Company Valuation: A Guide for Analysts, Investors, and CEOs

Why take this course?

**🌟 Company Valuation: A Comprehensive Course for Analysts, Investors, and CEOs **

Dive into the world of finance with our Company Valuation: A Guide for Analysts, Investors, and CEOs course! This is where theory meets practical application. Led by the esteemed Gerhard Kling, this comprehensive course will equip you with the skills to value companies using a variety of robust methodologies. Whether you're an aspiring analyst, seasoned investor, or a CEO looking to make informed decisions, this course is your gateway to mastering financial statement analysis and valuation techniques.

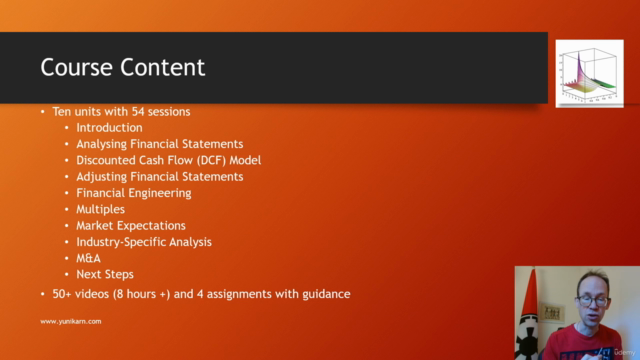

**📈 Course Overview **

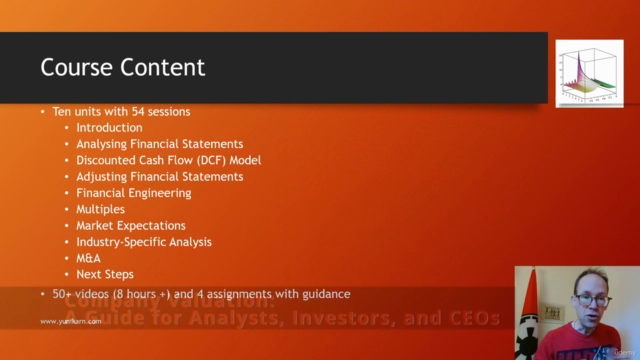

-

Financial Statement Analysis: Learn how to read and interpret financial statements to understand the drivers of company value.

- Understanding Financial Statements: Dissect income statements, balance sheets, and cash flow statements to extract meaningful insights.

- Value Drivers: Identify the key factors that drive a company's performance and valuation.

-

Discounted Cash Flow (DCF) Modeling: Grasp the intricacies of building and applying DCF models in Excel.

- Net Operating Income: Learn how to calculate net operating income, a crucial step in accurate business valuations.

- Invested Capital: Understand the concept of invested capital and its importance in evaluating a company's financial health.

-

Forecasting Free Cash Flows: Master the art of forecasting future cash flows, which are essential for DCF models.

- Forecasting Techniques: Discover methods to estimate future cash flows with confidence.

- Discount Rate Estimation: Learn how to determine the appropriate discount rate for your valuation model.

-

Financial Engineering: Explore advanced techniques to engineer financial solutions for complex valuation scenarios.

- Special Cases: Tackle valuing startups, banks, and real estate businesses using tailored approaches.

- Multiples & Asset-Based Valuations: Complement your DCF models with alternative methods, including multiples analysis for businesses like oil, gas & mining companies.

-

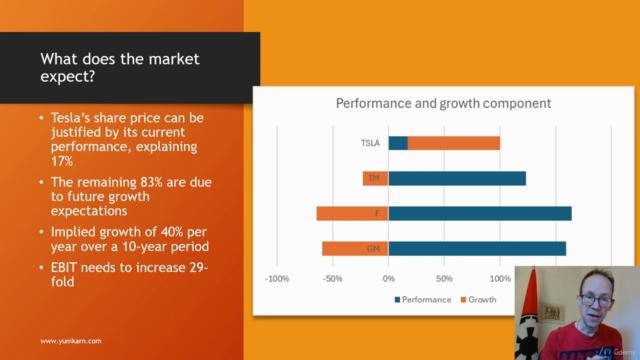

Market Valuation Techniques: Detect undervalued or overvalued companies by understanding market expectations and applying share price decompositions.

- Implied Growth Rates: Learn how to infer growth rates from a company's stock price.

**🎓 Hands-On Learning Experience **

- Real-Life Application: Value several companies throughout the course using Excel, transforming theoretical knowledge into practical skills.

- Interactive Assignments: Complete four comprehensive assignments with detailed instructions and refer to solution videos for guidance.

**🔑 Why Take This Course? **

- No Prior Knowledge Required: Whether you're new to finance or Excel, this course starts from the basics, ensuring that all participants are on an even footing.

- Real-World Applications: Learn methods that have been tested and applied in real-world scenarios by experts at McKinsey & Company.

- Expert Guidance: Benefit from Gerhard Kling's extensive experience in finance, as he shares insights gained from valuation problems across various industries.

**🎓 Course Highlights **

- Step-by-Step Learning: Each concept is introduced, explained in detail, and applied to real-life cases for a comprehensive understanding.

- Interactive Learning Modules: Engage with content that includes a mix of video lectures, reading materials, and interactive exercises.

- Excel Mastery: Gain proficiency in Excel, the tool at the heart of financial modeling and analysis.

**🚀 Transform Your Financial Acumen **

Enroll in Company Valuation: A Guide for Analysts, Investors, and CEOs today and unlock the full potential of your financial intelligence. With this course, you'll not only learn but also apply advanced valuation techniques that will set you apart in the finance world. Ready to become a valuation virtuoso? Join us now!

Course Gallery

Loading charts...