanding of financial modeling concepts. ✍️

-

Project Files: Access downloadable project files for each module, providing you with a solid foundation to build upon. 💻

-

Instructor Support: Enjoy one-on-one support from Andreas Exadaktylos, who is committed to your success and learning journey. 🤝

Course Features & Benefits:

-

Lifetime Access: Get immediate lifetime access to over 8 hours of high-quality video content. 🎬

-

Certification: Upon completion, receive a certificate of accomplishment to showcase your newfound skills. 🎉

-

Engaging Structure: A course structured with the best practices in learning and teaching for an effective and engaging experience. 📚

Ready to Advance Your Skills?

If you're eager to elevate your financial modeling and business analysis capabilities, this masterclass is your gateway to a world of opportunities. With expert guidance, practical exercises, and an abundance of resources at your fingertips, you're set for success! 🎯

Enroll Today & Embark on Your Learning Adventure!

Don't miss out on this unique opportunity to transform your approach to financial modeling and business analysis. Sign up now and take the first step towards mastering Excel and enhancing your professional skillset. 🎓

Remember, as Euripides once said, "Learning is more effective when it is an active rather than a passive process." Engage with the material, apply what you learn, and watch your expertise grow! 🚀

Enroll now and unlock your potential with our Excel Financial Modeling and Business Analysis Masterclass! 🎈

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

The Excel Financial Modeling and Business Analysis Masterclass offers comprehensive, practical training in advanced financial modeling suitable for both finance professionals and those new to the field. Students benefit from a wide array of techniques and tools presented step-by-step through real-world examples, while receiving valuable instruction on mastering complex Excel functions. Despite minor issues with pacing and interaction, this course serves as an excellent resource for those interested in enhancing their financial modeling skills in Excel.

What We Liked

- In-depth exploration of Excel financial modeling with a focus on practical applications such as Financial Statement Modeling, Budgeting, Forecasting, and Discounted Cash Flow Analysis.

- Comprehensive coverage of advanced Excel functions like SUMPRODUCT, SUMIFS, OFFSET, VLOOKUP, XLOOKUP, PMT, PPMT, IPMT, NPER, PV, NPV, XNPV, INDIRECT, ADDRESS.

- Incorporation of visual charting techniques for Analysis and Model Output including Trending Column Chart, Bullet chart & Four-Segment Line Chart.

- Value-added information provided from experienced instructors with real-world expertise, as indicated by testimonials.

Potential Drawbacks

- Occasional overly long pauses during videos which can disrupt the learning flow for some students and require extra attention to confirm video is still playing.

- Lack of macOS-specific Excel shortcuts in exercises, potentially limiting the applicability for Mac users.

- Some may find course content challenging due to advanced nature of formulas and modeling techniques.

- Presentation of lessons may not be as engaging or interactive as some other courses on Udemy.