The Complete and Ultimate Guide to Know Your Client (KYC)

Why take this course?

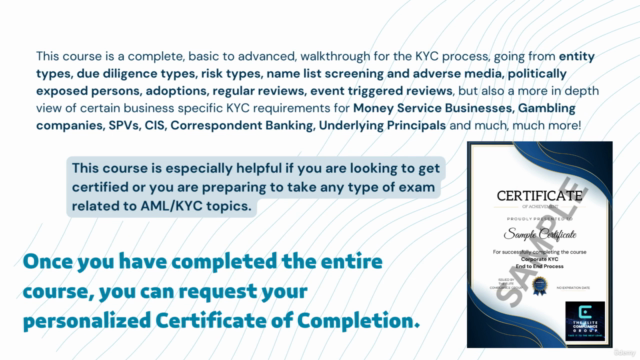

based on the provided outline, it appears you are looking for a comprehensive guide on Know Your Customer (KYC) procedures within the financial industry, particularly focusing on various aspects such as bearer shares, ownership structure during mergers and acquisitions, and specific business types like Money Services Business (MSB), gambling, and Special Purpose Vehicles (SPVs). The outline also includes considerations for correspondent relationships, syndicated lending, guarantors, and agent and underlying principal relationships, as well as due diligence requirements for Collective Investment Schemes (CIS) and Mandates.

Here's a summary of the key points you would find in each section:

-

Bearer Shares: These are shares held by whoever holds the bearer certificate, which presents risks in identity verification and ownership tracking, especially relevant during mergers and acquisitions.

-

Ownership Structure during a Merger and Acquisition: This involves understanding the complexities of ownership, including accumulation and domination methodologies to determine control.

-

Creating an Ownership Chart: This is essential for visualizing the relationships between owners within a company, which can be particularly complex in mergers and acquisitions.

-

Application of Accumulation and Domination Calculation Methodologies:

- Accumulation Methodology: This method calculates direct ownership percentages.

- Domination Methodology: This assesses indirect control through other means, such as rights or agreements that confer decision-making power.

-

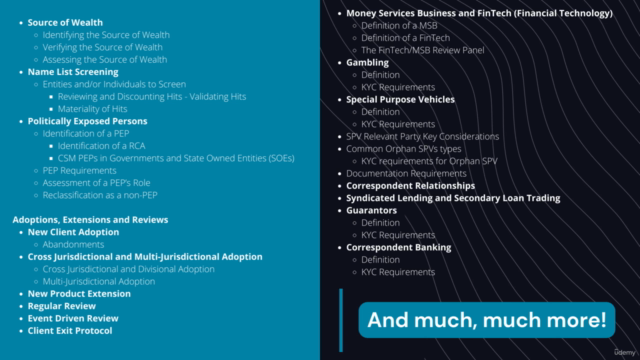

Source of Wealth: Identifying and verifying the source of wealth is crucial for KYC due diligence to ensure compliance with anti-money laundering (AML) laws.

-

Name List Screening: This involves screening entities and individuals against watchlists, financial sanctions lists, and politically exposed persons (PEPs) databases.

-

Politically Exposed Persons (PEPs): Identifying and assessing PEPs is a key KYC component due to the increased risk of bribery and corruption associated with such individuals.

-

Adoptions, Extensions, and Reviews: This includes adopting new clients, extending KYC procedures for cross-jurisdictional entities, reviewing KYC processes regularly or when significant events occur, and establishing client exit protocols.

-

Business Specific KYC Procedures:

- Money Services Business (MSB) and FinTech: These businesses require a dedicated review panel due to their inherent risk of money laundering.

- Gambling: This industry has specific KYC requirements due to its potential for fraudulent activities.

- Special Purpose Vehicles (SPVs): SPVs, especially orphan SPVs, require careful scrutiny to understand their purpose and the parties behind them.

- Agent and Underlying Principal Relationships: This includes due diligence on investment managers, advisors, and sub-managers, as well as understanding the nature of a CIS or mandate.

-

Final Notes: This section would cover waivers to KYC requirements and red flags that indicate potential risks or issues in compliance.

-

Glossary: A glossary would provide definitions for key terms used throughout the KYC guide, ensuring clarity and understanding of the concepts involved.

This outline serves as a roadmap for comprehensive KYC procedures, emphasizing the importance of understanding complex financial structures and relationships to mitigate potential risks associated with money laundering, fraud, and other illicit activities. It's a vital component of a financial institution's AML program, ensuring compliance with regulatory requirements and maintaining the integrity of the financial system.

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

The Complete and Ultimate Guide to Know Your Client (KYC) on Udemy is an extensive resource offering insights into KYC fundamentals from various angles. Although some improvements can be made regarding supplementary materials, caption accuracy, engagement, and narration quality, the course's valuable content overall provides a thorough exploration of essential industry concepts. Professionals and learners seeking a well-rounded examination of critical KYC aspects will find this to be an interesting course option for expanding their expertise.

What We Liked

- This course offers an in-depth exploration of Know Your Client (KYC) concepts, from basic to advanced levels, with a focus on various entity types and risk assessment.

- The course content is extensive and informative, serving as a comprehensive guide that covers KYC regulations, client risk rating, due diligence processes, name list screening, and offboarding procedures.

- The course is well-organized into eight sections with 43 parts, ensuring a structured learning experience. The material is made accessible by The Elite Compliance Group through its Certificate of Completion.

- Priced reasonably, the course offers great value for the extensive information in returns, making it an attractive option for learners wanting to gain knowledge on KYC regulations and best practices.

Potential Drawbacks

- Downloadable resources per section are limited; there are only three documents available to complement the entire eight-section course. More supplementary materials could enhance the learning experience.

- Inconsistencies in video captions hinder the user experience, with typos and blatant mistakes found in some sections. Improving caption accuracy would better support all learners during their progress through the course.

- A few users commented on the dense nature of slides and the lack of engagement during voiceover sections. Using more interactive examples and varying teaching methods could improve overall engagement.

- Some feedback addressed issues with occasional unengaging narration, which can be improved to help maintain learners' attention throughout the course duration.