Corporate Accounting (Advance)

Why take this course?

🚀 Course Title: Corporate Accounting (Advanced)

🎓 Headline: Master the Depths of Corporate Accounting - Basic to Advanced!

📘 Course Description:

Are you ready to delve into the complex and fascinating world of Corporate Accounting? This advanced course is meticulously designed to take you from the basics to a mastery of corporate financial management. With a comprehensive curriculum, this course will equip you with an in-depth understanding of company rules, regulations, and the practical application of theories.

What will you learn in this course?

🔹 Basic Corporate Accounting Terms:

- Understanding what a company is and where it sources its funds from.

- Exploring the meaning of shares, the different types, and their importance.

- Differentiating between shares and debentures and grasping their roles in corporate finance.

- Learning about the priority of payment during the winding up process.

- Getting to grips with the various types of share capital and the significance of the Memorandum and Articles of Association.

📊 STOCK EXCHANGES:

- Gaining insights into how BSE (Bombay Stock Exchange) and NSE (National Stock Exchange) operate.

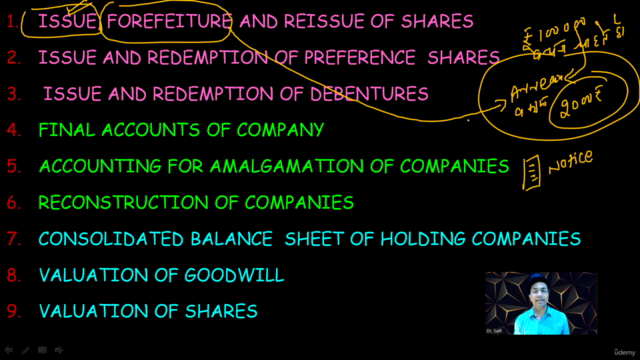

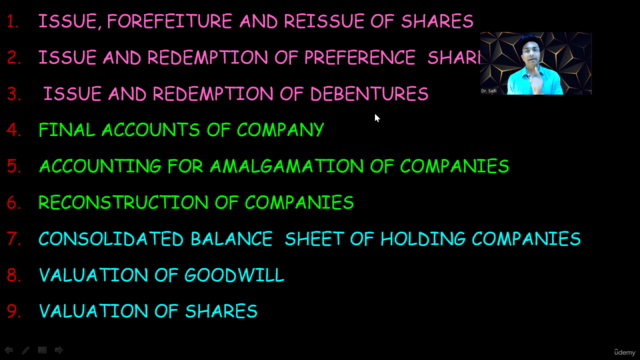

💲 Final Accounts:

- Comprehending the requirements of the Companies Act 2013, particularly Section 129 and Schedule III.

- Learning how to format and interpret a Balance Sheet, as well as the Statement of Profit & Loss.

- Understanding bad debts and the provision for bad debts within financial statements.

- Tackling practical problems to solidify your understanding.

💫 Redemption of Preference Shares:

- Learning about the intricacies of redeemable preference shares, including the balance sheet implications before and after redemption.

- Accounting for provision for redemption, redemption at a premium, and calls in arrear on preference shares.

🔄 Internal and External Reconstruction:

- Understanding the processes of internal reconstruction and its differences from external reconstruction.

- Learning how to account for these reconstructions with examples to clarify the concepts.

🤔 Goodwill:

- Discovering the real nature of goodwill within a corporate entity and its classification types.

- Exploring various methods to value goodwill, including the Average Profit, Super Profit, Capitalization, and Annuity Methods.

📈 Valuation of Share:

- Learning why and how shares are valued and employing different valuation methods.

🌍 Amalgamation and Mergers:

- Examining real-life examples of amalgamation, mergers, and external reconstructions.

💰 Issue forfeiture and Reissue of Shares:

- Exploring the process of issuing shares for cash or otherwise, understanding forfeiture, and reissuing shares through pro-rata allotment.

💲 Debentures:

- A comprehensive exploration of debentures, including total explanations and practical problem-solving.

🏣 Holding Companies:

- Understanding the role of holding companies and how they can benefit a corporate structure.

This course is designed to not only teach you the theoretical aspects but also to challenge you with practical problems that will test your understanding and help you apply what you've learned in real-world scenarios. Enroll now to embark on an educational journey that will set you apart as a Corporate Accounting professional! 🌟

Who is this course for?

This advanced course is ideal for finance professionals, accountants, students of commerce and business, and anyone interested in deepening their knowledge of corporate accounting and financial management. Whether you're looking to advance your career or gain a competitive edge, this course will provide you with the tools and insights needed to excel in the field.

Course Gallery

Loading charts...