Corporate Tax Filing: Schedule M-3: Reporting Requirements

Why take this course?

🧠 Master Corporate Tax Filing: Schedule M-3 🚀

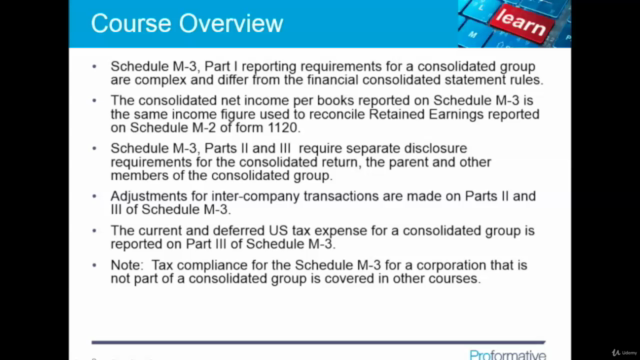

Course Overview:

As a corporation with substantial assets, navigating the complexities of the Schedule M-3 can be overwhelming. This course is meticulously designed to guide you through the intricate details of reporting requirements for a consolidated group. With a focus on understanding the differences between financial and taxable income, and how to reconcile these figures, you'll gain clarity and confidence in your filings.

Course Details:

📑 Understanding the Requirements:

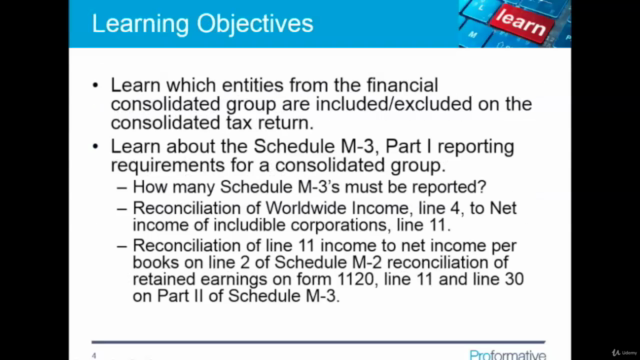

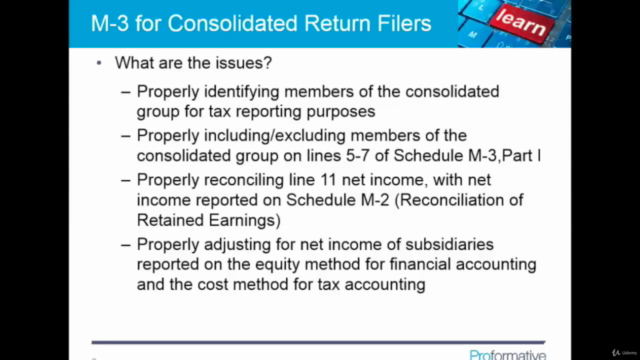

- Eligibility and Exclusions: Learn which entities are included or excluded from the consolidated tax return within your financial statements.

- Schedule M-3, Part I: Get to grips with the reporting requirements for a consolidated group.

- Net Income Reconciliation: Understand how to reconcile net income per books with Schedule M-3 and Schedule M-2, including reconciling retained earnings on Form 1120.

- Disclosure Requirements: Dive into the disclosure requirements for Schedule M-3, Parts II and III for a consolidated return, parent, and other members of the group.

- Inter-Company Transactions: Learn how to adjust for inter-company transactions, understanding temporary versus permanent deferrals on Parts II and III of Schedule M-3.

- Reporting Tax Expense: Gain knowledge on how to report current and deferred US tax expense for a consolidated group on Schedule M-3.

Course Highlights:

✅ Comprehensive Example: A real-world example of the Schedule M-3 for a consolidated group is provided, ensuring you can apply what you've learned to actual filings.

📈 Key Topics Covered:

- Identifying entities within consolidated financial statements that are required to be included in the consolidated tax return.

- Navigating Schedule M-3, Part I reporting for a consolidated group.

- Reconciling net income per books with the reported figures on Schedule M-3 and Schedule M-2.

- Understanding how to reconcile retained earnings per books.

- Meeting the disclosure requirements of Schedule M-3, Parts II and III.

- Handling inter-company transactions and understanding their impact.

- Learning the distinction between temporary and permanent deferrals.

- Reporting current and deferred US tax expense for a consolidated group on Schedule M-3.

Who Should Take This Course:

This course is ideal for tax professionals, accountants, financial analysts, and corporate decision-makers who are responsible for the preparation of consolidated tax returns for corporations with significant assets. It's particularly beneficial if you have previously completed the three intermediate courses covering tax compliance for Schedule M-3 for corporations not part of a consolidated group.

Course Outcome:

Upon completion, you will have a solid understanding of the Schedule M-3 filing and reporting requirements for a consolidated group, enabling you to navigate through the complexities of corporate tax filing with confidence and precision. You'll be equipped to ensure compliance and provide accurate, detailed information on book-tax differences as required by the IRS.

Join us in this engaging course to elevate your tax preparation skills to the next level. 🏆

Course Gallery

Loading charts...