Bank Guarantees and Standby Letter of Credit - An Overview

Why take this course?

🏦 Course Title: Bank Guarantees and Standby Letter of Credit - An Overview 🌟

Headline: Master Types & Uses in International Trade | URDG 758 & ISP 98 - Main Points | Clauses & Examples | Related SWIFT Messages 🚀

About the Course:

Embark on a comprehensive journey into the world of international trade finance with our expert-led online course. Bank guarantees and standby letter of credit are indispensable instruments in the realm of global commerce, and understanding their mechanics is paramount for professionals involved in international contracts and business dealings. 📈

Why Take This Course?

- Foundational Knowledge: Gain a solid grasp of the concepts behind trade finance instruments from the ground up.

- Practical Application: Learn how to handle guarantee/SBLC trade desk operations and apply your knowledge to business analyst assignments.

- Theoretical & Practical Insights: This course merges theoretical knowledge with real-world applications, ensuring you're well-versed in both.

- Risk Management: Discover how safeguard clauses in guarantee wordings can protect you from wrongful claims.

- SWIFT Proficiency: Understand the role of SWIFT messages in guarantees and SBLCs, and learn about message types and examples.

- Extensive Assessment: Put your understanding to the test with over 100 questions designed to evaluate your grasp of the subject matter.

- Perfect for:

- Bankers specializing in trade finance.

- Business Analysts/Consultants looking to expand their expertise.

- Aspirants aiming to achieve certifications like CSDG.

Course Content Overview:

Introduction:

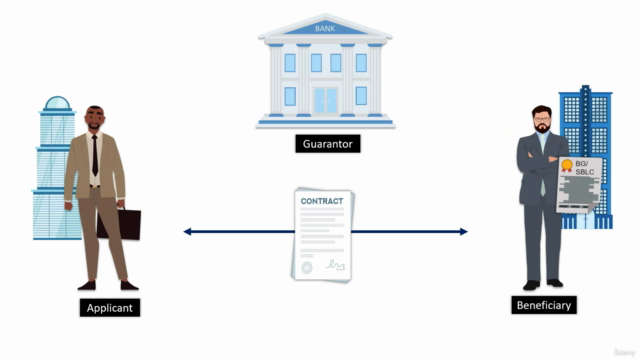

- What is a Guarantee and Standby Letter of Credit?

- Key features and understanding the parties involved.

- The ICC Rules for guarantees and Standby letters of credit.

- Flowchart guidance for demand guarantees and Standby letters of credit.

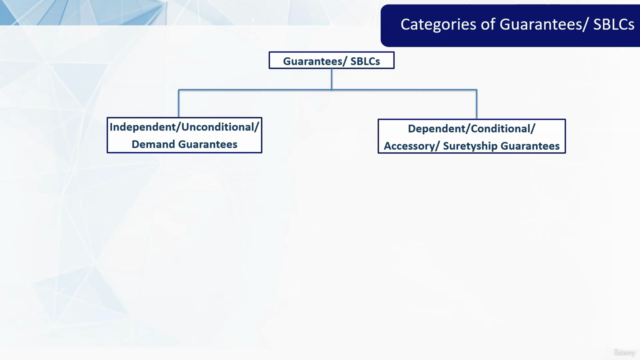

Broad Categories of Guarantees/SBLCs:

- Explore various types including Independent vs. Dependent Guarantees.

- Direct vs. Indirect Guarantees and the roles of Counter Guarantees and Confirmed SBLCs.

- Distinguish between Payment and Performance Guarantees, as well as Export and Import related Guarantees.

Types of Guarantees and Process Flow:

- Detailed explanation of Bid Bonds, Performance Guarantees, Advance Payment Guarantees, Retention Money Guarantees, Warranty Guarantees, and Payment Guarantees.

- Chronology of guarantees within contracts.

- Other relevant types of guarantees.

Summary of URDG 758 and ISP 98:

- A concise review of the main articles under URDG 758.

- An overview of the International Standby Practices (ISP) 98 Rules.

Comparisons & Drafting Safeguard Clauses:

- In-depth comparisons between SBLCs, demand guarantees, and Letters of Credit.

- Best practices for drafting safeguard clauses to protect your interests.

Operational Steps of Issuing a Bank Guarantee/SBLC:

- Step-by-step guide to the operational aspects of issuing these instruments.

SWIFT Messages in Guarantees and SBLCs:

- Understand the types of SWIFT messages relevant to trade finance.

- Learn about recent changes in MT 760 structure.

Examples & Practice Test:

- Real-world examples of Performance Guarantees, Standby Letters of Credit (MT 700), and Standby Letrogenetic Letters of Credit (MT 760).

- A comprehensive practice test to assess your learning outcomes.

Join our course to master the nuances of bank guarantees and standby letter of credit, and elevate your expertise in international trade finance! 📚✨

Course Gallery

Loading charts...