Credit risk and RAROC

Why take this course?

🧾 Course Title: Credit risk and RAROC: Profitability Valuation of a Credit Loan Portfolio Per Region, Product Type, and Branch

🚀 Course Headline: Master the Art of Measuring Profitability in Credit Portfolios with Fernando Hernandez!

Unlock the Secrets of Credit Risk Management 🔍

Welcome to an in-depth journey into the world of credit risk and profitability valuation within a commercial bank's portfolio. In this comprehensive online course, led by the esteemed Fernando Hernandez, you will learn how to effectively measure and manage the financial risks associated with credit assets.

Course Description:

🏦 Understanding Credit Risk: The course begins by delving into the nature of credit risk, where we explore the various factors that contribute to the potential for losses from borrowers' defaults. You will gain insights into the types of events that can lead to such risks and the impact they have on a bank's portfolio.

📊 Loss-Given-Default (LGD) Modeling: With an understanding of credit risk, we introduce you to the Loss-Given-Default model, which estimates the average loss incurred when a borrower defaults. We explore the various methodologies to derive an LGD estimate and how it forms the backbone for measuring credit risk.

🔬 Monte Carlo Simulation: To add a layer of sophistication to our LGD model, we incorporate Monte Carlo simulation. This approach allows us to simulate thousands of scenarios, incorporating probabilities that reflect the uncertainty in loan losses. By doing so, we can better understand and quantify the unexpected losses that could occur.

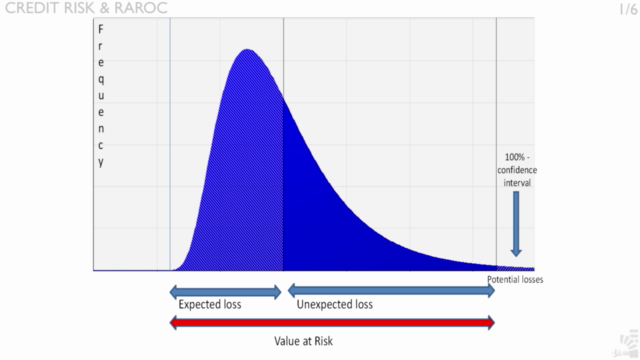

📈 Value at Risk (VaR) and RAROC: Building on the Monte Carlo framework, we then focus on VaR, which measures the potential loss in value of the portfolio under normal market conditions over a set time period. Additionally, we introduce the Risk-Adjusted Return on Capital (RAROC), a framework that allows us to evaluate the profitability of different segments within the bank's loan portfolio – by region, product type, and branch.

🌐 Real-World Applications: Throughout the course, you will engage with real banking examples and case studies that demonstrate the practical application of the concepts taught. These examples are designed to help you understand how to measure and manage profitability for a commercial bank's credit assets in today's complex financial environment.

Key Takeaways:

- A deep understanding of credit risk and its impact on bank portfolios

- Mastery of the Loss-Given-Default model and Monte Carlo simulation techniques

- Proficiency in calculating Value at Risk (VaR) for credit portfolios

- Knowledge of how to apply RAROC to assess and improve the profitability of a bank's credit assets

- Practical insights into risk management strategies for commercial banks

Join Fernando Hernandez in this comprehensive course and transform your approach to credit risk management and profitability valuation. 🎓

By the end of this course, you will have a solid grasp of how to measure and manage the complexities of credit risk within a commercial bank's loan portfolio. Whether you are a finance professional looking to deepen your expertise or a student aspiring to enter the field of banking and risk management, this course offers valuable knowledge that can help you navigate the financial landscape with confidence.

Enroll now and embark on your journey to becoming an expert in credit risk management and profitability valuation! 🌟

Course Gallery

Loading charts...