Cap Tables 101 for Entrepreneurs and Investors

Why take this course?

🎓 Master Cap Tables with Confidence: A Comprehensive Guide for Entrepreneurs & Investors

🚀 Course Title: Cap Tables 101 for Entrepreneurs and Investors

🧠 Headline: Everything you need to know about modeling Cap Tables

Introduction: Understanding the intricacies of a Capitalization Table (Cap Table) is not just an academic exercise; it's a critical skill for anyone involved in the startup ecosystem. Small errors in Cap Table modelling can lead to significant financial repercussions at the exit, making the knowledge and skills acquired in this course invaluable. Whether you're an entrepreneur raising capital or an investor evaluating opportunities, this course will empower you with both the theoretical foundations and practical tools necessary to navigate the complexities of Cap Tables with confidence.

What You Will Learn:

📚 Theory:

- What is a Cap Table, who needs it, and why it's crucial at different stages of your company's lifecycle?

- Characteristics of a Healthy Cap Table and how to maintain it.

- The differences between common and preferred shares, and their implications for your business.

- The intricacies of Employee Stock Option Plans (ESOPs) and how they can incentivize your team.

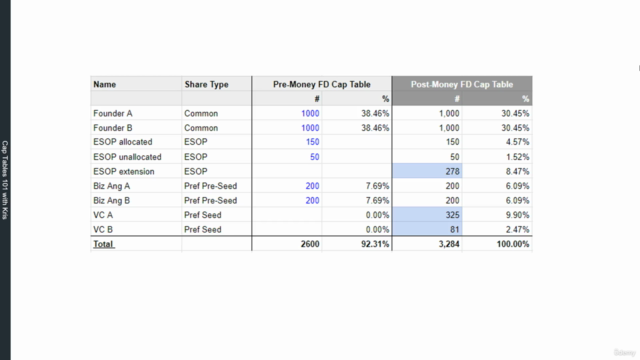

- The nuances between Cap Tables with Outstanding Shares and Fully-Diluted Cap Tables, and when to use each.

- A deep dive into different types of equity funding rounds: Equity Rounds, SAFE notes, Convertible notes, and secondaries, including their uses in fundraising or exiting investments, and timing considerations.

🔧 Practice:

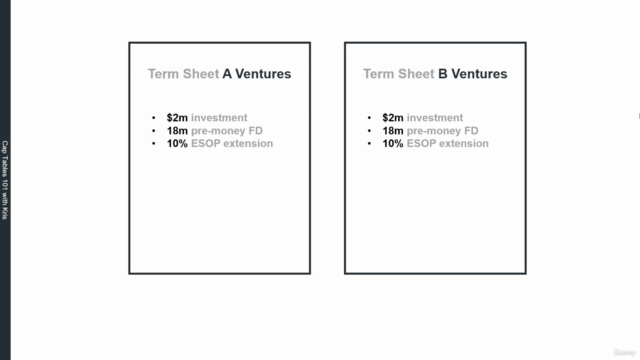

- Step-by-step guidance on modeling a Seed round.

- Strategies for extending ESOPs and how to manage the complexities that come with it.

- Techniques for modelling Series A rounds with Pro-rata options.

- Insights into SAFE conversion scenarios and best practices.

- Understanding Convertible Debt conversions and their impact on your Cap Table.

- Navigating secondary transactions and ensuring they are accurately represented.

- Mastering the art of formatting models for clarity and ease of understanding.

- Adopting standard color coding for inputs to enhance readability and efficiency.

- Learning how to conduct Iterative Calculations, troubleshoot errors, and fix issues that arise during modeling.

About Your Instructor:

🤝 Kris Przybylak, Investment Principal:

- With over 5 years of hands-on experience in the startup ecosystem as an Investment Principal at a Seed Stage VC Fund.

- An extensive track record of evaluating hundreds of Cap Tables and guiding startups through their growth stages.

- A solid finance background complemented by VC courses from prestigious institutions like the University of Michigan and the Rotterdam School of Management.

With Kris Przybylak as your guide, you'll gain a competitive edge by understanding how to effectively model and manage your company's Cap Table. This course is your stepping stone to making informed decisions that can lead to the success and growth of your venture or investment portfolio. 🌟

Enroll now and transform the way you approach Cap Tables! 🚀✨

Course Gallery

Loading charts...