Corporate Finance and Investment Decisions

Why take this course?

Corporate Finance and Investment Decisions Managing Working Capital, Factors for Capital Structure, Term of Funding, Risk Appetite & Corporate Strategy

🚀 Course Overview: This course module is a comprehensive guide to the intricate world of corporate finance, designed to equip you with a robust understanding of financial concepts and their application in real-world scenarios. From the basics of managing working capital to the complexities of determining an optimal capital structure, this course covers it all. You'll delve into the term of funding, understand risk appetite, and strategize for corporate success. Plus, you'll be guided through the process of making informed investment decisions and analyzing strategic business choices.

Why Take This Course?

- Real-World Application: Learn how financial theory translates into practical decision-making in both personal finance and corporate environments.

- Financial Analysis Mastery: Gain proficiency in interpreting financial statements, assessing market demand, and evaluating competitive market dynamics.

- Strategic Decision-Making: Discover the art of making strategic decisions by understanding capital markets, institutions, and their roles.

- Risk Management: Learn to identify, measure, and control credit risk, ensuring your financial strategies are resilient against adverse conditions.

- Capital Returns: Explore various methods of returning capital to investors, including dividends and share buybacks.

- Financial Risk Mitigation: Get to grips with advanced financial instruments like derivatives to effectively manage specific types of financial risk, such as currency exposure.

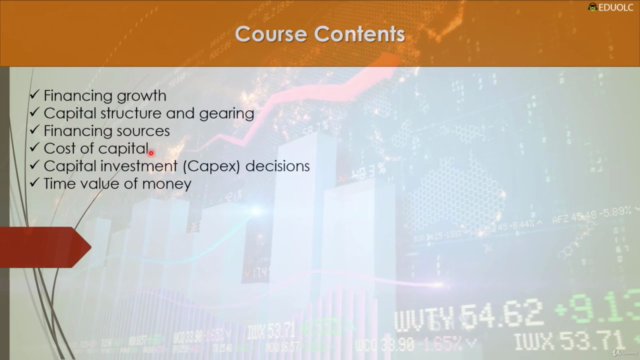

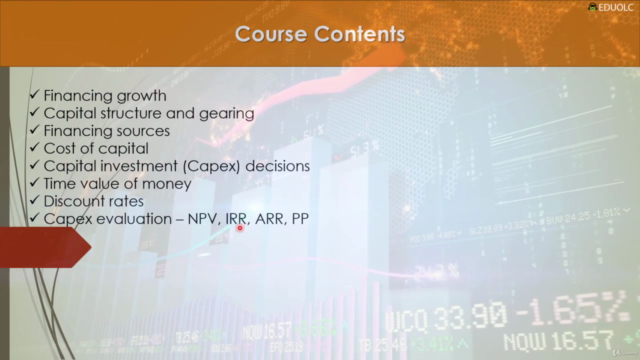

Course Content Breakdown:

📈 Module 1: Introduction to Corporate Finance

- Accounting and Financial Analysis Fundamentals

- Understanding the Role of Financial Statements

- The Importance of Cash Flow Management

🏦 Module 2: Managing Working Capital

- Techniques for Optimal Inventory, Receivables, and Payables Management

- Efficient Use of Current Assets and Liabilities to Maximize Profitability

⚖️ Module 3: Factors for Capital Structure

- Long-term and Short-term Financing Considerations

- The Impact of Debt vs. Equity on Business Operations

🕒 Module 4: Term of Funding Decisions

- Analyzing the Pros and Cons of Different Funding Sources

- Matching Funding Sources with Corporate Objectives

🤔 Module 5: Risk Appetite in Corporate Finance

- Understanding Different Types of Financial Risks

- Risk Assessment and Management Strategies for Corporates

🌟 Module 6: Corporate Strategy and Investment Decisions

- Strategic Planning and Implementation

- Valuing Investment Projects and Capital Budgeting Techniques

📊 Capstone Project:

- Apply your knowledge to a real-world business case

- Develop an integrated system for value-based financial management

- Evaluate large strategic decisions, considering market dynamics, capital markets, and investor sentiment

Who This Course Is For: This course is ideal for anyone interested in finance, including:

- Aspiring and practicing corporate finance professionals

- Business owners and entrepreneurs

- Investors seeking to understand the financial underpinnings of their investments

- Students and academics with a focus on finance or economics

- Individuals looking to improve their understanding of personal financial management

Key Takeaways:

- A deeper comprehension of financial concepts as they apply to both individual and corporate contexts

- The ability to read and understand financial news and reports

- Practical skills in financial analysis, strategic planning, and risk management

- Enhanced decision-making capabilities when it comes to personal finance, investment choices, and business operations

Join us on this journey to unlock the mysteries of corporate finance and become a savvy decision-maker with a keen eye for strategic investments. 🎓🚀

Course Gallery

Loading charts...