Corporate Tax Filing: Schedule M-3: Part III

Why take this course?

🧾 Course Title: Corporate Tax Filing: Schedule M-3: Part III

🔥 Headline: Master the Intricacies of Schedule M-3, Part III for Precision in Your Corporate Tax Reporting!

Course Description:

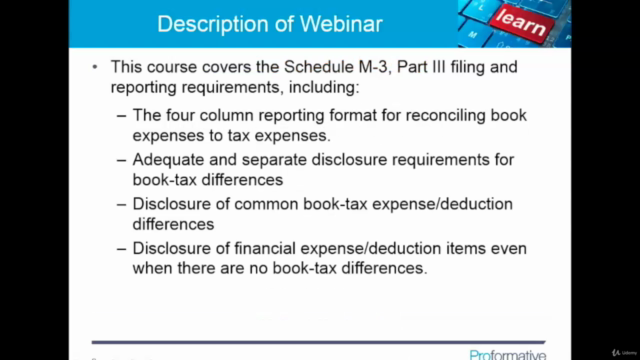

Dive into the complexities of corporate tax filing with our expertly designed course focused on Schedule M-3, Part III. This module is specifically tailored to guide you through the intricate process of disclosing expense/deduction items reported on financial statements, with an emphasis on accurate reporting and compliance with IRS requirements.

📑 Key Learning Points:

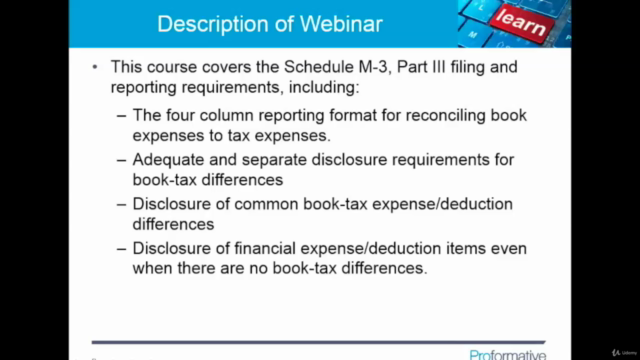

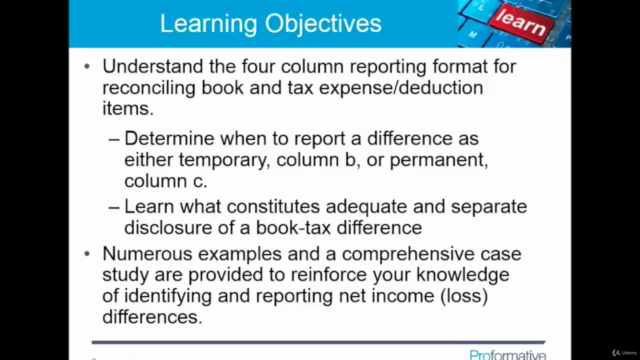

- Understanding Book-Tax Differences: Learn how to identify, categorize, and report temporary and permanent differences in expense/deduction items.

- Detailed Disclosures: Gain expertise in the disclosure requirements for various book-tax differences, ensuring your reporting is both thorough and precise.

- Specific Item Scrutiny: Understand when and how to separately disclose financial expense/deduction items even if there are no book-tax differences.

- Reconciliation Techniques: Master the reconciliation process between the net book income from Part II, Line 30, and the net income from Part I, Line 11, as well as with Line 28 on Form 1120.

- Compliance and Accuracy: Ensure that your Schedule M-3, Part III aligns with the total figures from both the financial statements and the tax return for accurate filings.

Course Content Breakdown:

- 📈 Four Column Reporting Format: Learn the step-by-step process of using the four columns to reconcile book income to taxable income.

- ⚖️ Adequate Disclosure Requirements: Understand the importance and methodology for disclosing book-tax differences adequately.

- 🔍 Common Book-Tax Differences: Explore typical scenarios and their impact on your reporting.

- 📉 Separate Disclosures: Identify when an expense/deduction item must be separately disclosed, even if there is no difference.

- ✅ Reconciliation Process: Learn how to reconcile the net book income with the net taxable income, ensuring a seamless flow of information across your financial reporting.

- 📊 Advanced Topics: While this course covers the majority of Part III, additional advanced topics will be addressed in subsequent courses to ensure comprehensive understanding.

Practical Application:

To solidify your knowledge, this course includes a comprehensive example of Schedule M-3, Part III. This real-world application will help you identify and report expense/deduction differences with confidence and precision, ensuring that your Schedule M-3 totals are accurate and in line with both financial and taxable income statements.

Course Conclusion:

Upon completion of this course, you will be fully equipped to tackle the complexities of Schedule M-3, Part III, a critical component of corporate tax filings. Your ability to navigate through these requirements accurately and efficiently will be significantly enhanced, contributing to your company's compliance and tax reporting excellence.

Enroll Now! Take control of your corporate tax filing duties and ensure the accuracy and compliance of Schedule M-3, Part III. Let this course be your guide to mastering the intricacies of expense/deduction reporting and reconciliation for a flawless tax filing season. 🚀💼✨

Course Gallery

Loading charts...