Company Valuations, Mergers and Acquisitions

Why take this course?

Course Title: Mastering Valuations, Mergers & Acquisitions 🚀

Headline: Dive Deep into Financial Strategies with Professor Francisco Vigariro 🎓💰

Course Description:

Are you an under-grad or post-grad student looking to master the art of Company Valuations, Mergers and Acquisitions? Look no further! This meticulously crafted course is your gateway to understanding the financial strategies that drive business decisions. Taught by the esteemed Professor Francisco Vigariro, this comprehensive online course is tailored for students who aspire to become future finance leaders or simply wish to enhance their corporate finance acumen.

Why Take This Course?

- Real-World Applications: Learn the practical applications of valuation models and how they are used in real business scenarios.

- Hands-On Learning: Engage with templates and exercises designed to answer complex valuation questions effectively.

- Expert Insight: Gain insights into the nuances of planning periods, terminal values, and their impact on business valuations.

- Diverse Valuation Scenarios: Understand how to approach majority and minority holdings valuations with confidence.

- Industry Dynamics: Explore the strategic considerations in mergers and acquisitions within the same industry and across different sectors.

- Critical Thinking & Problem Solving: Develop your ability to integrate various finance concepts into your solutions for valuation questions, preparing you for success in exams and real-world scenarios.

Course Highlights:

🔹 Valuation Fundamentals

- Learn the core valuation models and their practical applications.

- Understand the importance of Free cash flow, Dividend Discount Models (DCF), and Earnings Valuations in business appraisal.

🔹 Advanced Valuation Techniques

- Master the art of designing templates for comprehensive valuation analysis.

- Learn to apply planning periods and calculate the terminal value to predict a company's future cash flows accurately.

🔹 Mergers & Acquisitions Strategies

- Grasp the complexities of merging companies within the same industry, including conglomerate takeovers.

- Analyze the financial and strategic considerations in M&A transactions.

🔹 Exam Preparation

- Receive step-by-step guidance on tackling valuation questions in exams.

- Practice with a series of increasingly challenging problems to solidify your understanding of valuation models and their interplay with other finance concepts.

What You Will Learn:

-

Fundamental Application of Valuation Models

- Free cash flow valuations

- Dividend valuations

- Earnings valuations

-

Valuation Templates and Analysis

- Designing templates for valuation scenarios

- Applying these templates in practical situations

-

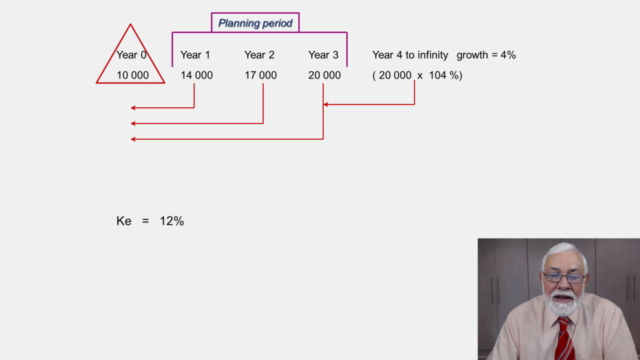

Planning Period & Terminal Value

- Identifying the planning period in valuation analysis

- Calculating and applying terminal values to forecast future cash flows

-

Holdings Valuation

- Understanding the differences between majority and minority holdings valuations

- Approaching each type of valuation with precision and clarity

-

Mergers & Acquisitions Insights

- Exploring mergers and acquisitions within the same industry and across different sectors

- Understanding the strategic rationale behind conglomerate takeovers

-

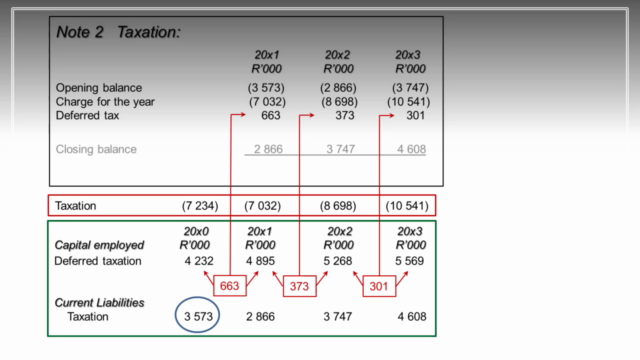

Integrating Finance Topics

- Learning how to integrate various finance topics, such as capital budgeting and risk assessment, into your valuation solutions

- Preparing for exams with a focus on problem-solving and critical thinking

Join Now and Elevate Your Financial Expertise! 🌟

With Professor Francisco Vigariro at the helm, you're not just learning—you're embarking on a journey to master the art of financial valuation, mergers, and acquisitions. Enroll today and take your first step towards becoming a finance virtuoso! 🎓🎉

Course Gallery

Loading charts...