Complete Accounting & Taxation Course 2025

Why take this course?

🚀 Complete Accounting & Taxation Course 2024 🎓

Dive into the world of finance with our comprehensive course, meticulously designed to empower you with a deep understanding of Accounting, Financial Management, MIS, Data Analysis, and Taxation. Whether you're in the realm of professional accounting, finance, management information systems, data analysis, or aiming to become a tax professional, auditor, or business management expert—this course is your gateway to success!

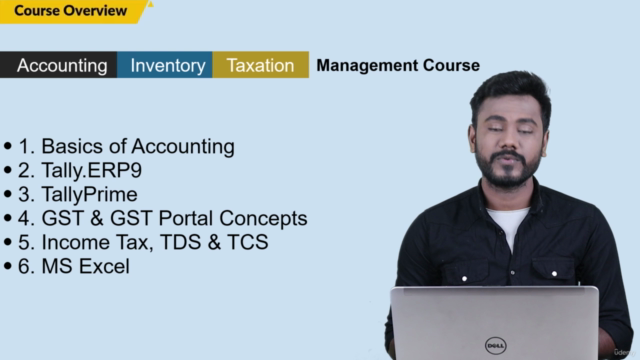

📚 What You'll Learn:

- Mastery over Accounting, Inventory Management, and Taxation Management

- Proficiency in using TallyPrime for all your accounting needs

- A thorough understanding of GST, Income Tax, TDS, TCS, and their applications

- Real-time data handling for GST classes

- Handling all the books of accounts with ease

🔥 Course Highlights:

- Faculty Excellence: Learn from Urs Ravi I, a faculty who not only educates but trains the trainers themselves.

- Tally Authorized Institute Faculty: Gain expertise directly from professionals certified to teach TallyPrime.

- TallyGuru & Office Expert: Be mentored by an expert recognized for their profound knowledge and skills in Tally.

- GSTN Recognized Tax Practitioner: Benefit from the insights of a tax professional accredited by the GST Network.

- Comprehensive Course Coverage: From the basics of Commerce to advanced Tally.ERP9, TallyPrime Full Course, GST Concepts, and Excel—everything you need to know is covered.

- Interactive Learning: Engage with quizzes, assignments, and practice tests for each chapter to ensure your knowledge sticks.

- Real-World Application: With case studies and assignments based on real-time data, you'll be prepared to apply your skills in the field.

- Material & Support: Access reference questions and soft copy materials to support your learning journey.

🎟️ Why Choose This Course?

- Hands-On Practice: Work with a licensed version of Tally to understand its practical application.

- 100% Satisfaction Guarantee: Our students report high satisfaction and successful application of their skills.

- Expert Guidance: Learn from the best—our faculty's reputation precedes them in the field of accounting and taxation.

📢 Course Breakdown:

- Accounting Fundamentals: Lay a strong foundation in double-entry accounting, financial statements, and more.

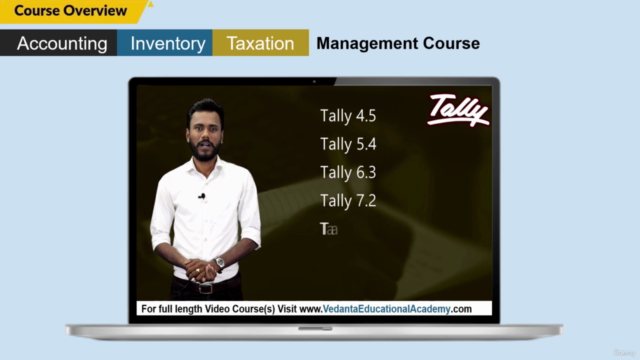

- Tally.ERP9 All Levels: Become proficient in managing inventory, sales, purchases, and accounts within Tally.ERP9.

- TallyPrime Full Course: Explore every facet of this powerful accounting software.

- GST Concepts & GST Portal: Understand the intricacies of Goods and Services Tax, including its implementation and compliance requirements.

- Income Tax Slabs, ITR1 & ITR4 Filing: Learn how to file taxes for individuals and businesses according to the latest slabs and forms.

- TDS & GST Filing: Get up to speed on Tax Deducted at Source (TDS) regulations, including slabs, forms, and returns.

- Excel Skills: From basic to advanced, master Excel to enhance your analytical capabilities.

🎓 Embark on a journey to become an accounting and taxation expert with our Complete Accounting & Taxation Course 2024. Enroll now and take the first step towards an illustrious career in finance! 🌟

Course Gallery

Loading charts...