Capital Budgeting – The Investment and Financing decision

Why take this course?

🎓 Course Title: Capital Budgeting – The Art of the Investment and Financing Decision 🚀

Course Headline: Master the Elements of the Investment Decision and Navigate Financing Strategies with Confidence! 💰

Unlock Your Corporate Finance Expertise: A Comprehensive Guide to Capital Budgeting

📘 Course Description:

Welcome to "Capital Budgeting – The Investment and Financing Decision," the ultimate course for finance enthusiasts and professionals alike. This engaging online course is meticulously tailored for undergraduate and postgraduate students of Corporate Finance who aspire to master the art of making informed investment decisions and understanding the complexities of financing them.

Why Take This Course?

-

Comprehensive Learning: Dive deep into the traditional methods of investment appraisal, a crucial part of every finance professional's skillset.

-

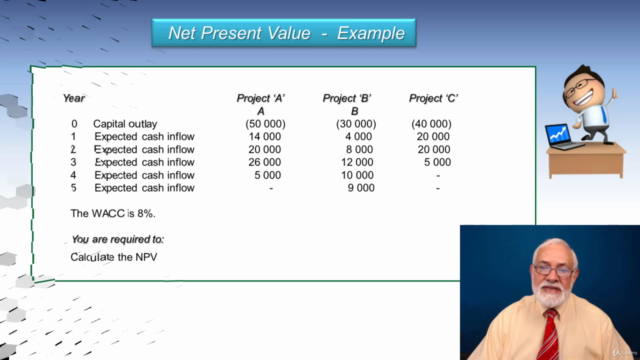

Balanced Perspective: Understand the nuances and trade-offs between Net Present Value (NPV) and Internal Rate of Return (IRR) approaches, helping you make more robust financial decisions.

-

Real-World Application: Learn to evaluate various factors that impact the profitability of projects, including inflation, relevant costs and revenues, and the cost of capital.

-

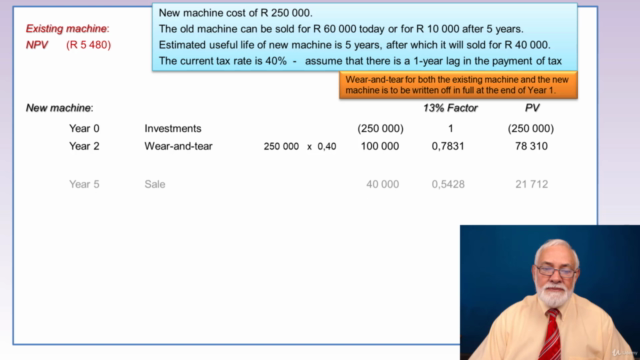

In-Depth Analysis: Explore the complexities of replacement investment decisions, operating leases, and the implications of financing choices.

-

Practical Examination: Test your knowledge with a series of examination questions designed to reinforce your learning and prepare you for real-world scenarios.

What You Will Learn:

-

Traditional Methods of Investment Appraisal: Get familiar with the fundamental techniques used to evaluate potential investments.

-

NPV vs IRR Debate: Weigh the pros and cons of Net Present Value versus Internal Rate of Return to determine which method is most appropriate for different types of projects.

-

Making the Investment Decision: Learn how to analyze and make informed decisions about investing in new projects, considering all relevant factors.

-

Evaluating Financial Health: Assess inflationary impacts, calculate opportunity costs, and determine the discount cost of capital for accurate financial planning.

-

Working Capital Considerations: Understand how changes in working capital can affect project cash flows and profitability.

-

Cost Analysis: Evaluate issue costs, finance costs, tax considerations, and more to ensure a comprehensive analysis of potential investments.

-

Operating Leases & Asset Investments: Explore the concept of investing in assets through operating leases and its implications for financial decision-making.

-

Financing Decisions: Gain insights into the various ways companies can finance their investments, including equity, debt, and hybrid instruments, and understand the trade-offs and costs associated with each option.

-

Examination Questions: Reinforce your learning with a set of questions that will help you apply what you've learned in practical, real-world contexts.

Your Instructor:

You will be guided through this journey by Professor Francisco Vigari, an expert in the field with extensive experience in teaching and applying corporate finance principles. With Professor Vigari's guidance, you will not only understand the theory but also learn to apply it effectively in your career.

Enroll now and embark on a transformative learning journey that will set you apart as a finance professional capable of making sound investment and financing decisions. 🌟

Course Gallery

Loading charts...