Depreciation Calculations for Financial Accounting

Why take this course?

🧰 Depreciation Calculations for Financial Accounting: A Step-by-Step Guide with Excel

🎓 Course Overview: Dive into the world of depreciation with ease and precision, using Excel spreadsheets to demystify this essential accounting concept. Eric Knight, DBA, CPA, your expert guide, will lead you through a series of focused lectures designed for beginners. Say goodbye to the confusion around depreciation chapters—with our course, you'll master the calculations and tools needed for financial reporting. 📊

What You Will Learn:

- Depreciation Essentials: Understand which assets are subject to depreciation, and how they impact your financial statements. 🏦

- Balance Sheet & Income Statement Dynamics: Learn the intricate relationship between these two critical components of financial reporting. ➡️📈

- Depreciation Concepts: Grasp the difference between depreciation expense and accumulated depreciation, and how they affect your company's books. 💰

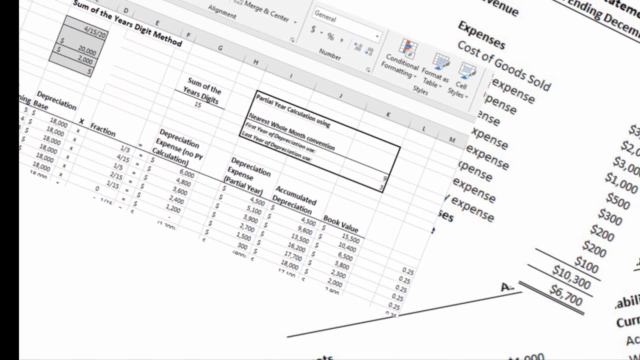

- Hands-On Depreciation Methods: Get hands-on experience with various depreciation methods including Straight Line, Declining Balance, Sum of the Years Digit, and Activity Method. 🔧

- Excel Proficiency: Utilize custom-made Excel templates for each method to perform depreciation calculations with confidence. 🗂️💻

- Real-World Applications: Learn from practical examples that reflect real business scenarios, ensuring you can apply what you learn in a variety of settings.

Who Will Benefit from This Course?

- Accounting Students: Beginners who want to strengthen their understanding of depreciation within the accounting cycle. 🎓

- Bookkeepers & Entrepreneurs: Professionals who manage assets and need to accurately account for depreciation in their business operations. 🚀

- Non-Accountants: Individuals looking to understand depreciation better, perhaps for tax purposes or personal financial management. 🧐

Course Features & Benefits:

- Tailored Learning Path: Tailored for beginners with no prior advanced knowledge required. 🛣️

- Expert Instruction: Learn from Eric Knight, an experienced instructor with a Doctor of Business Administration (DBA) and Certified Public Accountant (CPA) credentials. 🏫

- Real-World Examples: Engage with scenarios that mirror real business environments for practical learning. 🌐

- Excel Mastery: Receive Excel templates along with video tutorials, enabling you to solve problems and manage real-world assets effectively. 🖨️

- Comprehensive Coverage: Explore multiple depreciation methods, understand the concept of salvage value, and learn how to choose the right method for your situation. 🔍

- Advanced Insights: Gain a deeper understanding with an advanced topic on applying the straight-line test to the declining balance method. 🔬

Course Prerequisites: To get the most out of this course, students should have a foundational understanding of basic accounting concepts or the accounting cycle. This ensures that you can follow along and fully appreciate the depreciation methods discussed. ✅

Join Us to Master Depreciation! Embark on your journey to become a depreciation pro with our comprehensive online course. With Excel at your fingertips and Eric Knight as your guide, you'll not only learn the ropes but also gain tools that will last a lifetime. Enroll now to transform your understanding of depreciation in accounting and set yourself up for success! 🚀📚

Course Gallery

Loading charts...