Create Your Own Hedge Fund: Trade Stocks Like A Fund Manager

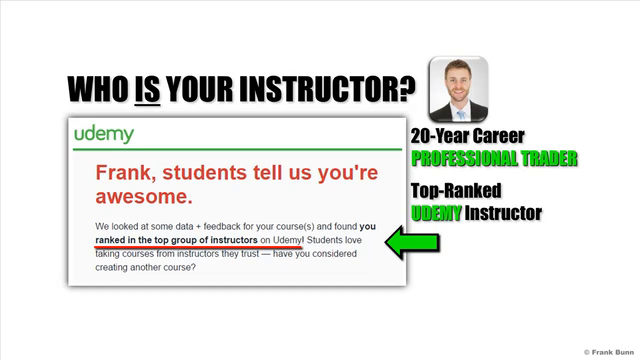

Why take this course?

🌟 Create Your Own Hedge Fund: Trade Stocks Like A Fund Manager 🌟

Are You Ready To Transform Your Financial Future?

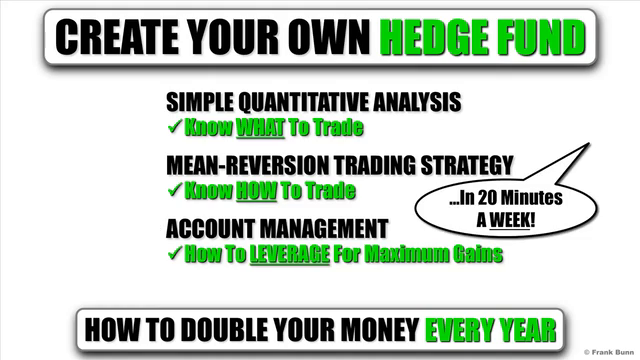

Imagine dedicating just an extra 20 minutes a week and unlocking the potential to retire with a million dollars. Sounds too good to be true? It's not! Welcome to the transformative world of CREATE YOUR OWN HEDGE FUND. This course is your ticket to trading the SlingShot Mean-Reversion Setup and leveraging your account for 100% annual gains. 🚀

Course Overview:

This course will forever change the way you look at the financial markets. Traditional trading knowledge is just the beginning. You'll discover how to target securities with unique fundamental attributes that have the potential for massive appreciation. The key lies in detecting the institutional 'footprint' that often leads to enormous price appreciation, a secret that can help you ride the BIG MOVES with enough leverage to make your financial dreams a reality.

Master the Art of High-Impact Trading:

- Detect Institutional Footprints: Learn how big institutions like banks and hedge funds move the market and position yourself to take advantage of these movements.

- Target Growth Companies: Harness the power of the 17 trillion dollar U.S economy by focusing on securities with exceptional fundamental attributes.

- Identify the Big Winners: Every year, certain securities double or even triple in value. Discover how to identify these opportunities and leverage them effectively.

Unlock the Secrets of Mean-Reversion:

- Trade the SlingShot Setup: Master the best low-risk, high-probability mean-reversion strategy designed for individual investors.

- Price-Action Patterns: Target specific price-action patterns to tactically set up trades and manage risk with precision.

- 3 Management Objectives: Learn the key objectives that will give you total control over your trades, ensuring you can make informed decisions confidently.

Set Up Your Trading Desk for Success:

- Chart Layouts: Configure efficient chart layouts that simplify your investment process.

- Quantitative Analysis Model: Incorporate a model right at your fingertips to streamline your trading analysis.

- Quick Scanning and Portfolio Management: Learn how to scan, analyze, and manage your trades and portfolio in just 20 minutes a week, without sacrificing performance or precision.

Implement a Hedge Fund Trading System:

After completing the course, you'll have a clear understanding of how to incorporate a hedge fund trading system into your investment strategy. You'll also learn sound account management tactics that are essential for wealth creation and long-term success in the markets.

Who Is This Course For?

If you're a trader who has been struggling to make consistent profits or an investor who is frustrated with poor returns and lack of risk management, this course is exactly what you need. It's designed for those who are serious about transforming their approach to the market and are ready to take control of their financial destiny.

Join us in CREATE YOUR OWN HEDGE FUND and embark on a journey to trade like a fund manager, leveraging mean-reversion setups and proper account management for big returns. With the right knowledge and tools, you can unlock the potential for life-changing financial gains. Are you ready to take that step? 📈💰

Enroll now and start your journey towards becoming a master trader who thrives in the dynamic world of finance!

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

This course offers advanced insights into hedge fund trading strategies, using mean reversion setups and the SlingShot technique to capitalize on high-probability, momentum options. However, students may find themselves investing in TC2000—a requirement with limited online availability—to fully benefit from the teachings by following along with provided course materials. While the instructor delivers content confidently and concisely, a more cautious approach when it comes to backtesting and risk assessment would further elevate this otherwise engaging learning opportunity for seasoned traders looking to trade their individual accounts or bolster IRA accounts with hedge fund techniques in mind.

What We Liked

- In-depth coverage of mean reversion strategies with actionable setups

- Direct and to-the-point explanations from a seasoned trader

- Course materials include downloadable TC2000 desktop formatted for SlingShot Mean Reversion

- Valuable information on how to utilize call and put options with this hedge fund technique

Potential Drawbacks

- Lack of software alternatives for TC2000, which is not free and has limited online access

- Speedy pace may be challenging for some students; concepts are not always fully explained

- Limited discussion on risk management beyond the use of 5-cent stop to avert loss/risk

- Absence of backtesting or rigorous performance evaluation, and limited consideration of broader market trends