The MBA Corporate Finance Fundamentals Course

Why take this course?

🎓 Course Headline:

Master MBA Corporate Finance Fundamentals with Expert Raj Gupta, Ph.D., Learn to Understand Financial Decision Making! 🚀

Course Title:

The MBA Corporate Finance Fundamentals Course

Course Description:

Dive deep into the world of corporate finance with our comprehensive MBA-level course crafted to provide you with a solid foundation in financial decision making. Taught by the esteemed Raj Gupta, Ph.D., Licensed Insurance Agent, and MBA, this course is designed for aspiring business leaders who wish to excel in the realm of finance.

Why Enroll?

- Expert Led Learning: Learn from an experienced instructor with a diverse academic and professional background.

- In-Depth Topics Covered: From Capital Budgeting and Capital Structure to understanding Financial Statements and Time Value of Money.

- Real-World Application: Gain practical insights into financial decisions made by companies and the roles of various financial institutions.

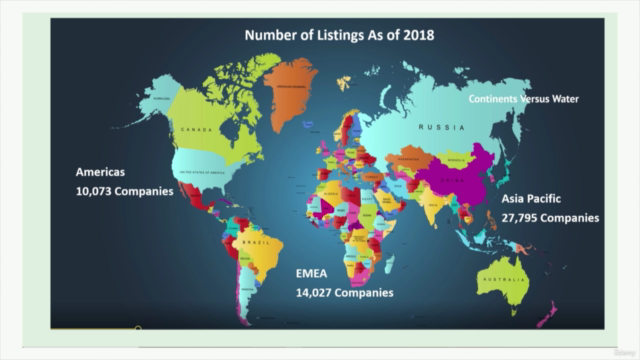

- Global Perspective: Explore how corporate finance is practiced across different regions with our eight Global Insights sections.

- Statistical Acumen: Master descriptive and inferential statistics, risk assessment, and apply them to real-world finance scenarios.

- Modeling Techniques: Explore the Dividend Discount Model, Expected and Realized Returns, and learn the intricacies of the Capital Asset Pricing Model (CAPM) and Weighted Average Cost of Capital (WACC).

Course Structure:

-

Introduction to Financial Decision Making

- Overview of financial decisions in companies

- Introduction to Capital Budgeting and Capital Structure

-

Data Sources for Financial Analysis

- Understanding sources of data for financial analysts

-

Roles of Financial Institutions

- Differentiating between Commercial Banks, Investment Banks, and Custody Banks

-

Financial Statements Explained

- Detailed study of Balance Sheets, Income Statements, Cash Flow Statements, and Shareholders' Equity

-

Time Value of Money and Financial Asset Valuation

- Mastering the Time Value of Money concepts

- Learning about Financial Asset Valuation techniques

-

"No Arbitrage Valuation by Comparable Companies"

- Analyzing company valuations based on comparable firms

-

Dividend Discount Model and Expected Returns

- Understanding the Dividend Discount Model

- Exploring expected and realized returns

-

Statistical Measures in Finance

- Defining risk with statistical measures

- Applying statistics to financial analysis

-

Historical Returns and Data Collection

- Examining historical financial returns

- Understanding how statisticians collect data

-

Risk, Return, and the CAPM/WACC

- Deep dive into the Capital Asset Pricing Model (CAPM)

- Calculating the Weighted Average Cost of Capital (WACC)

-

Global Insights in Corporate Finance

- Eight sections dedicated to global finance practices and perspectives

By the end of this course, you will have a comprehensive understanding of MBA-level corporate finance, equipped with the tools and knowledge to make informed financial decisions and contribute effectively to business strategy development.

🚀 Take the next step in your career: Enroll now and transform your financial acumen with The MBA Corporate Finance Fundamentals Course! 💼💰

Course Gallery

Loading charts...