Capital Budgeting

Why take this course?

Capital Budgeting: Basics of Making Smart Financial Investments

🧭 Understanding Capital Budgeting Capital budgeting is a cornerstone in the financial decision-making process for businesses, particularly when it comes to long-term projects like property acquisition, equipment purchases, and new product launches. In this comprehensive course by the Maxusknowledge Team, you'll delve into the basics of capital budgeting and learn how to craft a strategic plan that can propel your business towards sustainable growth through intelligent investments.

Course Highlights:

-

Introduction to Capital Budgeting: Learn what capital budgeting entails and why it's a critical financial tool for businesses looking to expand or invest in new projects.

-

The Essence of Long-Term Financial Planning: Understand the importance of forecasting future returns from investments and the role of capital budgeting in shaping your business's long-term financial health.

🔥 Mastering Capital Budgeting Techniques

-

Project Evaluation: Dive into the nuances of evaluating potential investments, considering costs, risks, and expected cash flows.

-

Cash Flow Forecasting: Gain insights into accurately predicting a business's future cash inflows from its investments and learn how this forecasting can be a game-changer for your financial models.

📈 Key Capital Budgeting Methods Explored:

-

Net Present Value (NPV): Discover how NPV is used to determine whether an investment will yield a return that exceeds its cost of capital.

-

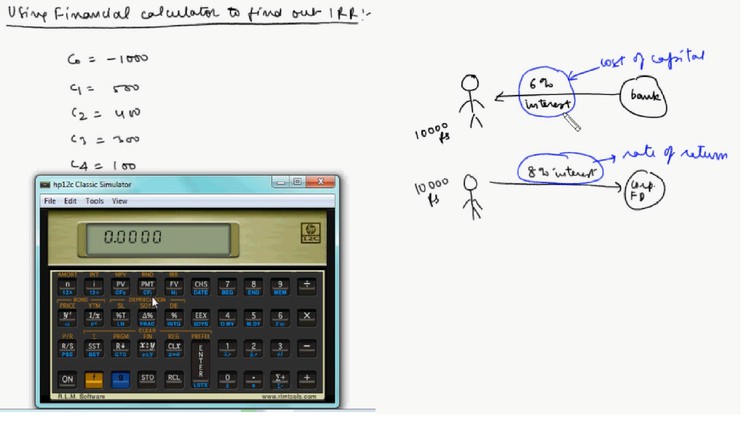

Internal Rate of Return (IRR): Learn to calculate the IRR and understand what it indicates about the profitability of an investment over time.

-

Discounted Cash Flow (DCF) Analysis: Explore how DCF can provide a comprehensive valuation of investments, accounting for cash flows that occur at different times.

-

Incorporating Non-Cash Items: Learn to include non-cash items like depreciation and tax implications in your financial models to get a more accurate picture of potential returns.

Key Takeaways:

-

Risk Assessment: Understand how to evaluate and manage the risks associated with long-term investments.

-

Growth Opportunities: Identify potential growth opportunities that could lead to significant gains for your company.

-

Financial Management: Make informed decisions based on solid financial analysis, contributing to maximum profitability and optimal business performance.

By the end of this course, you'll have a robust understanding of capital budgeting principles, techniques, and their applications in real-world scenarios. Equip yourself with the knowledge to make strategic investment choices and contribute significantly to your company's success. Let the Maxusknowledge Team guide you through the intricacies of capital budgeting today! 🚀

Enroll now and unlock the potential for informed financial decision-making that can set your business on a path to prosperity. With the Capital Budgeting: Basics of Making Smart Financial Investments course, you'll be well-equipped to navigate the complexities of capital budgeting and make decisions that align with your company's objectives. 💼💰

Loading charts...