Computing Corporate Earnings and Profits for Tax Purposes

Why take this course?

🌟 Course Title: Computing Corporate Earnings and Profits for Tax Purposes

Unlock the Secrets of Corporate Earnings & Profits (E&P) 🧐

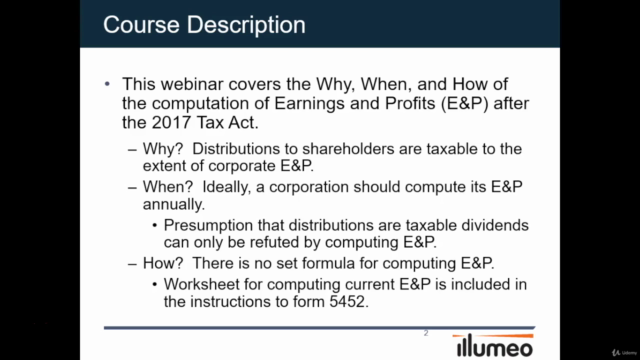

This comprehensive course dives deep into the intricacies of computing Earnings & Profits (E&P) for tax purposes. Understanding why, when, and how to accurately determine a corporation's E&P is crucial for managing tax liabilities effectively and ensuring compliance with tax regulations.

Why Compute Earnings & Profits? 🔍

- Understanding Tax Implications: Learn the critical role of E&P in determining the taxability of distributions to shareholders. Discover how proper computation can save your corporation from potential tax pitfalls.

When Should You Compute E&P? ⏰

- Timing is Key: Find out why it's essential for a corporation to compute its E&P annually, and the risks of not doing so.

- Refuting Presumptions: Understand how an E&P computation can counteract the presumption that distributions are taxable dividends.

How to Compute Earnings & Profits? 📊

- No One-Size-Fits-All Formula: Dive into the nuanced process of computing E&P with practical insights and methodologies.

- Hands-On Learning: Utilize our exclusive worksheet designed to guide you through the formulation process for Form 5452.

Course Highlights:

-

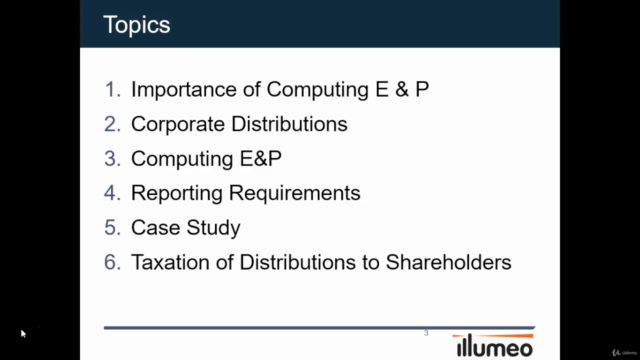

Comprehensive Overview: This course covers the entire spectrum of E&P computation, from the rationale behind it to the detailed methodology.

-

Real-World Application: With practical examples and a step-by-step approach, you'll learn how to apply these concepts to real-life situations.

-

Expert Guidance: Gain insights from seasoned tax professionals who specialize in corporate tax planning and compliance.

-

Interactive Learning: Engage with interactive content that reinforces your understanding of E&P computations.

-

Downloadable Resources: Get access to downloadable worksheets and resources to help you apply what you've learned directly to Form 5452.

Who Should Take This Course? ✏️

- Tax professionals looking to deepen their understanding of corporate taxation.

- Corporate financial managers seeking to optimize their company's tax position.

- Business owners who want to ensure their distributions are properly handled for tax purposes.

- Accounting students aiming to master the principles of corporate earnings and profits.

By completing this course, you'll be equipped with the knowledge to confidently navigate the complexities of E&P computations, ensuring your corporation remains in good standing with the IRS and optimizes its financial position. 🏆

Enroll Now and Take Control of Your Corporation's Financial Future!

Course Gallery

Loading charts...