Learn E-Way Bill on Govt Portal - Certificate Course

Why take this course?

🚀 Learn E-Way Bill on Govt Portal - Certificate Course 📜

Course Headline: Unlock the Full Potential of E-Way Bill Management with Our Comprehensive Online Course 🛣️💻

Introduction to the Course: In this course, we embark on a journey from the basics to advanced levels of handling E-Way Bills on the Government Portal. This is your golden opportunity to master all aspects of E-Way Bill registration, generation, and management, including bulk generation, validity extension, and even dealing with vehicle updates and sub-user management. Whether you're a business owner, an aspiring accountant, or just looking to expand your knowledge in accounting with GST in Tally, this course is tailored for you!

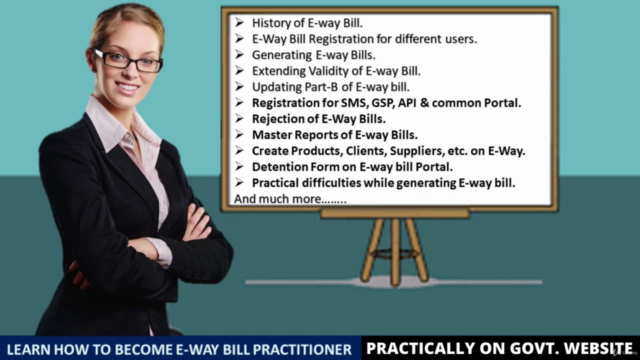

What You Will Learn:

- 🆕 E-Way Bill Registration for both Registered/Un-Registered Transportors and Normal Citizens.

- ✨ Generate E-Way Bills with ease and precision.

- 📈 Bulk E-Way Bill Generation to streamline your business operations.

- ⏳ Extend Validity of your E-Way Bills under various scenarios.

- ✅ E-Way Bill Rules and regulations to stay compliant.

- 📑 Edit/Delete E-Way Bills as per the need.

- 🚚 Update Part B/Vehicle information for accurate E-Way Bill generation.

- 🛠️ Change Vehicle Types, from single to multi vehicles, without any hassle.

- 👥 Sub User Management including creation and updates.

- ✍️ Detention Forms and their handling on the E-Way Bill Portal.

- 🧮 Cancelling & Printing of E-Way Bills when necessary.

- 📱 Registration for SMS, GSP, API, and Common Portal to integrate various services.

- 🔁 Rejection of E-Way Bills and how to handle them.

- 📊 Master Reports of E-Way Bills for a comprehensive overview of your transactions.

- 🚀 Create Products, Clients, Suppliers, etc., on the E-Way Bill Portal to keep your records up to date.

- 🚫 Exemption List and understand who is exempt from E-Way Bill requirements.

- 🤝 Problems faced while generating E-Way Bills and their solutions.

Course Requirements & Prerequisites:

- Basic Computer Knowledge to navigate through the government portal and understand the software tools used.

Who is this course for?

- Non-Accounting background students eager to delve into the world of accounts and taxation.

- Anyone aiming to become a successful Accountant, gaining an edge with expertise in E-Way Bill management.

- Business Owners who need to stay updated with compliance requirements.

- Career Seekers looking for opportunities in accounting and logistics.

- Individuals interested in learning advanced Accounting with GST within Tally.

Additional Support: Don't hesitate to reach out to your instructors, K.R. Gupta & R. Gupta, if you encounter any challenges or have queries beyond what the course covers. They are here to ensure your learning experience is fruitful and satisfying! 🤝

Enroll Now and Transform Your Knowledge of E-Way Bill Management! 🎓🌟

Course Gallery

Loading charts...