Corporate Tax Filing: Schedule M-3: Part II

Why take this course?

🎓 Course Title: Corporate Tax Filing: Schedule M-3: Part II

Headline: Master the Intricacies of Schedule M-3, Part II: A Comprehensive Guide to Filing and Reporting Requirements 🚀

Course Description:

Embark on a detailed journey through the complexities of Schedule M-3, Part II, with our expertly designed online course. This course meticulously covers the filing and disclosure requirements for income (loss) items as they appear on financial statements. You'll learn how to pinpoint and report detailed book-tax differences associated with these items, ensuring that you "get the numbers right" in your tax filings.

Key Topics Covered:

-

Understanding the Four Column Reporting Format: Learn how to reconcile book income with taxable income using Schedule M-3's unique four column structure. 📊

-

Disclosure Requirements: Gain insights into the adequate and separate disclosure requirements for book-tax differences, ensuring compliance and clarity in your reporting. 🕵️♂️

-

Book-Tax Income Differences: Explore the common types of book-tax income differences and how to effectively disclose them. 🤔

-

Financial Income Items Without Book-Tax Differences: Discover why certain financial income items must be disclosed, even when there is no apparent difference between book and tax treatments. 🛠️

What You Will Learn:

Upon completing this course, you will:

-

Confidently Complete Schedule M-3, Part II: Acquire the skills to accurately report income (loss) items on your company's corporate tax filings. ✅

-

Stay Compliant with FASB and IRS Standards: Understand the standards set by the Financial Accounting Standards Board (FASB) and the Internal Revenue Service (IRS) for Schedule M-3 reporting. 🏭✍️

-

Identify and Report Permanent vs. Temporary Differences: Learn to distinguish between permanent and temporary differences in a way that affects how you report deferred tax assets and liabilities. 📈

Course Structure:

-

Introduction to Schedule M-3, Part II: An overview of what the schedule is and its importance in corporate tax filings.

-

Column Analysis and Reconciliation: A deep dive into the four column reporting format, with practical examples to illustrate each step.

-

Disclosure Requirements for Book-Tax Differences: Step-by-step guidance on how to disclose differences according to IRS regulations.

-

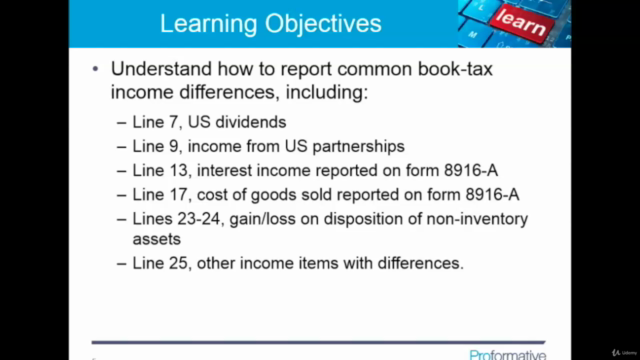

Common Book-Tax Income Differences: Real-world scenarios and case studies to help you understand and apply the concepts to your own financial statements.

-

Financial Income Items Not Resulting in Book-Tax Differences: Learn why certain items must be reported even when there is no difference, and how to handle these situations.

Additional Notes:

-

Previous and Subsequent Learning: This course builds upon the foundational knowledge provided in the "Corporate Tax Filing: Schedule M-3: Part I" course, with a focus on Part II. Part III will be covered in subsequent courses, ensuring a comprehensive understanding of the entire Schedule M-3 process. 🔄

-

Advanced Topics: A dedicated Advanced Topics course will cover additional line items not addressed in this course, providing a thorough understanding of all aspects of Schedule M-3. 🧐

By the end of this course, you will be equipped with the knowledge and skills to tackle Schedule M-3, Part II with confidence, ensuring your company's tax filings are accurate and compliant. Let's demystify Schedule M-3 together! 🎉

Enroll now to begin your journey towards mastering corporate tax filing for Schedule M-3, Part II. Don't miss out on this opportunity to enhance your expertise and contribute significantly to your company's financial reporting and tax strategy. 🌟

Course Gallery

Loading charts...