CPA, EA, US Business Taxation - Formation of Corporation

Key Consideration in Forming a Corporation

217

students

1.5 hours

content

May 2025

last update

FREE

regular price

What you will learn

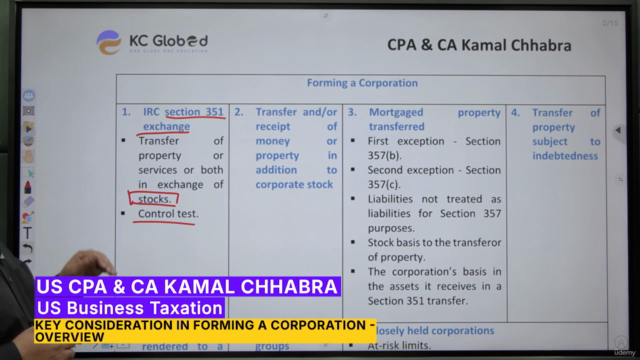

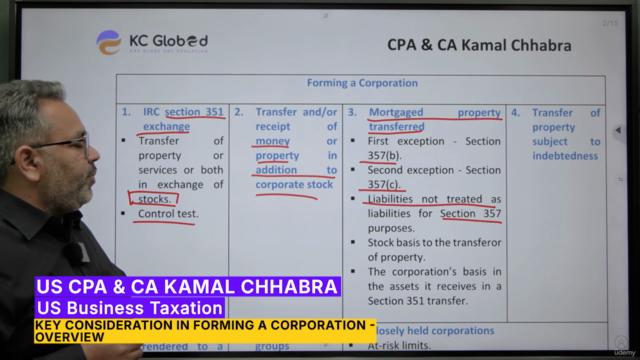

- Formation of a Corporation under IRC Section 351

Rules for the transfer of property in exchange for stock.

Understanding tax-deferred transfers.

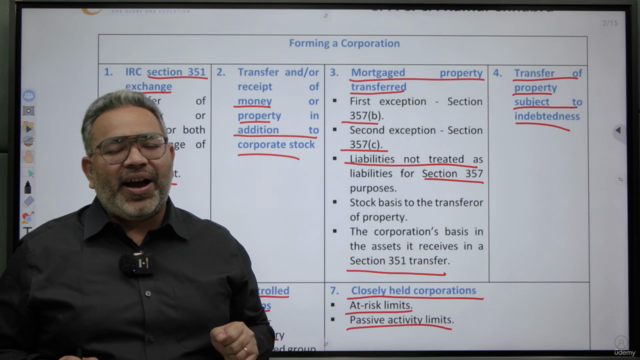

- Transfer of Property Subject to Indebtedness

Detailed exploration of Section 357(b) and Section 357(c).

Implications of liabilities exceeding the basis of the transferred property

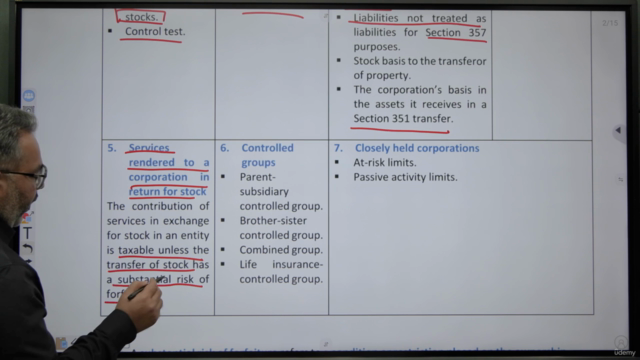

- Services Rendered to a Corporation in Exchange for Stock

Tax treatment of stock received in exchange for services.

Practical examples and case studies

- Controlled Groups and Closely Held Corporations

Defining and understanding controlled groups.

Unique considerations for closely held corporations.

Course Gallery

Loading charts...

6615837

udemy ID

15/05/2025

course created date

19/05/2025

course indexed date

Bot

course submited by