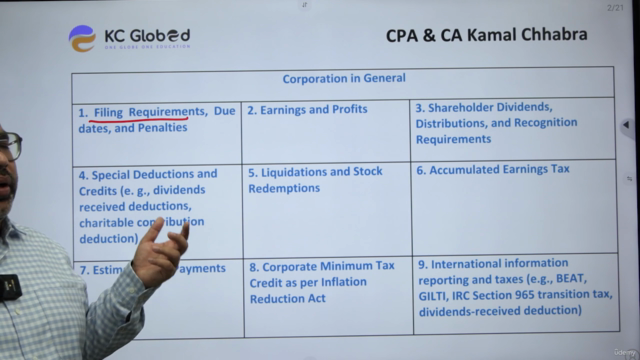

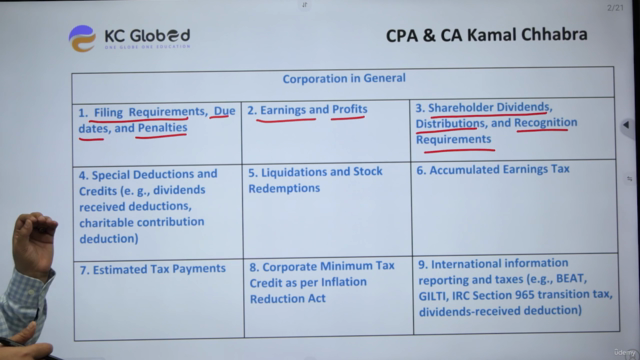

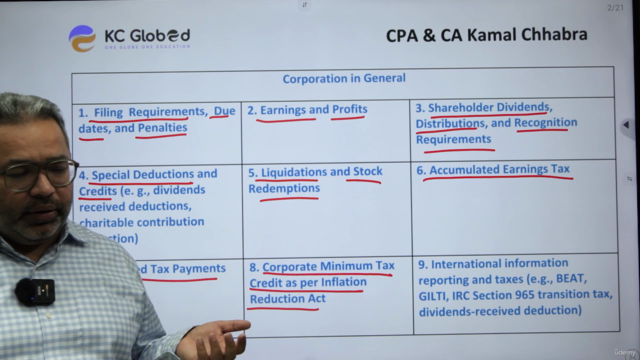

CPA, EA Exam Prep Business Taxation - Corporation in General

U.S. Business Taxation: Understanding Corporations

0

students

2 hours

content

May 2025

last update

$44.99

regular price

What you will learn

Filing Requirements: Understanding essential forms and deadlines.

Earning Profits: Taxation rules and strategies for optimizing profitability.

Shareholder Dividends: How dividends are taxed and distributed.

Liquidations: Tax implications during the dissolution of a corporation

Accumulated Earnings Tax: Avoiding penalties for excessive retained earnings

International Business Taxation: Compliance for corporations operating globally.

Course Gallery

Loading charts...

6608047

udemy ID

10/05/2025

course created date

17/05/2025

course indexed date

Bot

course submited by